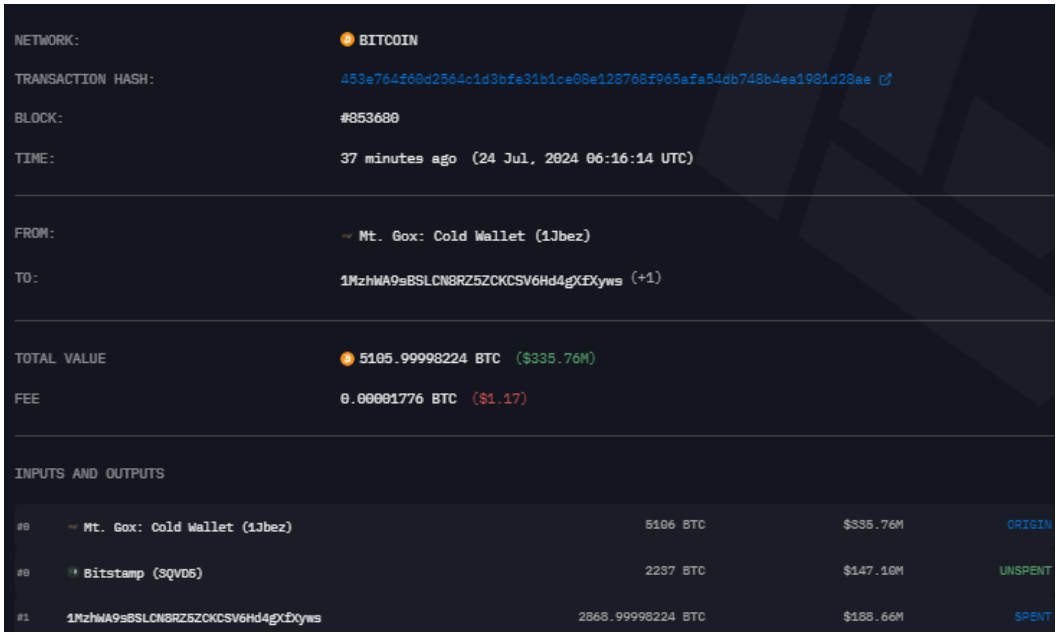

Mt. Gox, the defunct cryptocurrency exchange transferred 5,106 Bitcoin, worth about $335 million, to Bitstamp and an unknown wallet. This transaction is part of its ongoing repayment process.

Destination: Bitstamp

On July 24, Mt. Gox sent 5,106 Bitcoin in two transfers.

Arkham Intelligence, an analytics platform observed the transfers, and their data shows that 2,237 BTC, valued at $147 million, went to Bitstamp, while 2,869 BTC went to an unknown address.

The unknown address quickly moved the Bitcoin through multiple wallets, eventually reaching addresses associated with Bitstamp.

Experts think this splitting of Bitcoin between direct and indirect routes may help allocate repayments to specific creditors more efficiently, so likely this the reason why they did the transfers in this way.

10 years waiting

Mt. Gox’s repayment activities follow an official announcement made on July 5, where the exchange stated it would finally distribute owed funds in Bitcoin and Bitcoin Cash to its victims.

Bitstamp, one of the five exchanges involved in the Rehabilitation Plan, is helping return funds to users.

After a quick snapshot, the numbers shows that more than 66% of the Bitcoin owed to creditors has already been distributed.

History in making

Mt. Gox’s current Bitcoin holdings stand at 90,344 BTC, valued at around $6 billion, and this figure hasn’t changed in the past few days.

But then they accelerated the process, and transfers went crazy. On July 23, Mt. Gox had around 42,744 BTC, worth $2.85 billion, after sending out over 47,500 BTC.

By July 24, at 4:53 am UTC, 37,477 BTC was sent out, followed by another 5,106 BTC at 6:16 am UTC.

In total, 42,583 BTC were sent out within four hours, leaving the Mt. Gox entity with just 161 BTC, worth about $10 million.

Maybe we’re seeing the last chapter in the infamous Mt. Gox event. It would be just in time.