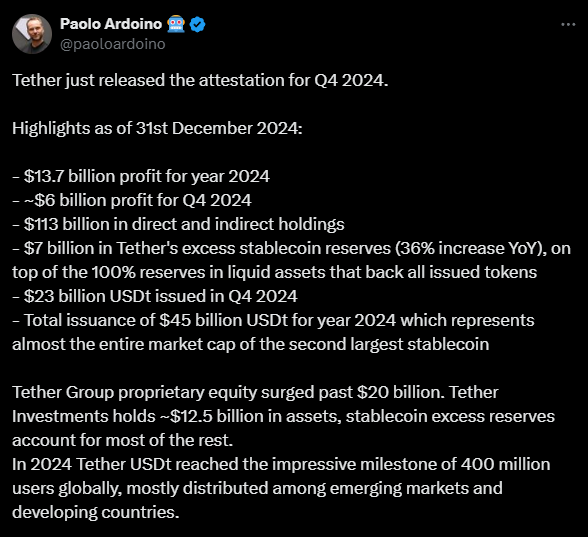

The stablecoin giant is finally stepping up to the plate with its first full financial audit.

CEO Paolo Ardoino says it’s a top priority, and they’re courting one of the Big Four accounting firms to make it happen.

Just in time?

Let’s get real, this is long overdue. The industry has been screaming for transparency, especially after Tether’s history of, shall we say, creative accounting.

Tether’s lack of third-party audits has raised eyebrows for years, with some fearing an FTX-style liquidity crisis.

Justin Bons, founder of Cyber Capital, isn’t mincing words.

“Tether is one of the biggest existential threats to crypto. We have to trust they hold $118 billion in collateral without proof!”

That’s a lot of trust. And remember, the CFTC fined Tether $41 million in 2021 for lying about its reserves. Not exactly a confidence booster.

The audit

Ardoino seems optimistic that things will be smoother under a pro-crypto president.

“If the President of the United States says this is a top priority, Big Four auditing firms will have to listen.”

But here’s the twist in the story, as Tether’s been promising a full audit for years, and all we’ve gotten are quarterly reports. It’s time to put their money where their mouth is.

The European fallout

Meanwhile, Tether’s not happy about new European regulations forcing exchanges to delist USDT. They call it rushed and unclear. But let’s be real, guys, transparency is key.

If Tether wants to avoid being the next FTX, they need to open their books wide. Hiring Simon McWilliams as CFO is a step in the right direction, but it’s just the beginning.

Tether’s got a lot riding on this audit. If they can’t prove their reserves are solid, it’s not just their reputation on the line, it’s the entire crypto market. So, will a Big Four audit save the day? The real question isn’t it?

Have you read it yet? The $11 million Netflix heist

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.