VanEck will launch the VanEck Avalanche Fund in June 2025. The fund will invest in tokenized Web3 projects and Avalanche RWA products. The company disclosed this in a statement shared with Cointelegraph.

The fund, called the PurposeBuilt Fund, is for accredited investors only. It will focus on liquid tokens and venture-backed projects across gaming, payments, artificial intelligence, and financial services.

Idle capital will be allocated to tokenized assets Avalanche offers, including money market fund tokens.

VanEck said the fund will be managed by the team behind its Digital Assets Alpha Fund (DAAF), which oversees over $100 million in net assets as of May 21, 2025.

PurposeBuilt Fund Will Use Idle Capital for Avalanche RWA Products

The VanEck Avalanche Fund will not let unused capital sit idle. Instead, VanEck said it will deploy it into Avalanche RWA products.

These are digital representations of real-world financial assets, such as tokenized treasury or money market funds.

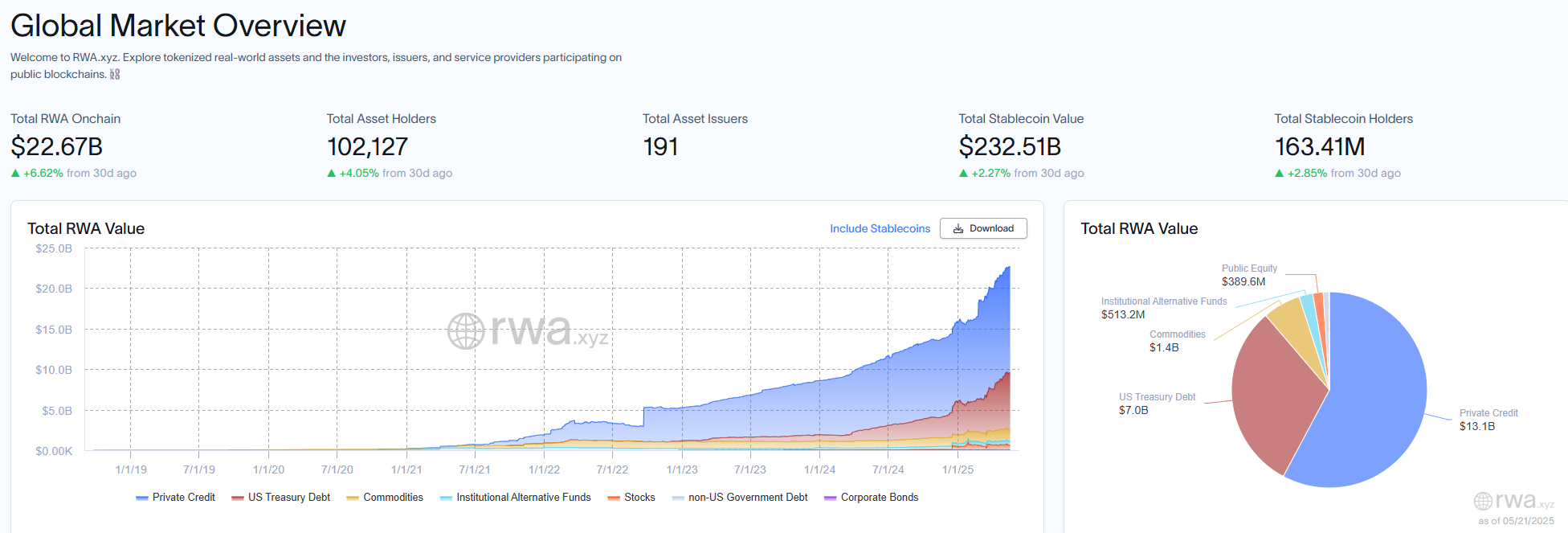

Real-world assets (RWAs) are among the fastest-growing crypto sectors, according to data from RWA.xyz. The structure allows capital to stay onchain while supporting traditional financial returns.

Pranav Kanade, portfolio manager of the DAAF, said in the announcement, “The next wave of value in crypto will come from real businesses, not more infrastructure.”

