Listen up, guys. You think you’re tough enough for the Bitcoin game? Well, let me tell you, it’s not for the faint of heart.

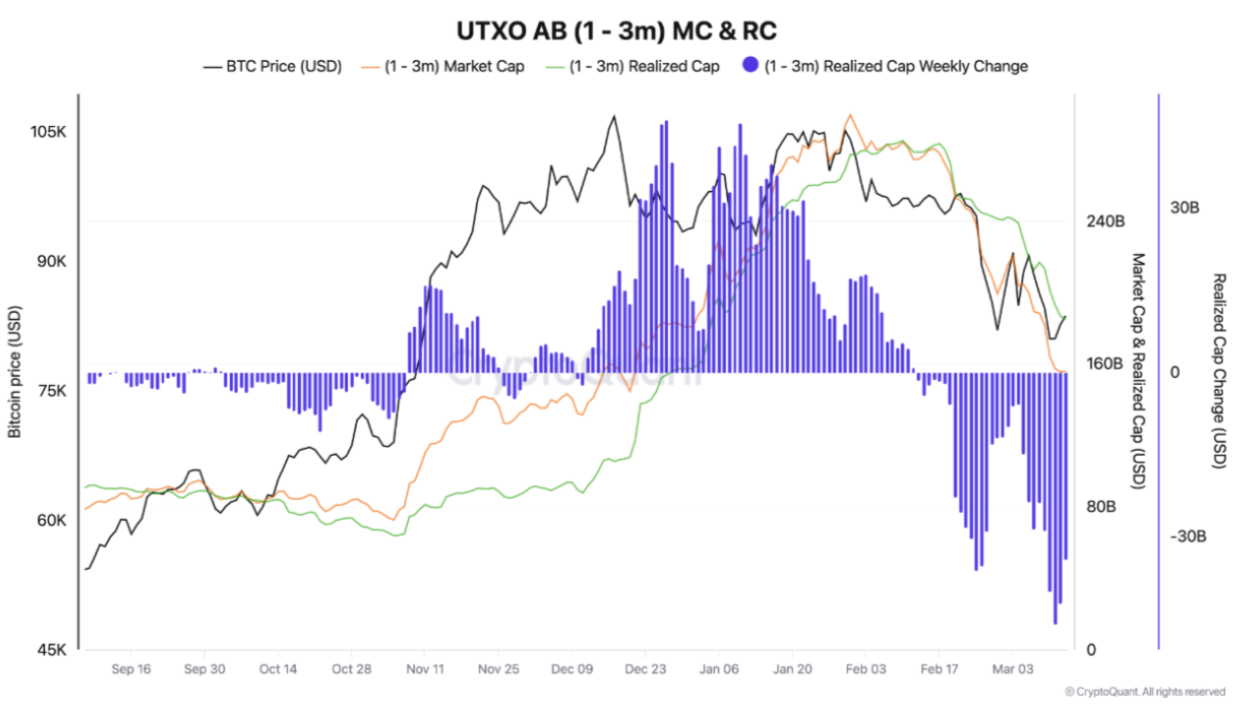

Research shows that new investors got burned to the tune of $100 million in just six weeks. $100 million down the drain.

All because of panic selling. Have you heard about paper hands?

Buy high, sell low? Is this a meme?

These short-term holders, they couldn’t take the heat. Maybe they aren’t holders at all, but speculators.

They bought in when the market was hot, and then they bailed when things got rough. CryptoQuant’s data paints a quite grim picture, these investors are underwater, holding coins worth less than what they paid for them.

It’s like buying a car for $50,000 and selling it for $30,000. Not exactly the smartest move, if you know what I mean.

Number go up? Number of losses?

The numbers don’t lie. The realized cap of these investors’ holdings is lower than their market cap, which means they’re locking in losses.

