The Bitcoin whales are on the move, and it’s not just a ripple in the ocean. Over the past week, Bitcoin has surged by over 4%, and these whales are literally diving in headfirst.

One massive whale just splashed down $200 million into Bitcoin, adding 2,400 coins to its stash.

Thousands of Bitcoin

This isn’t just any whale, it’s a behemoth holding over 15,000 Bitcoin, worth $1.3 billion at current prices. On the other hand, this whale wasn’t always so eager.

Just a few months ago, it was selling off its stash when Bitcoin’s price was dancing between $86,000 and $100,000.

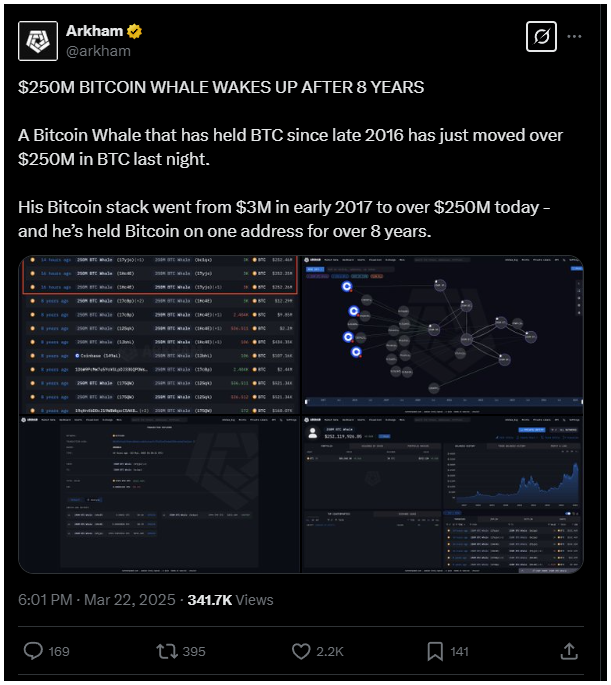

Now, it’s back in the game, and it’s not alone. Another whale, dormant for eight long years, has finally woken up.

This sleeping giant moved over 3,000 Bitcoin, worth $250 million, in one swift transaction. Talk about a wake-up call!

And if you thought that was all, think again. BlackRock, the world’s largest asset manager, is also getting in on the action.

It’s been steadily accumulating Bitcoin over the past week, adding 4,054 coins to its treasure chest. That’s a total of 573,878 Bitcoin, worth a mind-boggling $50 billion.

But what’s really interesting is that BlackRock’s iShares Bitcoin Trust led a rally in spot Bitcoin ETFs, ending a five-week streak of net outflows with $744.4 million inflow.

There is a second best?

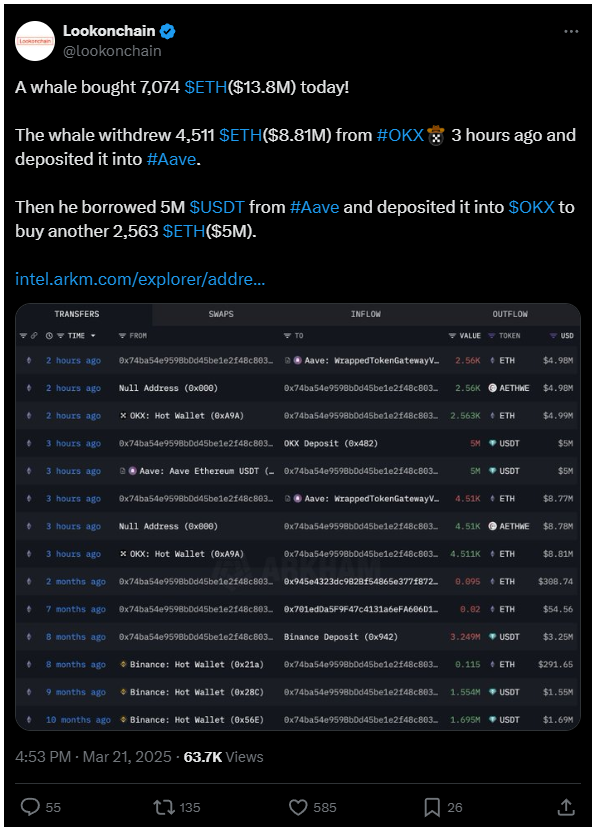

But Bitcoin isn’t the only game in town. An Ether whale recently added 7,074 Ether to its stash, worth $13.8 million.

Ether might be down from its all-time high, but its open interest has surged to new heights, and more people are holding onto it.

All this means the big players are back, and they’re not just dipping their toes in the water, they’re jumping in with both feet. In the world of crypto, timing is everything.

These whales aren’t just making moves, they’re making statements with their behavior.

They’re betting big on Bitcoin and Ether, and it’s hard not to wonder what they see that we don’t. Maybe it’s time to take a closer look at your own crypto portfolio. After all, when the whales start swimming, you might want to follow the tide.

Diamond hands

And let’s not forget the personal touch. Imagine holding onto something for eight years, watching it grow to $250 million.

That’s a legacy, not simply an investment. These whales aren’t just playing the market, they’re building empires.

Have you read it yet? The people have spoken, delisting vote is coming on Binance

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.