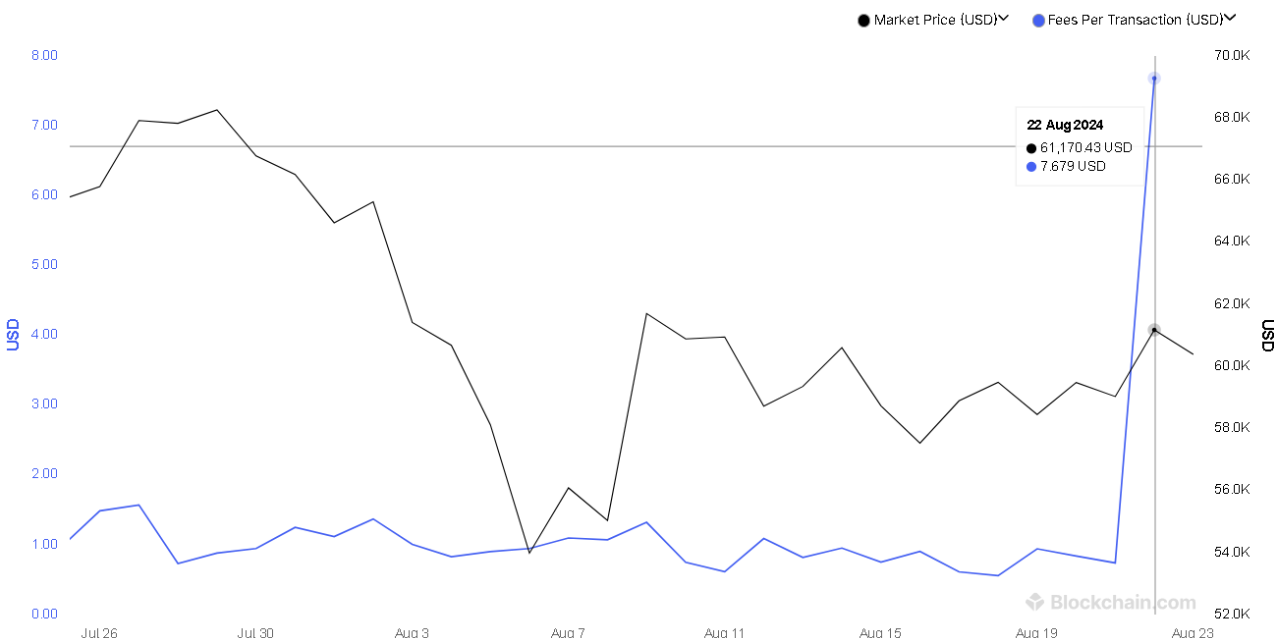

The average transaction fee for Bitcoin skyrocketed by 937.7% on August 22, jumping from $0.74 to $7.679 per transaction.

This jump was primarily due to a sudden increase in network demand for blockspace.

Market price for blockspace

Bitcoin’s average transaction fees remained relatively low for several weeks, staying below the $2 level.

Just a few days earlier, on August 18. fees even hit a historic low of $0.558, making Bitcoin transactions more cheaper.

But while low transaction costs indeed can encourage wider public use, they also negatively impact miners’ revenue, which relies on these fees next to the coinbase transaction in the block reward.

The Bitcoin network imposes a fee on every BTC transfer as compensation to miners who authenticate transactions.

When the demand for network bandwidth, the blockspace increases, so do the fees needed to send txs on the blockchain. Natural balance between demand and supply.

