Scam Sniffer said address poisoning recently cost two victims more than $62 million. One victim lost $12.2 million in January after copying the wrong address from transaction history. Scam Sniffer tied that loss to an “address poisoning attack.”

The report also pointed to a similar $50 million case in December. Together, the two incidents made up the $62 million total Scam Sniffer cited.

Address poisoning is a crypto scam that uses “dust” transfers. Attackers send tiny transactions from look alike addresses. As a result, the fake address shows up in the victim’s history. Later, the victim copies it by mistake.

Address Poisoning Attack Targets Copy Paste Habits

In an address poisoning attack, the scammer makes a wallet address look familiar. The address matches the same first and last characters seen in past transfers. However, the middle characters differ.

Security firm Web3 Antivirus said this scam keeps causing large losses. “Address poisoning is one of the most consistent ways large amounts of crypto get lost,” the firm reported on Thursday.

Web3 Antivirus said it tracked major address poisoning losses over time. It put the range from $4 million to $126 million. It added, “Recent incidents show this trend isn’t slowing down,” while pointing to fresh cases.

Signature Phishing Theft Hits $6.27M Across 4,741 Victims

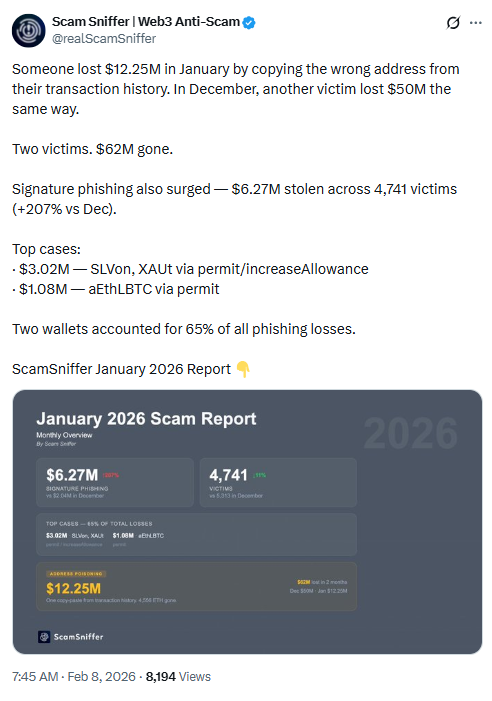

Scam Sniffer also reported a rise in signature phishing. The firm said attackers stole $6.27 million from 4,741 victims in January. It said that total was 207% higher than December.

Two wallets drove most of the theft, Scam Sniffer said. It reported that two wallets accounted for 65% of all signature phishing losses.

Signature phishing differs from address poisoning. It relies on a user signing a harmful onchain action. These actions can include unlimited token approvals. In that case, the approval can let attackers move tokens later.

Ethereum Fusaka Upgrade Linked to Cheaper Dust Attacks

Analysts warned that Ethereum’s Fusaka upgrade made address poisoning cheaper to run. They pointed to lower transaction costs that can reduce the price of dust transfers. The upgrade took place in December.

Coin Metrics reported earlier in February that stablecoin related dust activity rose on Ethereum. It said stablecoin dust now makes up about 11% of all Ethereum transactions. It also said the activity covers about 26% of active addresses on an average day.

Coin Metrics said it analyzed more than 227 million balance updates for stablecoin wallets on Ethereum from November 2025 through January 2026. It found 38% of those updates were under a single penny. The firm said that pattern matched “consistent with millions of wallets receiving tiny poisoning deposits.”

DAI Mentioned as Illicit Parking Place in Address Poisoning Reports

Blockchain intelligence firm Whitestream reported on Sunday that the decentralized stablecoin DAI has gained a reputation as a preferred stablecoin for illicit actors. It said DAI serves as a “parking place” for illegally sourced funds. It linked that claim to recent address poisoning cases.

Whitestream said this stems from protocol governance. It said the governance does not cooperate with authorities in freezing DAI wallets.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: February 9, 2026 • 🕓 Last updated: February 9, 2026