Circle’s USDC stablecoin launched on the XRP Ledger (XRPL) on June 6, making the overcollateralized digital dollar available on Ripple’s blockchain network.

The rollout gives users access to USDC on XRPL, now supported across multiple decentralized finance applications.

USDC is the second-largest stablecoin by market capitalization, valued at over $61 billion, according to Circle.

The token is fully backed by reserves, including short-term U.S. Treasury bills. The integration brings USDC stablecoin to XRP holders without needing to leave the network.

Ripple confirmed that USDC on XRP Ledger will benefit from the auto-bridging feature, which uses XRP as an intermediary asset.

This function helps move stablecoins like USDC between decentralized exchanges (DEXs) by connecting trading pairs with XRP automatically.

Ripple: Stablecoins Support Practical Use Cases

Markus Infanger, Senior Vice President at RippleX, addressed the development in a public statement.

“Stablecoins are key entry points connecting traditional financial markets with the crypto space — essential for use cases focused on utility rather than speculation,” he said.

Support for USDC stablecoin on XRPL adds a widely used dollar-pegged asset to Ripple’s ecosystem.

This change allows developers to deploy or integrate USDC in decentralized applications on XRP Ledger. The network’s low fees and finality also apply to USDC transactions.

The launch follows Ripple’s ongoing expansion into real-world asset (RWA) functionality, with XRPL being positioned as a settlement layer for tokenized financial products.

The availability of USDC stablecoin on XRP Ledger broadens its use beyond trading into payment and treasury services.

USDC Stablecoin Tied to U.S. Treasury Policy

Circle’s expansion of USDC stablecoin aligns with U.S. efforts to regulate digital dollars. At the White House Crypto Summit on March 7, U.S.

Treasury Secretary Scott Bessent said the department would prioritize stablecoin development to support global demand for the U.S. dollar.

The yield on the 10-year U.S. Treasury bond now stands at over 4.3%, based on data from TradingView. Rising interest rates follow reduced foreign demand for U.S. debt.

Countries have been offloading Treasury holdings, raising borrowing costs and putting pressure on U.S. debt servicing.

In this environment, USDC stablecoin issuers like Circle buy large volumes of Treasury bills to back the token.

This gives investors a stable digital dollar and offers issuers yield from government debt, which finances USDC reserves.

USDC on XRPL Launches as Global Demand Shifts

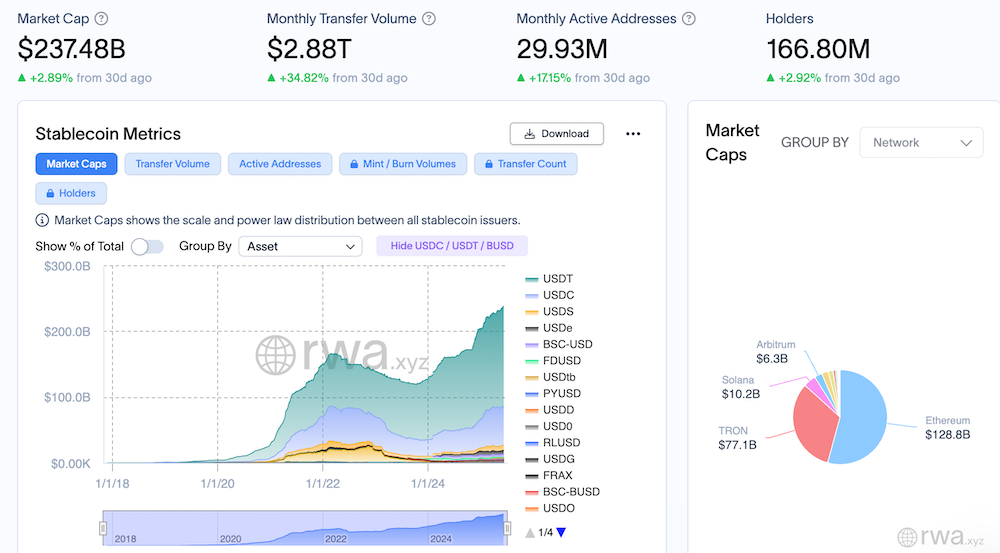

The total stablecoin market cap has exceeded $237 billion, according to data from multiple tracking sites.

Circle’s USDC forms a significant part of this market. By adding USDC to XRPL, Ripple expands the list of networks where the stablecoin is natively available.

The growing use of USDC stablecoin reflects shifts in global finance, where digital tokens backed by U.S. Treasuries gain traction.

Platforms like RWA.XYZ show increasing correlation between stablecoin growth and Treasury demand patterns.

Ripple’s announcement does not include trading volume data for USDC on XRP Ledger, but the company expects new use cases to emerge through its integration.

Developers can now use USDC stablecoin for cross-border payments, on-chain settlements, and blockchain-based finance.

Bitcoin Advocate Criticizes Stablecoin Treasury Strategy

Criticism of U.S.-backed stablecoins has come from Max Keiser, a longtime Bitcoin supporter.

In a recent post, he said that pegging digital tokens to the U.S. dollar will not resolve long-term currency issues.

He argued that “stable tokens backed by gold” could outperform USDC and similar dollar-backed assets.

Keiser cited gold’s high stock-to-flow ratio as a feature that protects value during inflation cycles.

He did not provide alternative data, but his criticism targets the structural reliance on U.S. government debt.

Meanwhile, Circle continues to list Ethereum, Solana, Avalanche, Stellar, and now XRP Ledger as supported blockchains for USDC stablecoin.

The move aligns with the company’s stated plans to increase access across multiple ecosystems.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.