Treasury, a Euro-denominated Bitcoin company, launched with a starting balance of 1,000 BTC after securing €126 million ($147 million) in funding.

The private round was led by Winklevoss Capital and Nakamoto Holdings, according to an announcement shared on Wednesday.

The raised funds were used to buy Bitcoin directly. Treasury confirmed its goal “to be the first Bitcoin treasury company listed on a primary European exchange.”

The company will pursue a reverse listing by merging with the Dutch lender MKB Nedsense. A reverse listing allows a private firm to enter public markets by merging with an already-listed company.

Treasury Plans for Euronext Amsterdam Listing

Treasury aims to secure a listing on Euronext Amsterdam through its planned merger with MKB Nedsense. The reverse listing structure offers a direct path to the exchange.

Founder and CEO Khing Oei said Treasury would expand its Bitcoin reserves through both equity issuance and convertible debt.

The firm explained in its announcement that it will continue to accumulate Bitcoin as its primary reserve asset.

With its first allocation of 1,000 BTC, Treasury now stands among the most significant corporate Bitcoin holders in Europe.

Its launch highlights the rise of companies choosing Bitcoin as a reserve currency on European exchanges.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

European Bitcoin Treasury Holdings

Data from BitcoinTreasuries.NET shows that Europe’s largest corporate Bitcoin holder is the German firm Bitcoin Group, with 3,605 BTC worth about $400 million.

Second is the French firm Sequans Communications, which holds 3,205 BTC valued at around $356 million. In third place is the UK-based Smarter Web Company, with 2,440 BTC worth about $270 million.

By entering the market with 1,000 BTC, Treasury places itself among these leading corporate holders. The European Bitcoin treasury sector is becoming increasingly active, with new entrants competing for space in public markets.

Dutch cryptocurrency provider Amdax also announced that it plans to launch a Bitcoin treasury company and seek a listing on Euronext Amsterdam, echoing Treasury’s approach.

Risks Around the Bitcoin Treasury Model

While the Bitcoin treasury model is gaining traction in Europe, it also faces concerns.

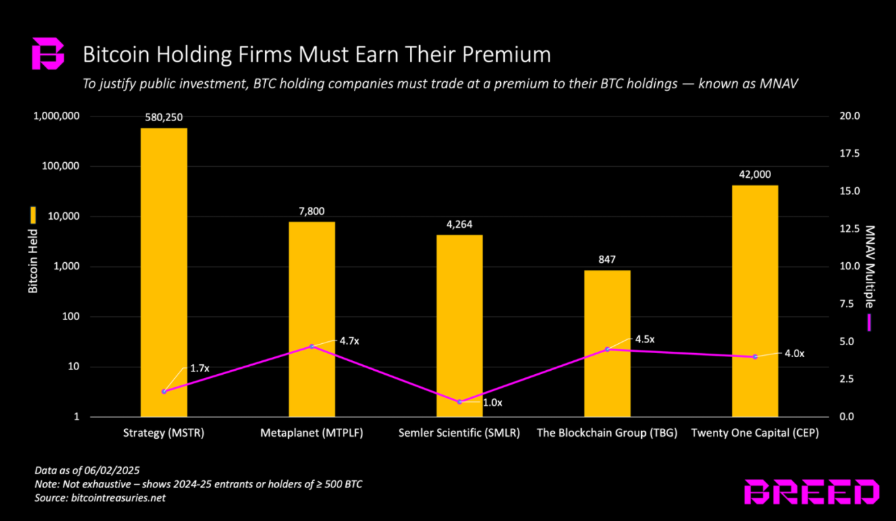

A report from Breed, a venture capital firm, warned that many companies relying on this model may struggle long term.

The report pointed to a possible “death spiral” risk for firms that trade too close to their net asset value.

CEO Khing Oei acknowledged the risks tied to leverage in this sector. “We are closely monitoring the leverage percentages which competitors have been adopting over the years,” he said. Treasury noted that its strategy keeps leverage “lower than our peers.”

Other analysts also highlighted structural risks. Josip Rupena, CEO of Milo and a former Goldman Sachs analyst, compared crypto treasury firms to collateralized debt obligations that played a role in the 2007–2008 financial crisis.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 3, 2025 • 🕓 Last updated: September 3, 2025