A new legal battle emerges for Binance and its ex-CEO Changpeng “CZ” Zhao as they face a class-action lawsuit accusing them of facilitating the laundering of stolen cryptocurrency.

Investors in trouble

Binance is one of the world’s largest cryptocurrency exchanges, and its former CEO, Changpeng “CZ” Zhao, are now contending with a new class-action lawsuit.

Filed on August 16 in Seattle, the lawsuit comes from three cryptocurrency investors. These investors allege that their digital assets were stolen and subsequently laundered through Binance, making recovery impossible.

The plaintiffs assert that their stolen funds were sent to Binance by cybercriminals, who then used the platform to sever the connection between the stolen assets and the blockchain ledger, rendering them untraceable.

A critical aspect of blockchain technology is the immutable record of transactions, which theoretically should make such assets traceable.

The plaintiffs argue that without platforms like Binance to launder stolen crypto, law enforcement could potentially track down the perpetrators by following the blockchain trail.

This sounds true, like if we don’t have roads, crime would stop immediatelly as criminals can’t going nowhere to doing crime, right? Ffs.

Interesting takes

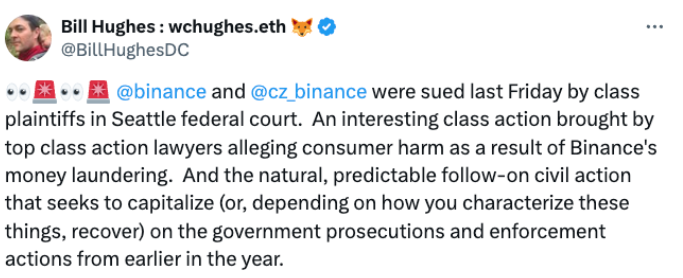

Bill Hughes, senior counsel and director of global regulatory matters at Consensys, the company behind Ethereum, expressed skepticism about the lawsuit’s success in proving these serious allegations.

Hughes remarked that this lawsuit is a predictable follow-on to ongoing government prosecutions.

But he also acknowledged that the lawsuit puts Binance in a precarious position, with potentially far-reaching consequences for the whole cryptocurrency industry if this case advances to trial.

Hughes highlighted that if the case proceeds through discovery and pre-trial motions, it could bring blockchain analytics and the process of on-chain asset recovery under pretty intense scrutiny.

He pointed out that Binance’s defense could place the efficacy of blockchain tracking and asset recovery on trial, a challenging stance for the company, especially if it values the industry’s integrity.

Risky business

This lawsuit is just the latest in a series of legal challenges for CZ and Binance.

In November last year, CZ pleaded guilty to violating U.S. money laundering laws and stepped down as Binance’s CEO as part of a settlement with authorities.

In April, CZ was sentenced to four months in prison, and began serving his sentence in June and is expected to be released in September.