A new report from the on-chain analytics wizards at Santiment has dropped some juicy insights about the “Total Amount of Holders” for the top three cryptocurrencies, Bitcoin, Ethereum, and XRP.

It counts how many addresses on a blockchain hold any amount of the asset, and more holders are better.

„Number go up” technology?

When this number goes up, it’s like a party invitation for new investors or a reunion for those who had previously sold off their coins.

Sometimes, existing holders might even shuffle their coins around to keep things private. So, when you see an increase in this metric, it’s a good sign that adoption is on the rise

But here’s where it gets interesting, because if the number starts to drop, it might mean some investors are packing their bags and leaving the party altogether.

And that’s exactly what’s happening with Bitcoin right now.

Comes for the king?

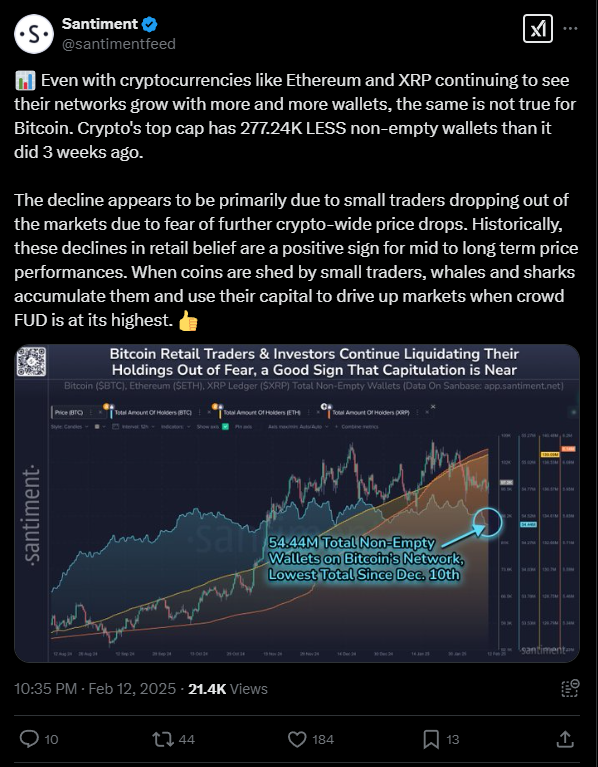

Santiment’s chart shows that both XRP and Ethereum have been on an upward trend in terms of holders for quite a while, and this suggests that new investors are flocking to these networks like moths to a flame.

XRP is particularly stealing the spotlight with its rapid growth in holders.

On the other hand, while Ethereum and XRP are gaining traction, Bitcoin is experiencing a bit of a slump.

The number of holders has been moving sideways for some time but took a nosedive in the past days and weeks.

In fact, over the past three weeks, around 277,240 non-empty addresses have vanished from the Bitcoin blockchain.

Take the money and run?

This decline typically signals that retail investors are cashing out, which could be concerning, but Santiment points out that historically, when retail investors exit stage left, it can actually be a good omen for Bitcoin’s price in the mid to long term.

Why? Because when smaller traders sell off their coins, it gives whales a chance to scoop them up and potentially drive prices back up when market sentiment is low.