Peak demand, peak costs

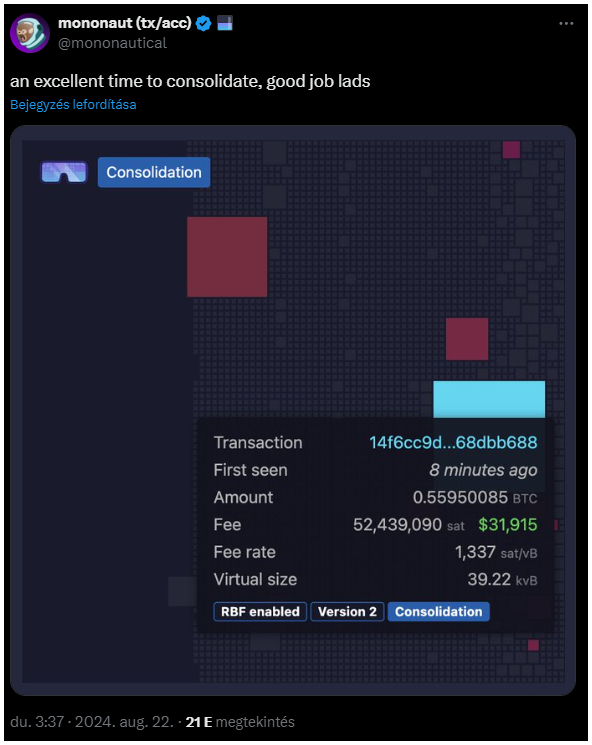

The pretty unexpected rise in fees led to some extreme cases, as this spike forced many in the crypto community to pay way higher than usual fees in this period.

One painful incident was shared by a Bitcoin developer known as Mononaut, who reported that a user was charged 0.5 BTC in fees to consolidate 0.55 BTC. Ouch.

Fee market is a free market

The craziness didn’t last too long, by August 23. it ended, and mempool data shows that average Bitcoin transaction fees went back to $0.34.

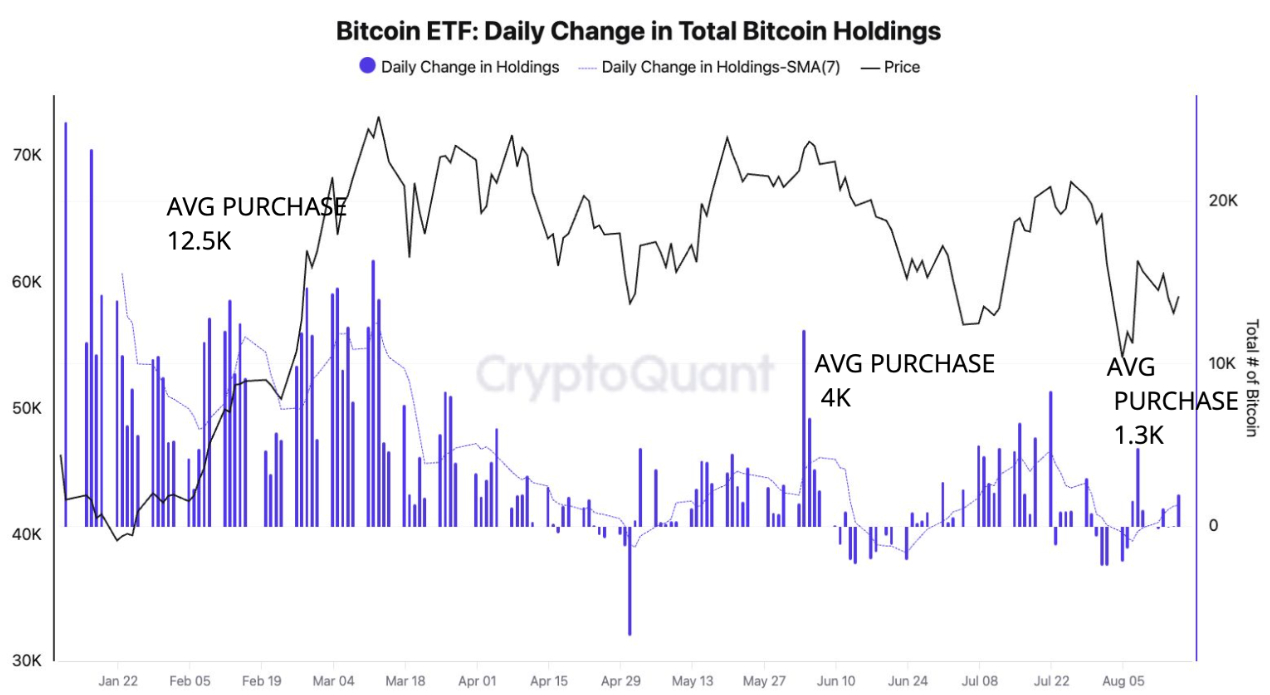

A new CryptoQuant analysis revealed that Bitcoin demand decreased big time in the last months, with growth dropping from 496,000 BTC in April to a negative growth of 25,000 BTC right now.

This is partly attributed to a decrease in purchases by spot Bitcoin ETFs in the United States, which fell from 12,000 BTC in March to an average of 1,300 BTC between August 11 and August 17.

But also worth to mention, daily 1,300 BTC is still more than the daily mined new supply.