Finbold’s crypto expert, Vinicius Barbosa observes that the cryptocurrency market appears to be slowing down, signaling a prolonged period of stagnant prices. The crab market will continue?

Stay in the line

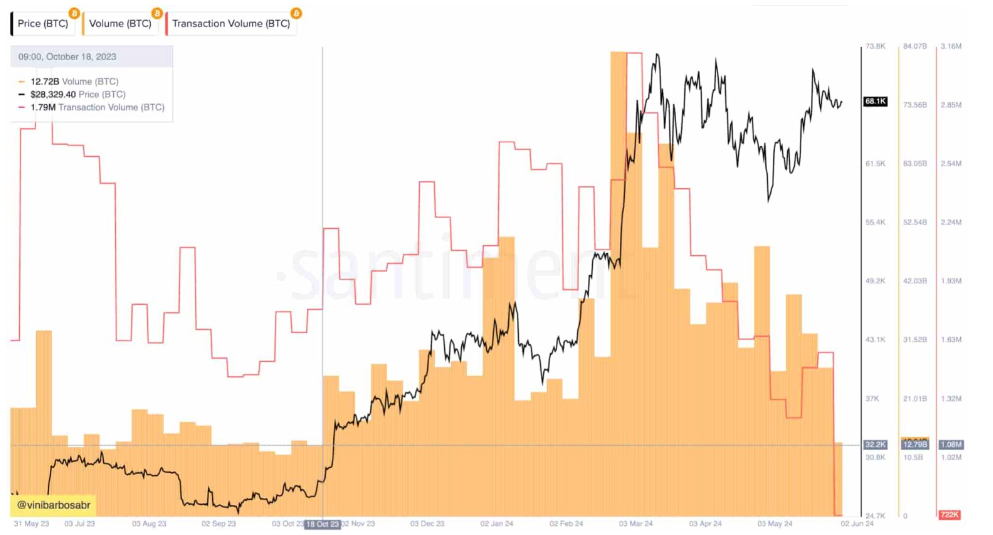

Since February 2024, Bitcoin has fluctuated between $60,000 and $72,000, with few short deviations from this range.

This has resulted in a largely neutral momentum for Bitcoin, with both trading and transaction volumes plumetting.

According to market data, Bitcoin’s seven-day trading volume has dropped below $14 billion, a level last seen in 2023 when Bitcoin was priced below $30,000, half of its current price. Bitcoin now is traded at around $68,000.

This indicates a huge decline in interest in Bitcoin trading and on-chain transactions, with only 722,000 BTC moved in the past week, compared to 1.79 million BTC in October 2023 when the trading volume was similar, but the price was half as much.

Never saw this before

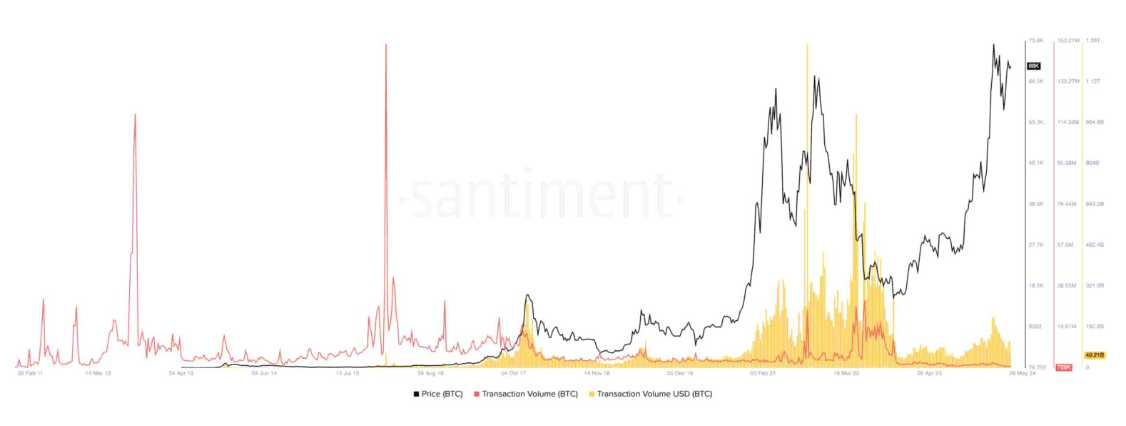

Zooming out for longer timeframes, Bitcoin’s current transaction volume is at its lowest since the cryptocurrency’s inception, and many says this low network activity stands in contrast with the historical increase in speculative demand for Bitcoin.

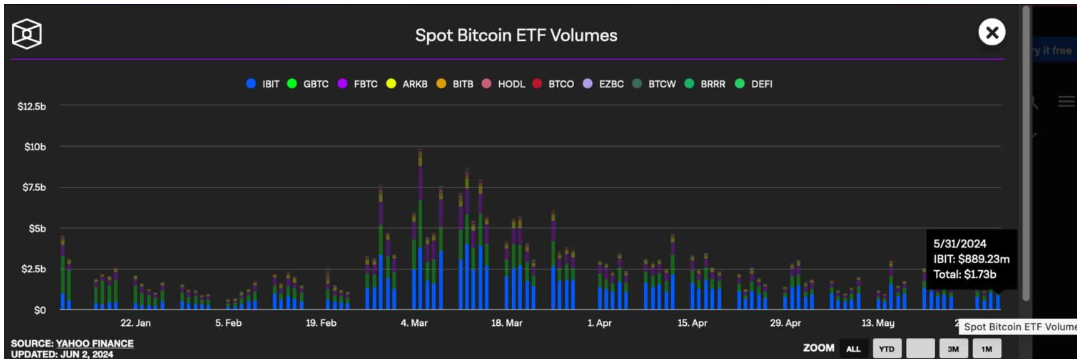

In 2024, Bitcoin spot ETFs, approved earlier this year, have generated $1.73 billion, according to data from IntoTheBlock and Yahoo.

These ETFs have recorded a total volume of $12 billion over the last seven days, comparable to Bitcoin’s spot volume on cryptocurrency exchanges, and this trend indicates a growing preference for trading regulated and custodial exchange-traded funds over Bitcoin itself, or at least, among the professional traders.

The market is changing

Another important factor, the derivatives volume highlights the bigger-than-usual speculative interest in Bitcoin, as CoinGlass data reveals a daily derivatives volume exceeding $34 billion, nearly three times the seven-day volume for spot trading.

The volume of futures contracts and other Bitcoin derivative financial products has remained steady since peaking in March 2024.

These trends suggest a market shift towards speculation on Bitcoin prices through ETFs and derivatives, rather than acquiring Bitcoin for self-custody or long-term holding from cryptocurrency exchanges.

This behavior moves away from Bitcoin’s original vision of peer-to-peer transactions and depict the increased risks associated with trading derivative products, or any third party service, where traders and investors aren’t holding their own keys.