Bitcoin’s been on a tear lately, climbing higher like it’s got a rocket strapped to its back.

Experts say it’s powered by stablecoins, those steady Eddie coins that people use to buy Bitcoin.

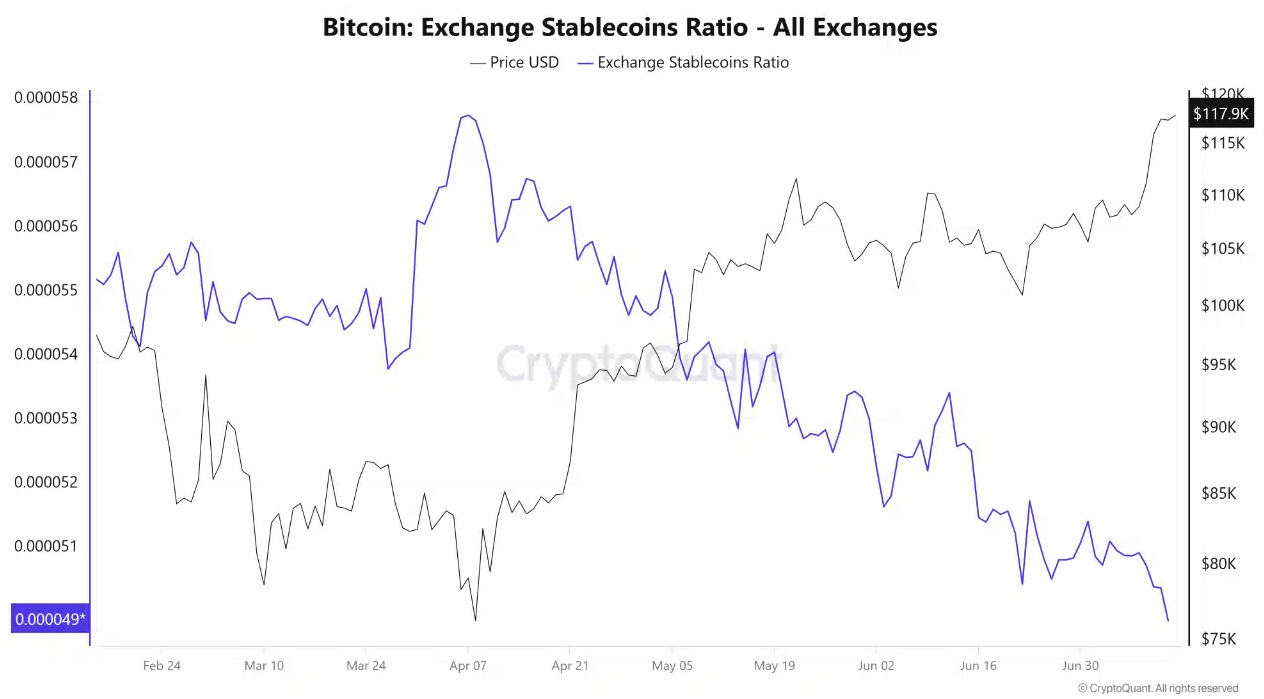

Sounds good, right? Well, not so fast. The reserves of these stablecoins on exchanges are drying up faster than your office coffee supply on a Monday morning. And that’s where the story gets interesting.

Bitcoin ATH

Picture this, Bitcoin’s price is cruising around $120,000 in the time of writing, a new ATH, with a safety net near $111,600.

But the Exchange Stablecoins Ratio, basically how many stablecoins are sitting ready to buy, has hit its lowest point in months.

Translation? Investors are burning through their stablecoin stash to snap up Bitcoin.

Demand’s hot, no doubt. But here’s the catch, when the fuel runs low, the rally might sputter if no fresh money jumps in.

