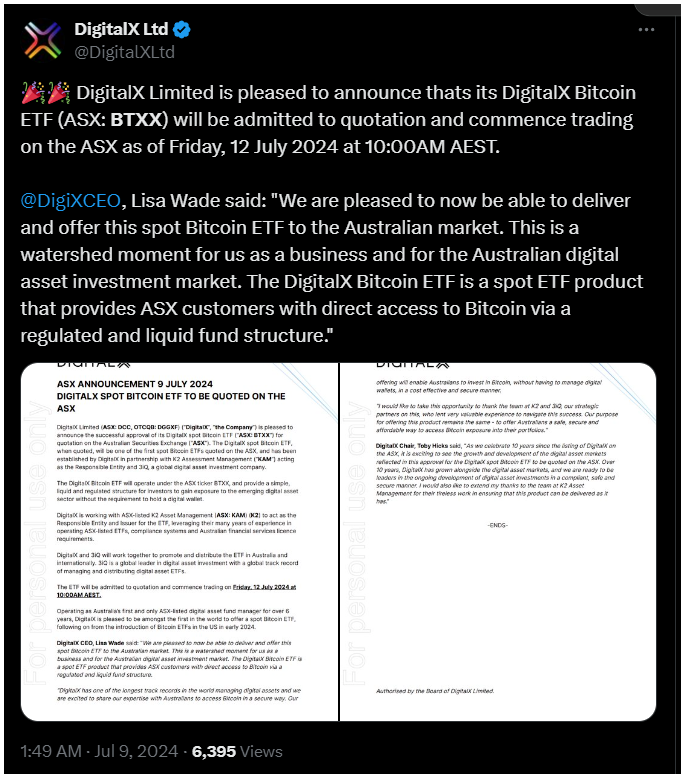

Australia gave the green light to a second spot Bitcoin ETF, this time from asset manager DigitalX.

The new product will be listed on the Australian Securities Exchange, the ASX, under the ticker BTXX.

Teamwork

K2, experienced in managing ASX-listed ETFs, will handle the ETF’s management, while DigitalX and 3iQ will focus on promoting and distributing the ETF both in Australia and internationally.

Lisa Wade, the CEO of DigitalX stated that their offering will allow Australians to invest in Bitcoin without needing to manage digital wallets, providing a secure and cost-effective way to invest.

This is the standard, good ol’ marketing fluff for any paper Bitcoin btw, so this isn’t something revolutionary result, fair to say.

Synthetic solutions

On June 20th, VanEck got approval for the first spot Bitcoin ETF after negotiating with the ASX for three years.

But VanEck’s Australian ETF doesn’t directly hold Bitcoin, instead, it invests in the US VanEck Bitcoin Trust, launched in January after SEC approval, what means it’s a derivative of a derivative.

Paper Bitcoin squared. We have to admit since January, investors in the US have put billions into cryptocurrency ETFs, with 11 products approved, so it’s a success story, no doubt. Hong Kong followed in April with six ETFs, though interest there is much lower.

Bitcoin is dead, but institutions didn’t get the memo

Bitcoin’s price nearly tripled in March but it slowed down since then.

A market dump by Germany, the US, and repayments from Mt. Gox caused price to drop below $54,000 around a week ago, marking the first time it fell that low since February.

It has since rebounded to $57,000 and seems to be stabilizing in this level, in time of writing.

Investors are using this dip as a good buying opportunity, crying in the social media as it keep dipping, but the investment inflows stabilizing at over $440 million in the last week alone.

Also the ETF’s net inflows surged to nearly $300 million after a period of stagnation. BlackRock bagged the most with almost $180 million, followed by Fidelity’s FBTC, and Grayscale saw over $25 million from new buyers.