A big movement in Litecoin has been observed, where a large holder withdrew $20 million worth of LTC from Binance.

Based on the common views, withdrawal is for long term holding.

Deep water

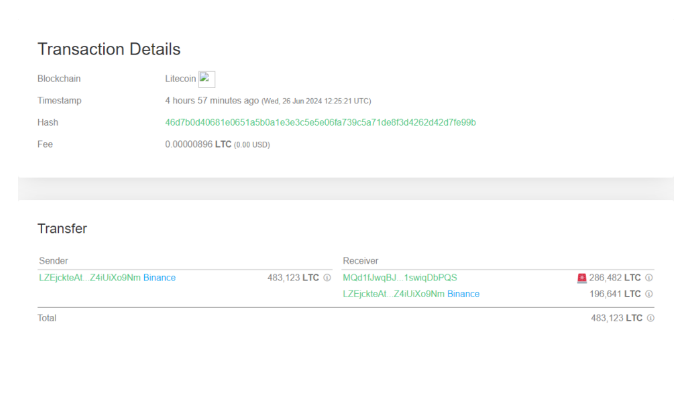

Data from the crypto tracker WhaleAlert warned that a huge transfer just happened on the Litecoin blockchain.

🚨 286,482 #LTC (20,575,399 USD) transferred from #Binance to unknown wallethttps://t.co/N4sBOdEXIA

— Whale Alert (@whale_alert) June 26, 2024

286,482 LTC, valued at around $20.6 million, were moved in a single transaction, from an exchange wallet.

This transaction is maybe attributed to a whale, an entity with a giant amount of cryptocurrency, capable of influencing markets through their activity.

Market powers

The effect of a whale transaction depends on the whale’s intentions, and while the exact reason for this transfer is unclear, the details provide some clues.

The Litecoin was sent from a wallet associated with Binance to an unknown wallet. Unknown wallets are typically personal, self-custodial addresses not linked to any centralized platform.

Transfers like this, known as exchange outflows, suggest that the investor might be planning to hold onto the cryptocurrency for an extended period or might have made a fresh purchase.

Either way, it signaling the buying, holding intentions, not the selling. Which is positive for many.

If the intention behind this transfer is accumulation, it hopefully signal a bullish trend for Litecoin, as the reduced supply on exchanges typically followed by price increases.

But if the whale intends to sell the LTC through over-the-counter deals, this could lead to a bearish trend, because it’s selling pressure.

Veteran, but still active

In the past years, Litecoin has maintained its status as one of the most active blockchains globally.

A new post from Litecoin’s official X handle mentioned that the daily active address count for Litecoin surged to 802,470.

Active addresses are those that participate in transactions on the network daily, reflecting the chain’s traffic and usage.