After the start of February, the total market cap for altcoins, affectionately known as TOTAL3, has hit a rough patch.

It’s like that friend who keeps trying to climb a mountain but keeps sliding back down, frustrating, right?

Up or down or what?

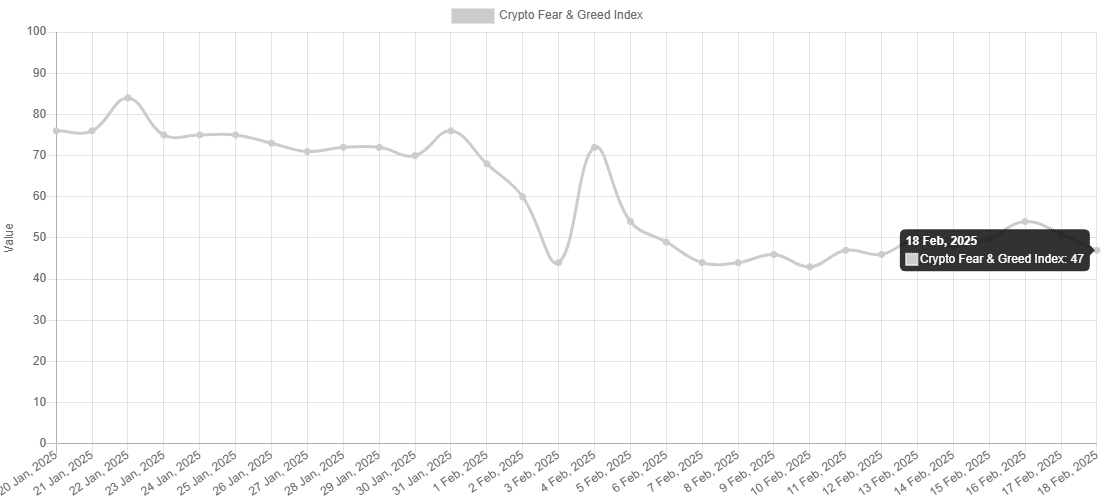

So, what’s got traders feeling blue now? Well, the LIBRA scandal certainly threw a wrench in things, and let’s not forget President Trump’s tariff wars that have added to the chaos few weeks back.

The mood in the crypto community has shifted dramatically, as just last month, sentiment was riding high, but now? It’s taken a textbook nosedive, especially for altcoins.

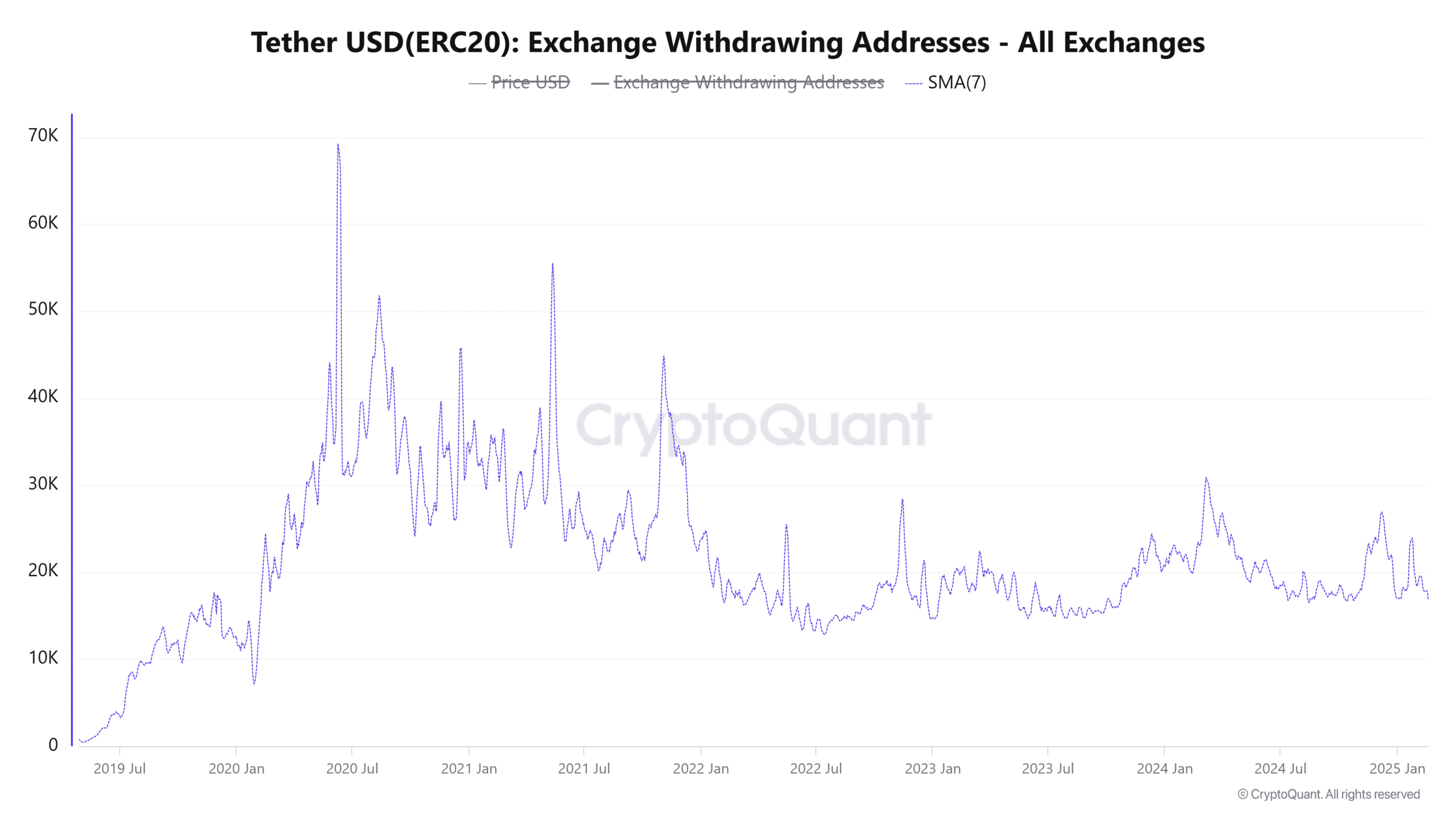

Adding fuel to the fire, Tether metrics are showing some serious signs of distress, because the number of addresses withdrawing Tether from exchanges has taken a hit lately.