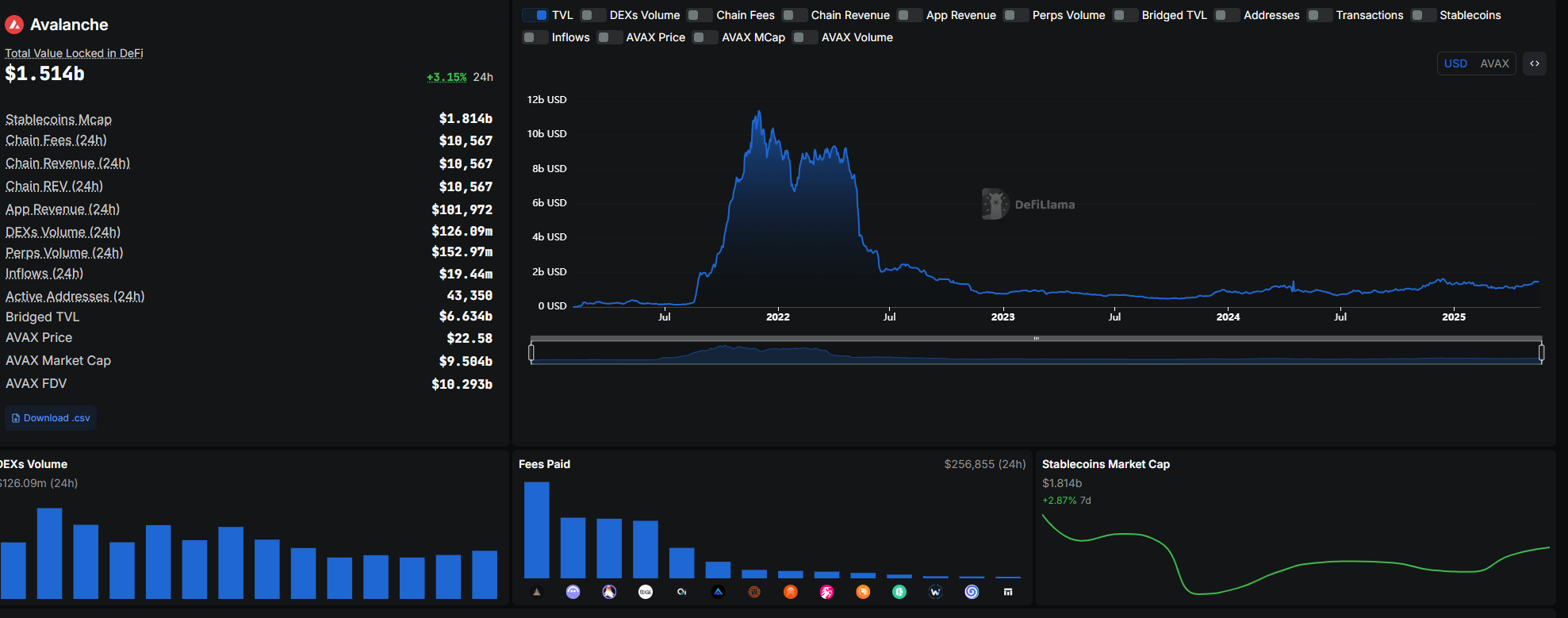

Avalanche TVL Hits $1.5B as Institutional Projects Expand

Avalanche is becoming a hub for real-world assets (RWA) and institutional blockchain applications.

The platform uses subnets, or separate networks, to run custom Ethereum-style smart contracts. These subnets give institutions better control over onchain processes.

On May 16, Solv Protocol launched a yield-bearing Bitcoin token on Avalanche. The product was designed for institutional buyers. The move added to tokenized assets Avalanche offers to financial institutions.

According to DefiLlama, Avalanche TVL reached $1.5 billion on May 21, 2025. This value reflects total locked funds across DeFi and tokenized projects on the network.

John Nahas, chief business officer at Ava Labs, said, “We’re seeing a shift away from speculative hype toward real utility and sustainable token economies.”

VanEck Web3 Fund Follows Other Crypto Initiatives

The VanEck Avalanche Fund adds to VanEck’s recent product launches in digital assets.

On May 14, VanEck launched an actively managed ETF focusing on digital economy companies. In April, it introduced another ETF that tracks a passive index of crypto firms.

The PurposeBuilt Fund focuses specifically on Avalanche-based tokenized projects. It includes both liquid tokens and early-stage crypto ventures. The use of Avalanche RWA products shows VanEck’s continued interest in blockchain-based financial infrastructure.

Asset managers like VanEck have also filed more than 70 ETF applications with the U.S. Securities and Exchange Commission (SEC).

The filings include spot crypto ETFs and staking-based funds. This trend follows policy changes since President Donald Trump took office in January 2025.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.