After a massive 180% rally in early December, pushing TRX’s price up to $0.44, it seems the holiday sell-off has taken a toll.

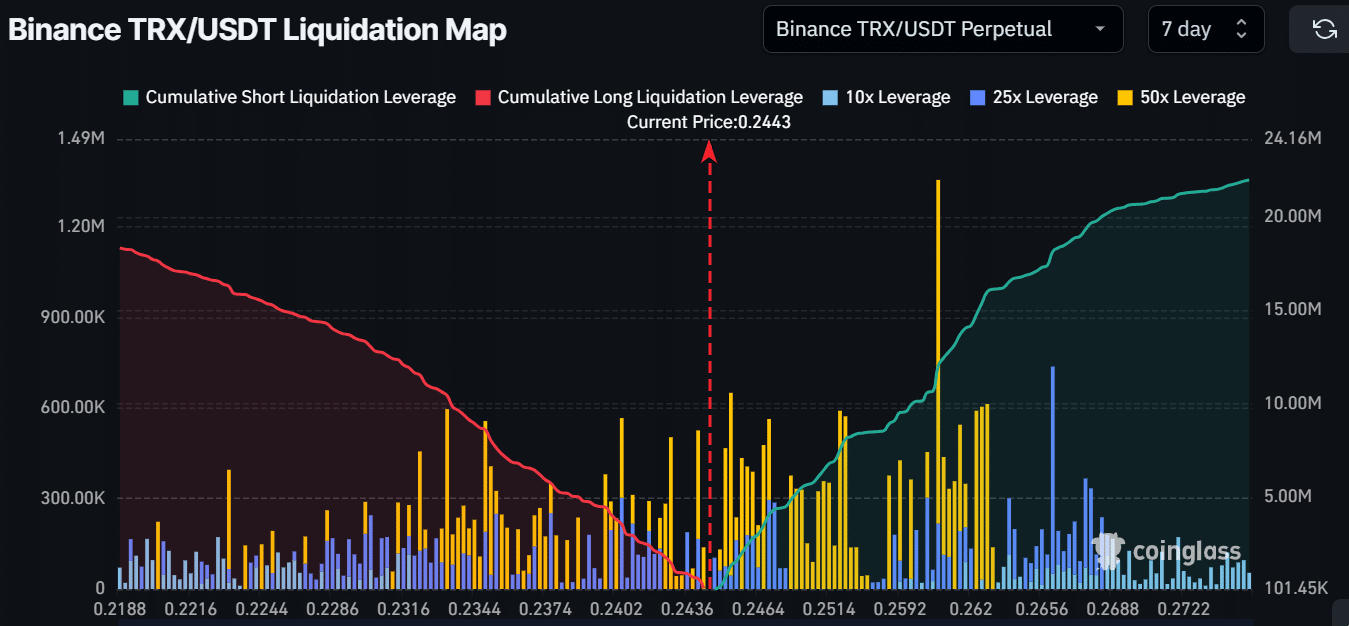

As of now, TRX is struggling to recover and has been stuck in the $0.22-$0.27 range since January.

This has created a playground for swing traders looking to cash in on the ups and downs.

Stuck in?

With the market feeling a bit jittery ahead of next week’s FOMC meeting, TRX’s sideways movement might continue for a bit longer.

Technical indicators aren’t painting a pretty picture either, because low capital inflows and a flat RSI suggest that demand is muted right now.

So, those key price points of $0.27 and $0.22 are becoming important for both buyers and sellers.

The good news

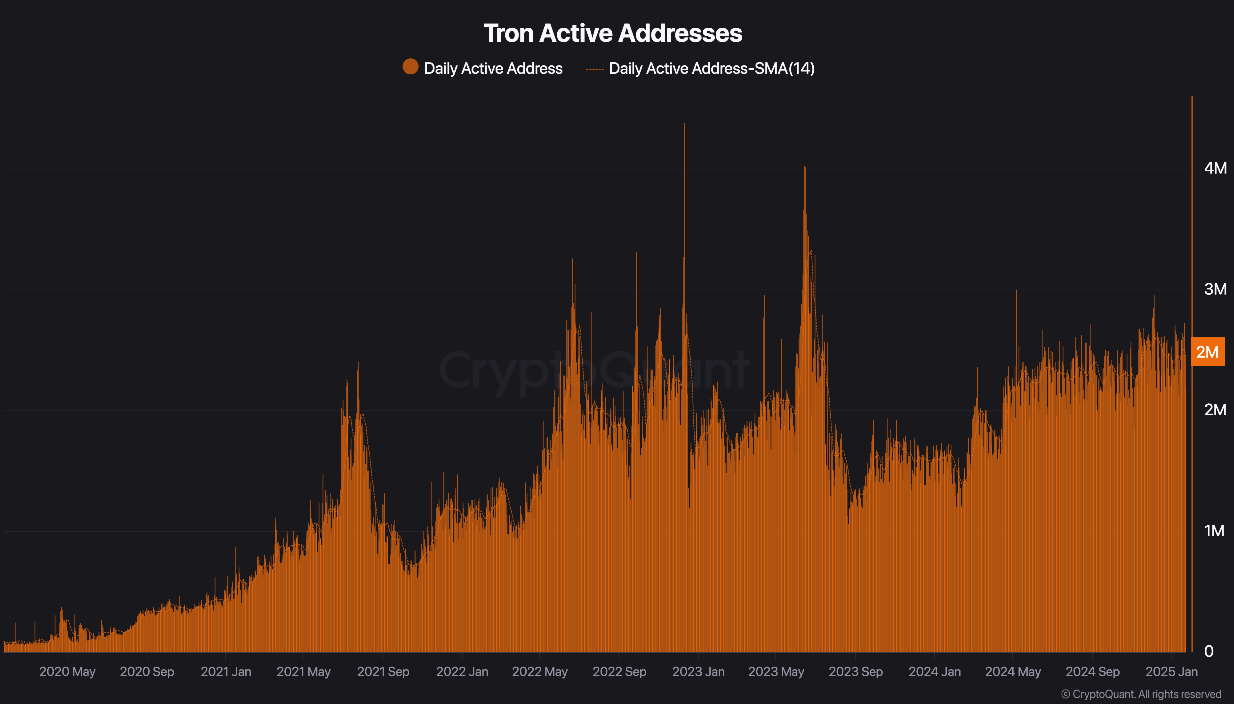

There’s some exciting news brewing beneath the surface, despite the price stagnation Tron’s network is experiencing quite explosive growth, with user numbers skyrocketing to over 2 million.

CryptoQuant analyst DarkFost attributes this surge to rising investor confidence, particularly after the launch of their high-yield stablecoin, USDD 2.0.

On January 15th alone, Tron recorded $3.6 trillion in transfers, signaling robust network activity.

“Confidence in TRON’s growth appears well-founded.”

What’s next for TRX?

While the short-term price outlook seems like a tight squeeze, liquidity levels between $0.22 and $0.26 are nearly equal, suggesting that any sudden shifts could lead to big price movements.

Even though TRX is currently caught in a consolidation phase, its growing user base and network activity gives some reasons for optimism.