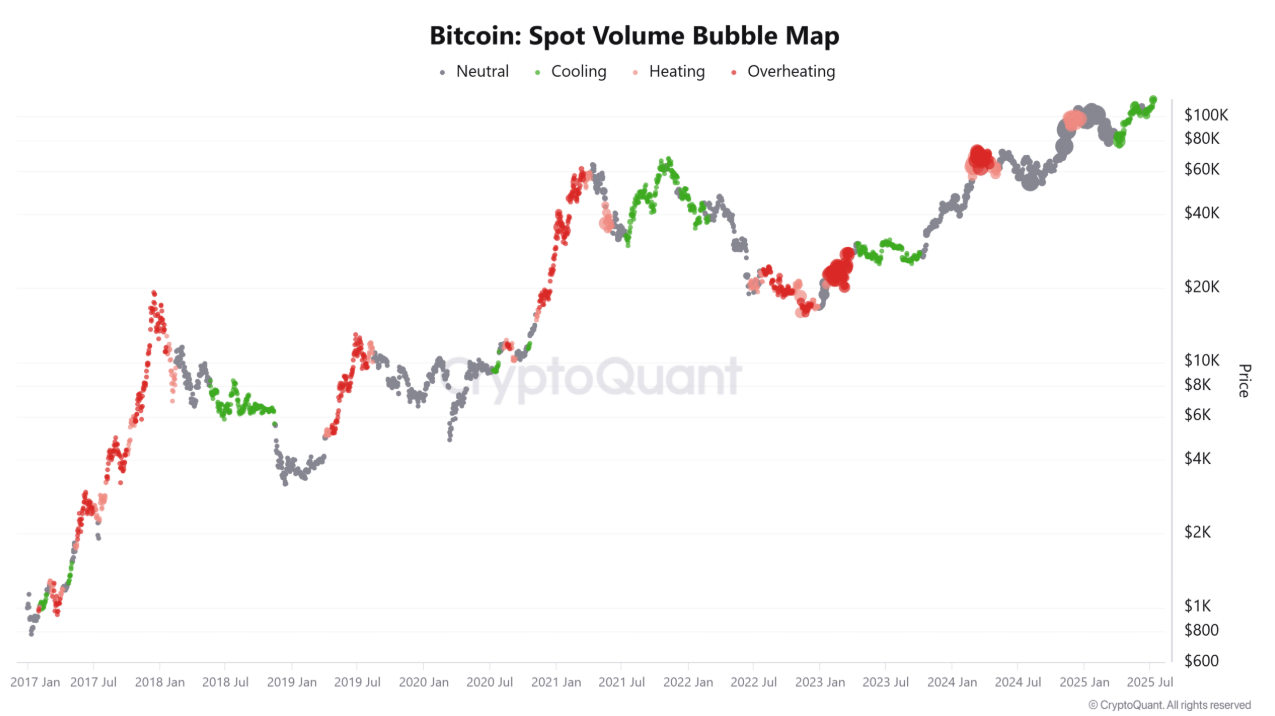

Now, you’d think with prices climbing, trading volume would be booming, right? Analysts say forget about it.

The Spot Volume Bubble Map tells a quite different tale, it’s shrinking, showing less trading action under the surface. Like that one guy in the office who suddenly stops pitching in during crunch time, volume’s cooling off.

Fewer players are jumping into the fray, which could mean the rally’s losing steam. If volume doesn’t pick up soon, Bitcoin might just chill out or even dip a bit.

Hold tight

And then there’s the scary stuff, because valuation warnings flashing red.

The NVT and NVM ratios, fancy metrics that compare Bitcoin’s market cap to how much it’s actually used, have shot up by 88% and 25% respectively.

When these spike, it’s like your favorite sports team running up the score early but looking tired by halftime. Historically, this signals a market top or at least a pause for breath.

Miners are holding tight instead of selling at these new highs. The Miner Position Index plunged over 140%, meaning miners expect prices to keep climbing.

That’s like your coworker refusing to sell their company stock because they believe in the long game.

It’s bullish, sure, but it also means if the market turns, latecomers might get squeezed.

Buy the dip?

So, who’s got the upper hand? Bulls are in control now, no doubt, directional indicators show buyers leading the dance.

But the ADX, a measure of trend strength, is just shy of 20, telling us this party’s not quite in full swing yet. The rally’s got legs, but they’re a bit wobbly.

Bitcoin’s on a high-wire act. Strong demand and miner confidence back the rally, but warning signs from overvaluation, cooling volume, and weak trend strength suggest caution.

If fresh money doesn’t pour in, we might see Bitcoin take a breather, maybe even a little tumble. Then we’ll buying the dip, I guess.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.