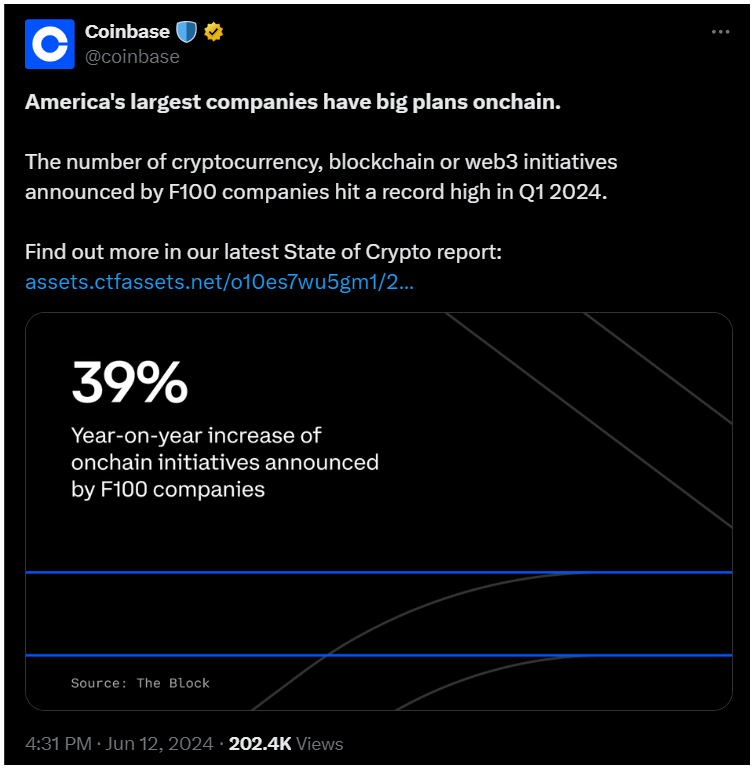

A recent report from Coinbase highlights a big increase in blockchain projects among Fortune500 companies, showing a 39% rise compared to last year.

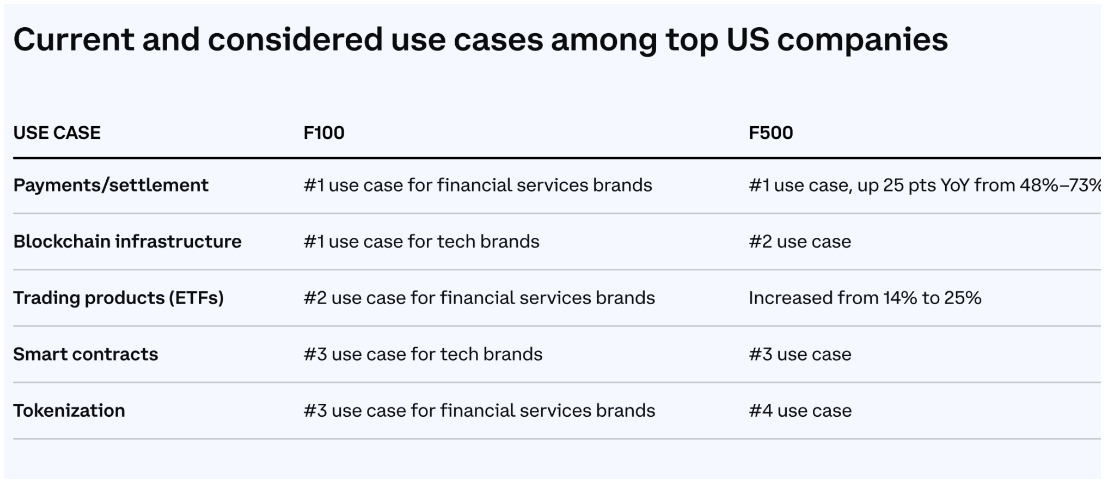

Their survey revealed that 56% of Fortune500 companies are now involved in blockchain projects, including payment applications for consumers.

Bitcoin is not fringe anymore

The launch of spot Bitcoin ETFs has been met with huge demand, with assets under management surpassing $63 billion by now.

The SEC’s approval of spot Ether ETFs, pending CFTC approval, also represents another key development, making crypto more accessible for everyone through well-known, trusted financial products.

Interest in on-chain government securities is also growing, particularly in real-world asset tokenization, as high interest rates have driven up demand for tokenized U.S. Treasury products, which have surged over 1,000% since early 2023, reaching $1.29 billion.

BlackRock’s tokenized Treasury fund, BUIDL, has become the largest at $382 million, overtaking Franklin Templeton’s $368 million fund.

Based on the analsyts’ and industry experts’ estimations, by 2030, the tokenized asset market is expected to reach $16 trillion, comparable to the EU’s current GDP.

If crypto is for criminals, what are big companies doing?

People are noticing that if major corporations and funds are start to use crypto, it must be good for the average person too.

And now we see as more and more big companies are venturing into the crypto space, reinforcing this view.

Major payment companies like PayPal and Stripe are also pushing forward with blockchain adoption.

Stripe merchants can now accept USDC payments via Ethereum, Solana, and Polygon through Circle, with automatic conversion to fiat, and cross-border transfers without fee.

In 2023, stablecoins’ annual settlement volume reached $10 trillion, over 10 times the global remittance volume.

Small business, big impact

Blockchain isn’t just for large corporations. Coinbase found that small businesses in the U.S. are exploring crypto solutions too.

About 68% of small businesses believe crypto can solve financial issues like transaction fees and processing times.

Nearly half of Fortune500 executives think crypto could widening access to the financial system and help in wealth creation.

They also noted that banks should collaborate more with crypto-using companies to promote innovation.