Listen, Warren Buffett, the Oracle of Omaha himself, has been stacking cash like a wise capo counts his chips before a big game. As of mid-2025, Berkshire Hathaway’s cash pile hit $350 billion.

That’s cash and Treasury bills combined, the biggest stash ever for a US public company.

You got to wonder, is Buffett signaling trouble ahead for stocks and Bitcoin, or just keeping his options open?

Chaos?

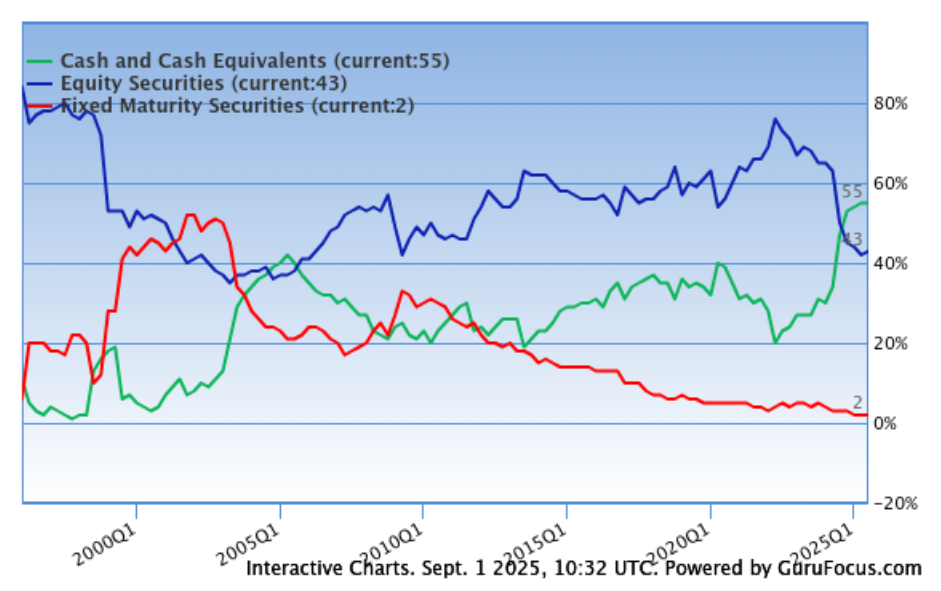

Buffett’s always been a contrarian. When the masses get greedy, he gets cautious. Back in ’98, right before the dot-com bubble exploded, he was loading up on cash, $13 billion then.

Same story in 2005-07, sitting on $44 billion before the 2008 financial meltdown.

Like clockwork, when the market heat rises too high, Warren steps back, piles cash, and waits for the chaos. And now it looks like he steps back, piles cash, and waits.

Now check this, because the Nasdaq is sky-high, at 176% of the US money supply, even higher than the 2000 dot-com peak. Against the GDP, it’s nearly double that peak. Stocks are racing ahead of the economy and money supply.

This is insane:

The Nasdaq's market cap relative to the US M2 money supply has hit a record 176%.

This means the market value of the Nasdaq is nearly TWICE as large as the the total stock of liquid money in the economy.

The ratio has now exceeded the 2000 Dot-Com Bubble peak… pic.twitter.com/ICXiOy1smK

— The Kobeissi Letter (@KobeissiLetter) August 30, 2025

Bitcoin? It hasn’t missed the party either. It’s been riding high alongside Nasdaq, with its price almost doubling to $124,500 in August.

They move almost in sync, with a correlation of 0.73. So if stocks stumble, Bitcoin could take a hit too.

More money

But the money supply, the M2, which had been flat most of 2025, just started to grow again, ticking up 4.8% year-over-year in July, the fastest pace since early 2022.

Central banks are cutting rates across the globe, and the US Fed might follow, pushing money growth possibly back to double digits. More money means more fuel for assets like Bitcoin.

Bargains

They say Buffett’s cash pile is like his famous elephant gun, ready to fire when the right opportunity shows up.

He’s not just hoarding cash out of fear, he’s likely waiting to pounce on bargains when the market finally flinches, as he always did.

So yes, from the conservative viewpoint, Buffett’s cash stash is a red flag waving for caution. Stocks look overheated.

Bitcoin’s riding shotgun and could face the fallout. But if liquidity rises, Bitcoin still has a chance to shine. In this high-stakes game, caution and opportunity go hand in hand, just ask the Oracle.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: September 2, 2025 • 🕓 Last updated: September 2, 2025

✉️ Contact: [email protected]