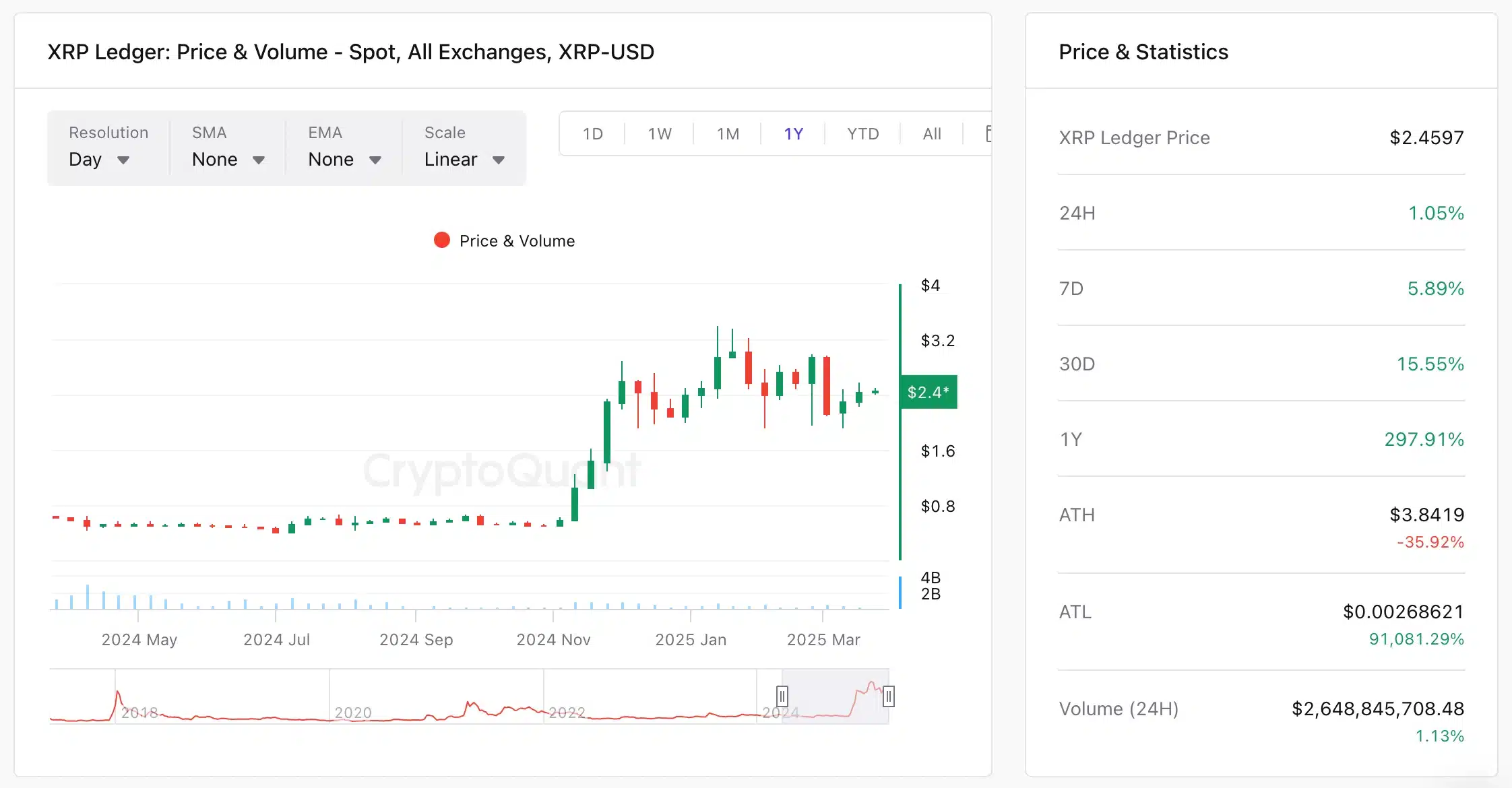

Listen up, we have to talk about Ripple again, and this time it’s not just about the drama with the SEC.

The XRP Ledger has just hit a major milestone, they handled over 2.8 billion transactions without a single hitch.

That’s like running a marathon without tripping once, impressive, right? And it’s not just the numbers, major institutions are starting to take notice.

Just getting started

The settlement between Ripple and the SEC has added fuel to the fire, boosting XRP’s momentum.

But what’s really driving this train is XRPL’s efficiency and reliability. Jasmine Cooper, RippleX’s Head of Products, puts it bluntly and said that XRPL is the go-to choice for asset issuers and institutional players simply because it’s fast and secure.

And let’s not forget OpenEden, which is tokenizing U.S. Treasury bills on XRPL, giving institutional investors access to on-chain financial instruments. That’s like having a VIP pass to the digital finance party!

BlackRock is coming

But here’s the big deal, BlackRock, the giant asset management firm, is exploring asset tokenization, and guess what?

XRPL is right in the middle of it. Cooper highlights examples like SockGen issuing stablecoins and Aberdeen launching money market funds through Archax on XRPL.

And what’s more? XRPL is expanding its ecosystem with advancements in DeFi and cross-border payments.

The introduction of Automated Market Makers has enhanced trading and liquidity, making centralized exchanges less necessary.

Plus, RippleX is integrating an Ethereum Virtual Machine sidechain to attract developers by allowing Ethereum-based smart contracts on XRPL. That’s like having the best of both worlds!

Developments

The launch of RLUSD, Ripple’s new USD-backed stablecoin, is another game-changer.

It’s perfect for cross-border transactions and could accelerate XRPL’s adoption if it secures regulatory approval.

So, is XRP Ledger the next big thing for institutional blockchain adoption? It certainly looks like it.

With its flawless track record and growing institutional interest, XRPL is positioning itself as a major player in the financial industry.

Have you read it yet? The big Bitcoin players are back in town

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.