A big milestone has been reached with 32.6 million ETH, over 27% of the total supply, now being used to secure Ethereum’s proof-of-stake network, by staking.

The problem is, while this is indeed impressive, it’s also way too much.

Stakeholder capitalism

The increase in staked ETH shows strong interest for Ethereum staking, even though the new ETFs can’t stake their holdings due to regulatory rules.

The amount of staked ETH has grown steadily, with a smaller slowdown after the Shanghai upgrade in spring 2023, but people likes the ’more you have, more you get’ method.

Slow bureaucracy

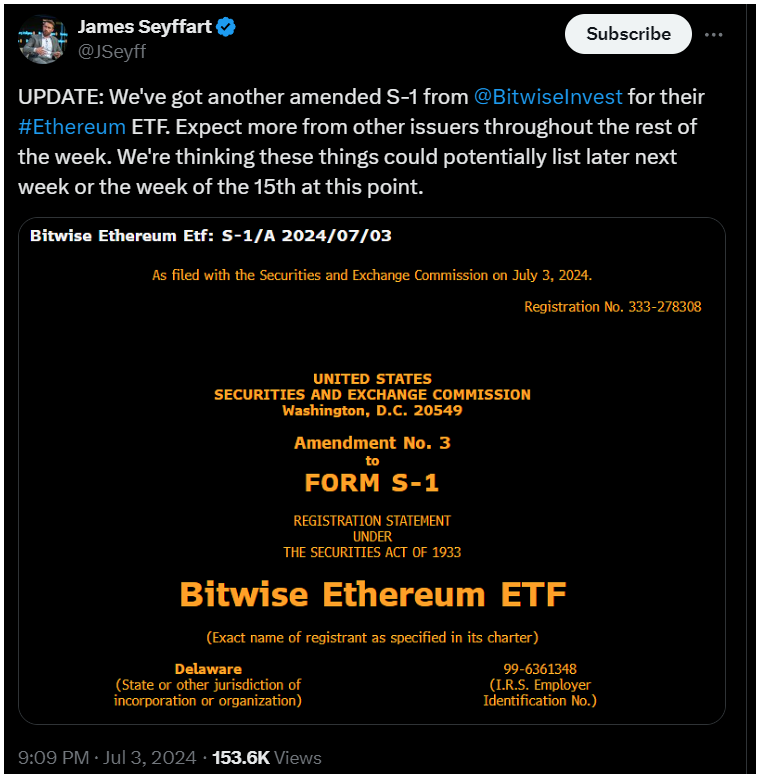

The process for the SEC to approve Ethereum ETFs is slower than expected. This makes he analysts’ work a little complicated, as predictions becoming pretty unreliable.

For example, Bloomberg ETF analyst James Seyffart suggested on Twitter that these ETFs might start trading next week or the week after, but experts told this already more times in the previous months.

This slow approval process has led traditional finance players starting to explore new ways to enter to the crypto market, because simply put, they became impatient.

Franklin Templeton, which manages $1.6 trillion in assets, is planning to launch a fund focused on altcoins and staking rewards, and Toronto-based Purpose Investments already has an Ethereum fund that can stake the underlying ETH.

Economic security doesn’t equal real security

Evan Van Ness, an Ethereum researcher, shared in the social media that while the high amount of staked ETH provides strong economic security for Ethereum, it also raises concerns about centralization.

When he was questioned by the press, he told there is a risk in this model.

„We definitely don’t need this much ETH staked, given how Ethereum proof-of-stake has so many times more economic security than proof-of-work, if your staking pool is running a majority client or runs in the cloud, you are putting your ETH at risk.”

Danny Ryan, an Ethereum Foundation researcher, explained the economics of staking, as staking on Ethereum is driven by reward curves and economic incentives designed to keep the network secure and encourage participation.