BitMEX co-founder Arthur Hayes believes that changes in central bank policies are set to drive an increase in the price of cryptocurrencies.

So it begins

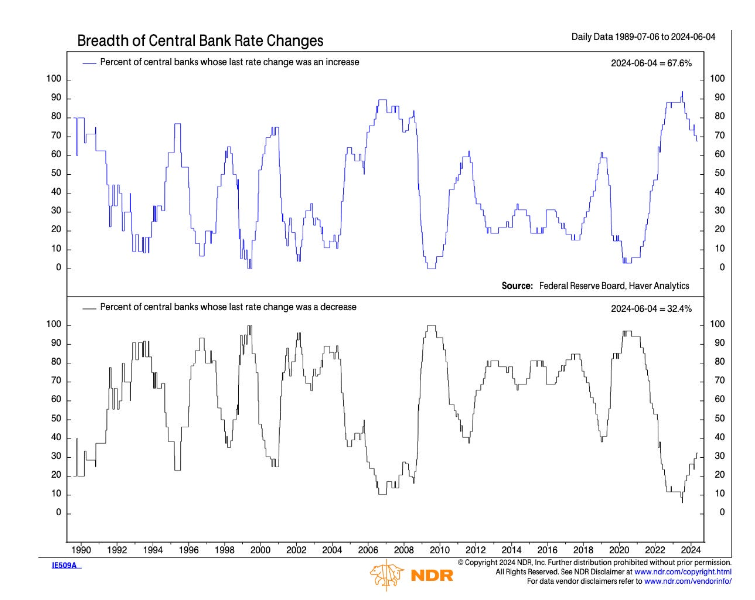

In his recent essay, Hayes, now the Chief Investment Officer of the crypto investment fund Maelstrom, highlights that both the Bank of Canada and the European Central Bank have done rate cuts.

This shift, according to Hayes, could indicate a global trend toward more relaxed monetary policies, which might soon be mirrored by the US Federal Reserve, known as quantitative easing, or let us say, money printing.

“The June central banking fireworks kicked off this week by the BOC and ECB rate cuts will catapult crypto out of the northern hemispheric summer doldrums. This was not my expected base case. I thought the fireworks would start in August, right around when the Fed hosts its Jackson Hole symposium. That is typically the venue where abrupt policy changes are announced going into autumn. The trend is clear. Central banks at the margin are starting easing cycles.”

Fortune favors the brave

Hayes asserts that this shift in monetary policy signals a golden opportunity to invest in Bitcoin and other altcoins.

But worth to mention he also got huge bags to pump, so he’s maybe a little biased.

“The macro landscape has changed vs. my baseline. Therefore, my strategy shall change as well. For the Maelstrom portfolio projects, who asked for my opinion on whether to launch their tokens now or later. I say, Let’s F*ing Go! For my excess liquid crypto synthetic-dollar cash, a.k.a. Ethena’s USD that’s earning some phat APYs, it is time to deploy it again on conviction shitcoins. Of course, I’ll tell readers what those are after I have purchased them. But suffice it to say, the crypto bull is reawakening and is about to gore the hides of profligate central bankers.”

Hello printer my old friend

This potential bullish phase in the cryptocurrency market could mirror past instances where monetary policy changes caused significant growth in digital assets.

The easing cycles initiated by central banks could raise investor interest and drive up the price of cryptocurrencies, and Hayes’s confidence in this trend suggests a speculative yet optimistic outlook for the near future.

Arthur Hayes’s analysis shows a pivotal moment for cryptocurrencies, driven by central banks’ policy shifts, as the liquidity levels correlate with the prices.

We saw this before, and now it seems it’s coming again. The expected easing of monetary policies could catalyze a new bullish phase for Bitcoin and altcoins.