Typically, when we see fewer people pulling out their Tether, it means they’re gearing up for something big, like accumulating more coins.

But in this case, it might just mean folks are cashing out and moving their profits elsewhere.

Maybe they’re diving into DeFi applications or just stashing their coins in hot wallets to wait for a better buying opportunity. Either way, it’s not exactly a vote of confidence.

Money out

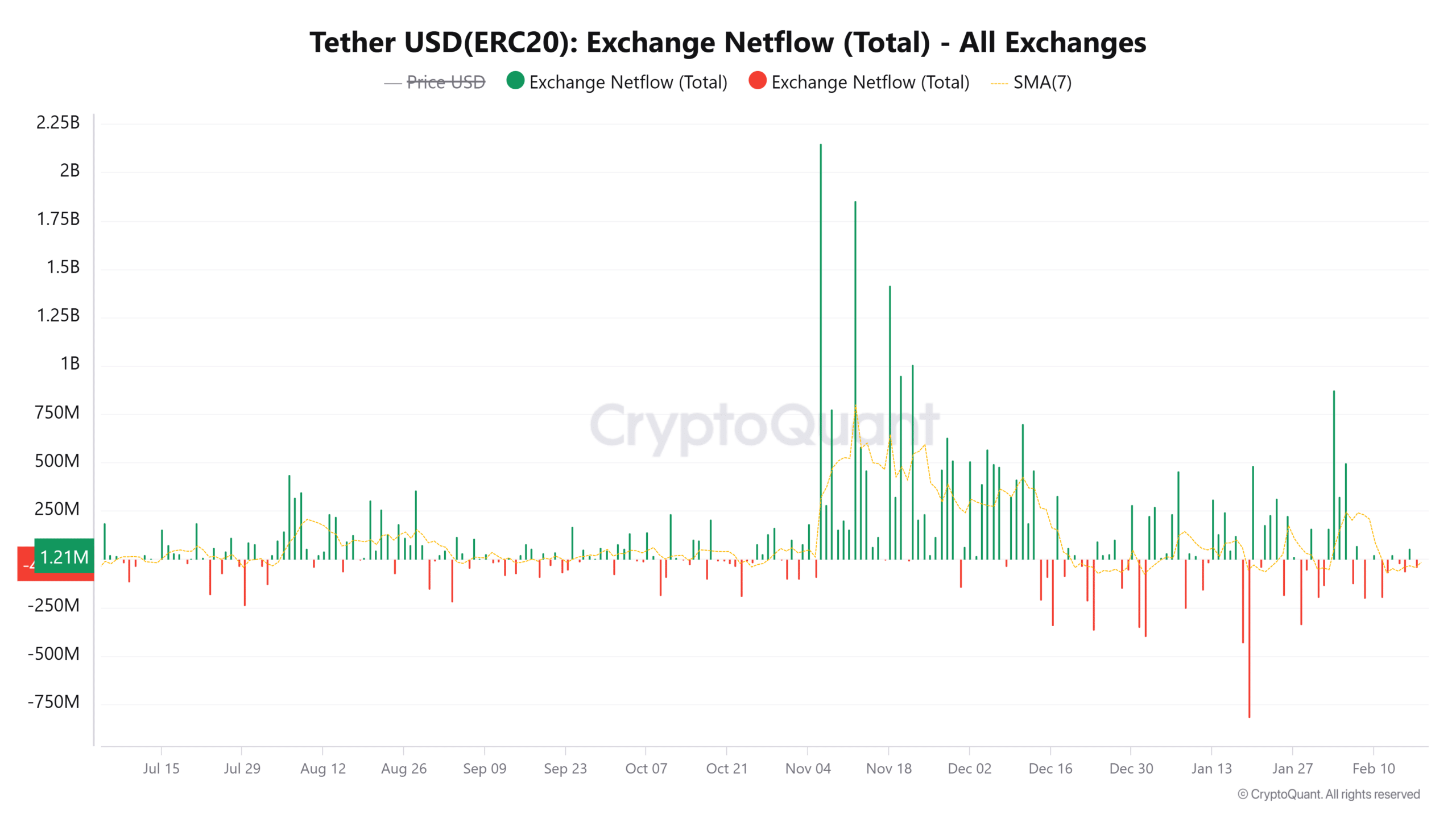

And if that wasn’t enough to raise eyebrows, the net flow of USDT has been negative for several days now.

Simply put, this means more people are taking their Tether out of exchanges than putting it in.

This is quite the turnaround from the bullish vibes we saw back in November and early December when inflows were booming.

Altmarket decline intensifies?

The altcoin market cap has been stuck in a range since early December, and after some losses earlier this month, it dipped below $1 trillion and has struggled to regain its footing ever since.

The Fibonacci levels suggest that if things don’t turn around soon, we could be looking at support zones around $760 billion and $822 billion.

The market is looking pretty bearish right now, with no sign of an imminent reversal in sight.

If Bitcoin bulls want to make a comeback and restore some faith in the market, they’ll need to defend quite important support levels around $92k and $94k.

Have you read it yet? Bitcoin mining in the U.S. is booming, and brings prosperity

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.