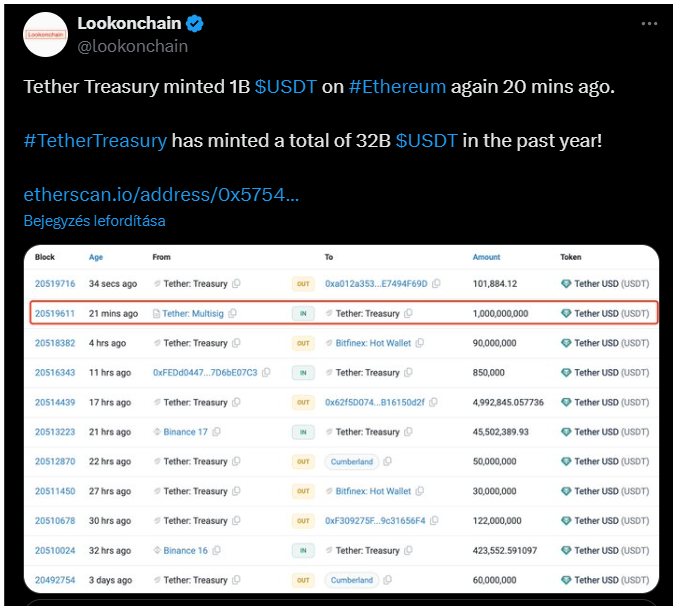

There is another $1 billion in USDT landed on the Ethereum network, which comes right on the heels of another billion-dollar transfer that took place on the Tron network just days earlier.

Inflows to the crypto market

Tether Treasury minted this additional billion dollars as part of a series of transactions this month.

Just to give you some context, Tether has over $125 billion in USDT currently circulating. That’s a lot of stablecoins.

The transaction involved moving funds from a Tether multi-signature wallet to the Tether Treasury.

Earlier, on November 13, Whale Alert highlighted that Tether had transferred $1 billion USDT to the Ethereum chain.

Tether’s CEO, Paolo Ardoino, clarified that while the transaction was authorized, it hadn’t been issued yet.

As it stands, Ethereum is home to the largest chunk of authorized USDT, totaling around $62.9 billion. Tron is the second player, close behind with $62.7 billion in authorized USDT.

What’s next for Tether?

The newly minted stablecoins are set to be held in reserve for future market demands on on-chain exchanges.

This move seems strategic as Tether gears up for whatever the market throws its way.

Arkham Intelligence reported that Tether also minted another billion USDT on the Tron network on November 14.

This transaction originated from a black hole address and eventually made its way to a Tether multi-signature wallet before being transferred to the treasury.

In August, Tether also minted another billion USDT to expand its supply. Ardoino mentioned that while these tokens were approved, they weren’t quite ready for distribution yet.

Tron’s growing popularity

Tron is seeing some serious action lately in case of stablecoins. The network generated over $577 million in revenue in Q3 2024, with more than 73% coming from staking and around 26% from burning activities.

Tron is now the second-largest stablecoin network, accounting for about 35% of all stablecoins out there.

It’s particularly popular in developing countries where high inflation drives demand for more stable assets.

CryptoQuant noted that since the U.S. presidential elections earlier this month, $3.2 billion worth of USDT has been traded on centralized exchanges, and analysts think that this growth in stablecoin market capitalization could have a positive effect on digital currency prices overall.

Stablecoins help inject liquidity into the crypto ecosystem, so when minting goes up, it could signal bullish trends for traders.

Conversely, a drop in stablecoin supply might suggest waning interest in digital assets.