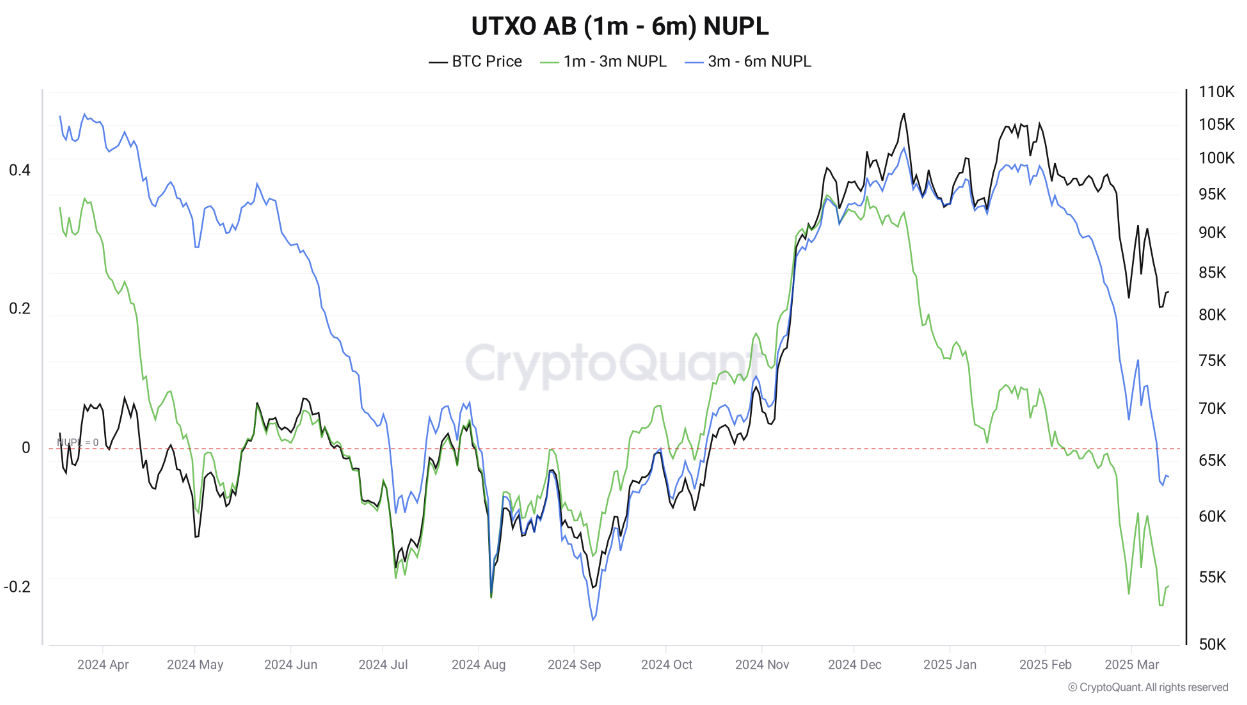

It’s a vicious cycle, more selling, more pressure, and the price keeps dropping. And let’s not forget the NUPL score, which is currently at -0.19.

That’s like a big red flag waving in the wind, saying more coins are being held at a loss than at any point in the past year.

Losses are temporary?

But here’s the thing, while these newbies are running for cover, the big players are just getting started.

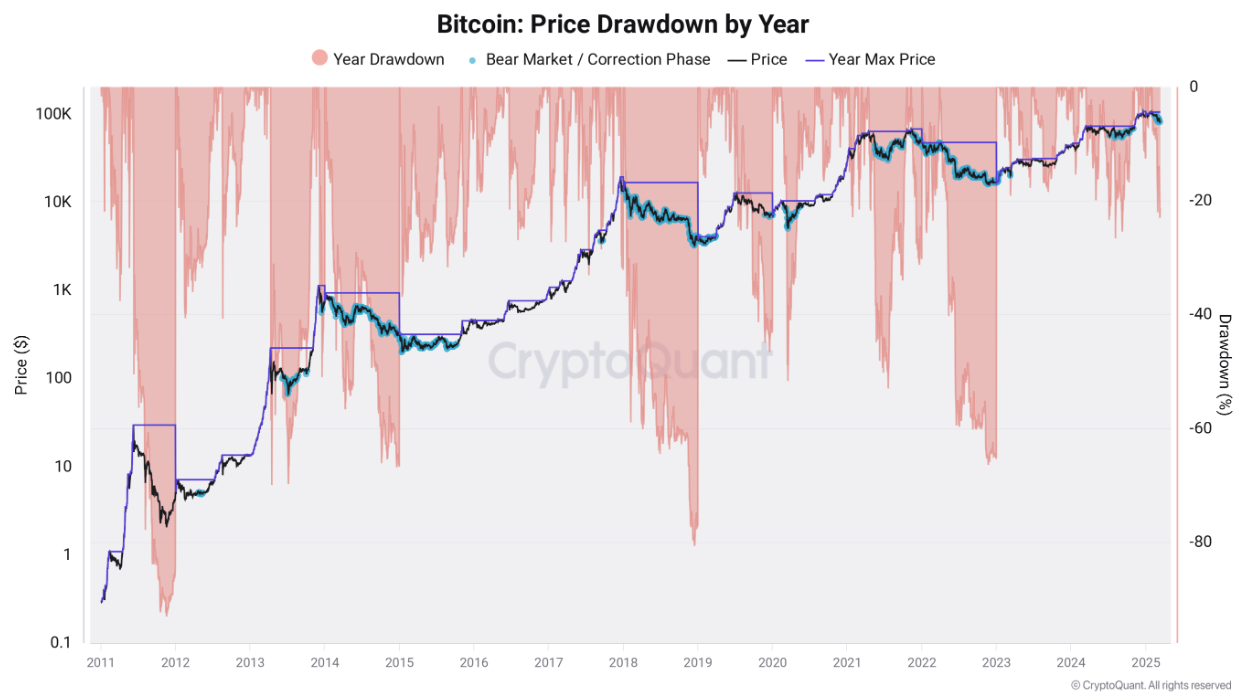

They’re buying in at around $80,000, ignoring the short-term fluctuations. They know the game, guys.

They know that bull market corrections are usually short-lived, but this time, things might be different. CryptoQuant’s warning us that this correction could be more than just a blip on the radar, it could be a sign of a broader bearish phase.

So, if you’re thinking of jumping into the Bitcoin pool, think twice. It’s not all fun and games. You gotta be ready to ride the waves, or you’ll end up like these poor souls, $100 million in the hole.

Have you read it yet? Bitcoin takes a beating, so it’s Peter Schiff’s „I-told-you-so” moment

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.