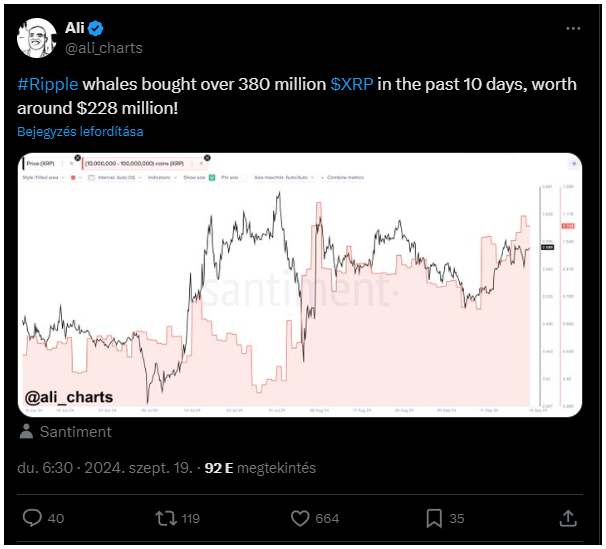

XRP whales made a massive move, snapping up hundreds of millions of dollars worth of the crypto.

Ali Martinez, a well-known crypto analyst shared in the social media that these large investors have bought 380 million XRP in the last 10 days, spending about $228 million at current prices. Do they know something what we don’t?

Massive XRP accumulation

Martinez shared that whales, who typically hold between 10 million and 100 million XRP, now possess a total of 7.11 billion XRP.

This is equivalent to approximately $4.25 billion, which represents 12.59% of the circulating supply of XRP.

The volume itself of this accumulation could signal super-strong confidence among large investors, suggesting that they see a bright future for XRP.

Why are whales buying XRP?

The huge uptick in whale activity is pretty likely a sign that these investors believe in XRP’s potential, particularly because of its clear legal status.

Unlike many other cryptocurrencies, XRP indeed gained regulatory clarity following the SEC’s lawsuit against Ripple, where XRP emerged victorious.

This win provided XRP with a quite important foundation, making it one of the few digital assets that investors view as legally secure.

In addition to the legal clarity, XRP also saw increased adoption, largely driven by Ripple’s expanding network of partnerships. This combination of factors gives XRP a strong position in the crypto market.

Technical indicators point to gains

From a technical analysis’ standpoint, there are positive signs that could predict a price rally for XRP.

One such signal is the formation of an inverted head and shoulders pattern on the price chart, which is a textbook bullish pattern.

If the price breaks above the $0.65 neckline, it could potentially climb to $1, offering a really nice return for those invested in the coin.