Bitcoin has taken a bigger downturn, dropping below the $59,000 level. Some see this dip as a good opportunity to buy, but new data suggest that investors should be more cautious.

Stablecoin inflows reflect buyers’ numbers, and now, inflows are low

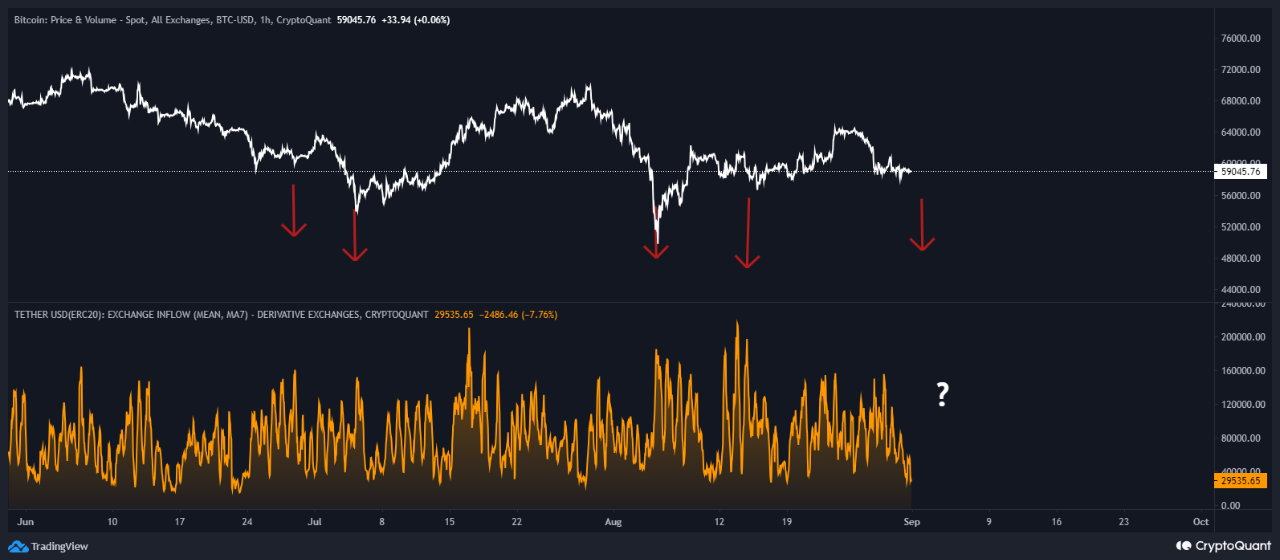

CryptoQuant analyst known as ‘Kriptolik’ shared that stablecoin inflows to exchanges are nearing historic lows, and this is not a good sign.

This trend might signal that investors are uncertain about the end of Bitcoin’s current decline, so simply put, they await more price dip.

Stablecoins are frequently used to buy assets like Bitcoin when the market appears to be recovering.

The analyst pointed out that typically, after a dip in Bitcoin’s price, investors would transfer large amounts of stablecoins to exchanges, betting on a market rebound. But now this isn’t happening.

The current low inflow levels suggest that investors are pretty hesitant to buy Bitcoin even at its lower price, they may think the downturn isn’t over yet.

The struggle is real

After closing August, Bitcoin hasn’t shown any recovery as September starts. Since the start of the month, Bitcoin’s price has hovered around the $58,000 range, struggling to break out of it.

Bitcoin remains down by 8.5% over the past week, with a current trading price of $58,156 at the time of writing. Weak market.

Where are we in the Bitcoin halving cycle?

Popular crypto analyst Mags shared in the social media that Bitcoin’s current price action mirrors previous cycles, where the price fluctuated near its all-time high for months before resuming its uptrend.

#Bitcoin – Bull run 2.0 Incoming.

The current monthly consolidation on BTC looks a lot like the previous cycle when the price surged all the way to its all-time high.

Back then, the price also consolidated near the ATH for months, with most people flipping bearish, before it… pic.twitter.com/b0olonVokl

— Mags (@thescalpingpro) September 1, 2024

During previous cycles, Bitcoin’s price consolidated near its peak for several months, causing many to lose confidence before it eventually skyrocketed again.