The country’s Financial Intelligence Unit, the FIU slapped Upbit with a partial business suspension, temporarily blocking new customers from making crypto deposits and withdrawals.

This move is all about Upbit allegedly violating South Korean rules by dealing with unregistered crypto service providers.

What’s the real reason behind the ban?

The FIU’s decision comes after inspections revealed that Upbit wasn’t following the rules, and they were accused of facilitating transactions with unregistered crypto asset service providers.

Upbit has apologized to its customers and is working on fixing the issues.

They’re also hinting that these sanctions might not be set in stone, suggesting that things could change if they can sort out the problems with the authorities.

Existing customers are good to go

The good news for current Upbit users is that they can still use all the exchange’s services without any restrictions, but new customers will have to wait it out for three months.

Upbit is emphasizing that they’ve already made necessary improvements and are waiting to see if these efforts will lead to any changes in the sanctions.

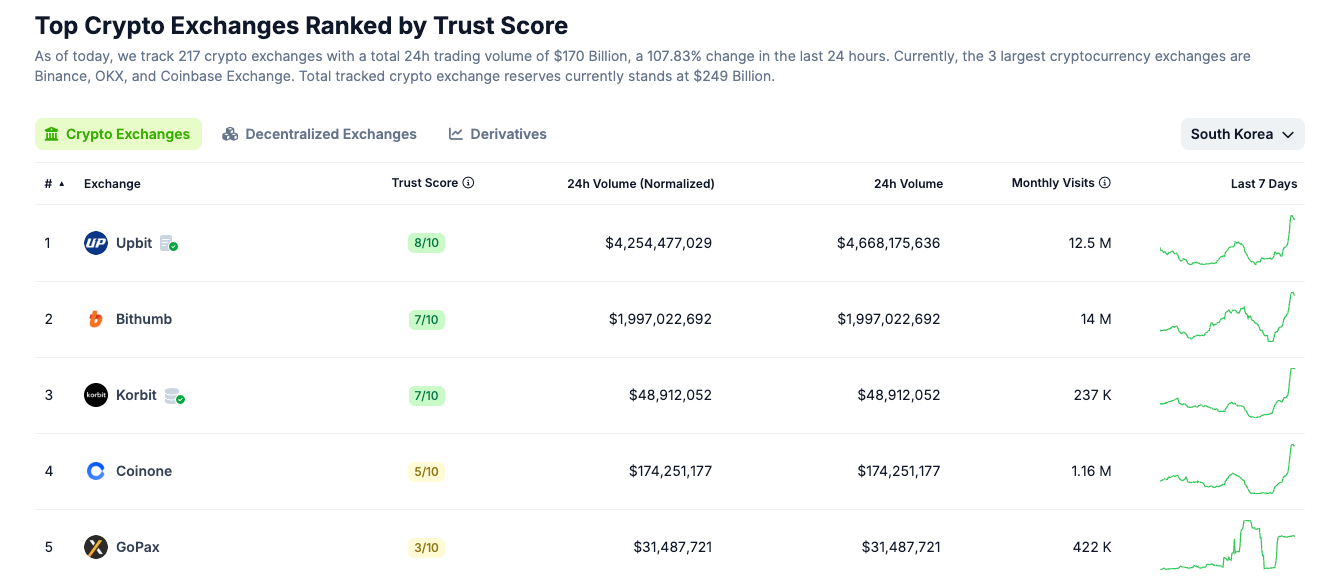

This news comes at a tough time for Upbit, as since January, their daily trading volumes have plummeted by about 70%.

That’s a quite big drop, especially considering Upbit is one of the largest exchanges globally.

The exchange was previously flagged for Know Your Customer violations, with reports of up to 600,000 breaches in client identification procedures. It seems like Upbit has some work to do to regain its footing.

The future for Upbit

As Upbit navigates these challenges, it’s clear that regulatory compliance is unavoidable in the crypto industry.

Whether Upbit can bounce back from this setback remains to be seen, but one thing is certain, though, the crypto industry is always changing, just like crypto market and exchanges need to stay on their toes to keep up.

Have you read it yet? Infini loses $49 million in a hack

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.