The Wisconsin Investment Board has exited its entire position in BlackRock’s Bitcoin ETF. According to a May 15 SEC filing, the board reported zero spot Bitcoin ETF holdings for the first quarter of 2025.

The SEC filing shows the Wisconsin Investment Board sold all 6,060,351 shares of BlackRock’s iShares Bitcoin Trust (BlackRock IBIT).

At current market value, those Bitcoin ETF shares are worth about $355.6 million.

The Wisconsin Investment Board had previously purchased $164 million worth of Bitcoin ETF shares in the first quarter of 2024.

At the time, the board became one of the first U.S. state funds to add spot Bitcoin ETF exposure for retirees.

Bitcoin ETF Exposure Made Up Only 0.2% of Wisconsin Investment Board’s Portfolio

By the end of 2024, the Wisconsin Investment Board managed more than $166 billion in assets. Its BlackRock IBIT stake accounted for about 0.2% of that portfolio before it was removed.

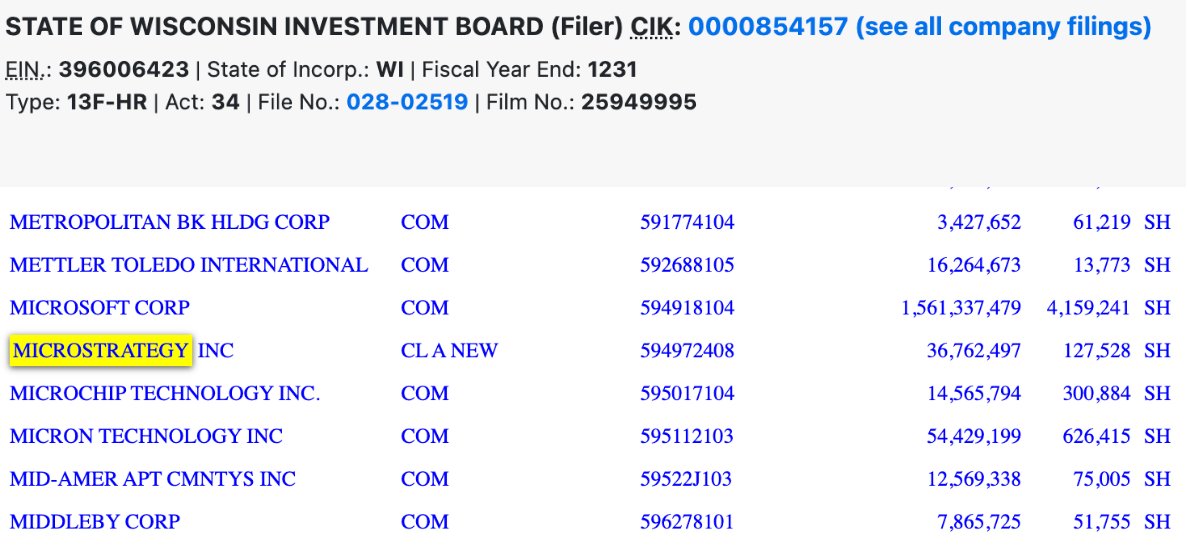

In the previous quarter, the board had shifted around 1 million shares from the Grayscale Bitcoin Trust (GBTC) into BlackRock IBIT. The move suggested a consolidation of its Bitcoin ETF holdings under a single provider.

Now, that position has been fully liquidated, as shown in the most recent SEC filing. The board did not provide any public comment on why it sold all its Bitcoin ETF shares.

Mubadala Investment Company Expands Bitcoin ETF Holdings in Same Quarter

In contrast, Mubadala Investment Company, the sovereign wealth fund of Abu Dhabi, increased its position in the BlackRock IBIT.

According to its latest SEC filing, Mubadala bought 491,439 new shares of the spot Bitcoin ETF in Q1 2025.

As of March 31, Mubadala held 8,726,972 Bitcoin ETF shares, worth around $512 million. The fund raised its exposure while the Wisconsin Investment Board removed theirs.

Both filings reflect institutional behavior during the same quarter, showing different approaches to the Bitcoin ETF market.

IBIT Inflows Reach $45 Billion, No Outflows Since Early April

IBIT inflows continued to rise despite Wisconsin’s exit. According to Farside Investors, IBIT recorded a $232.9 million net inflow on May 14. Total net inflows reached $45 billion as of that date.

The streak of daily IBIT inflows ended on May 13, when the fund saw a net inflow of zero.

However, IBIT has not recorded any outflows since April 9, marking more than five consecutive weeks of uninterrupted inflows.

Other spot Bitcoin ETF products remain behind. The Fidelity Wise Origin Bitcoin Fund (FBTC) has seen about $11.6 billion in net inflows. The ARK 21Shares Bitcoin ETF (ARK) has recorded around $2.7 billion.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.