Bitcoin reserves on exchanges have plummeted to levels not seen in years, and this drop could have some serious implications as the price inches closer to $100,000.

Where’s the Bitcoin?

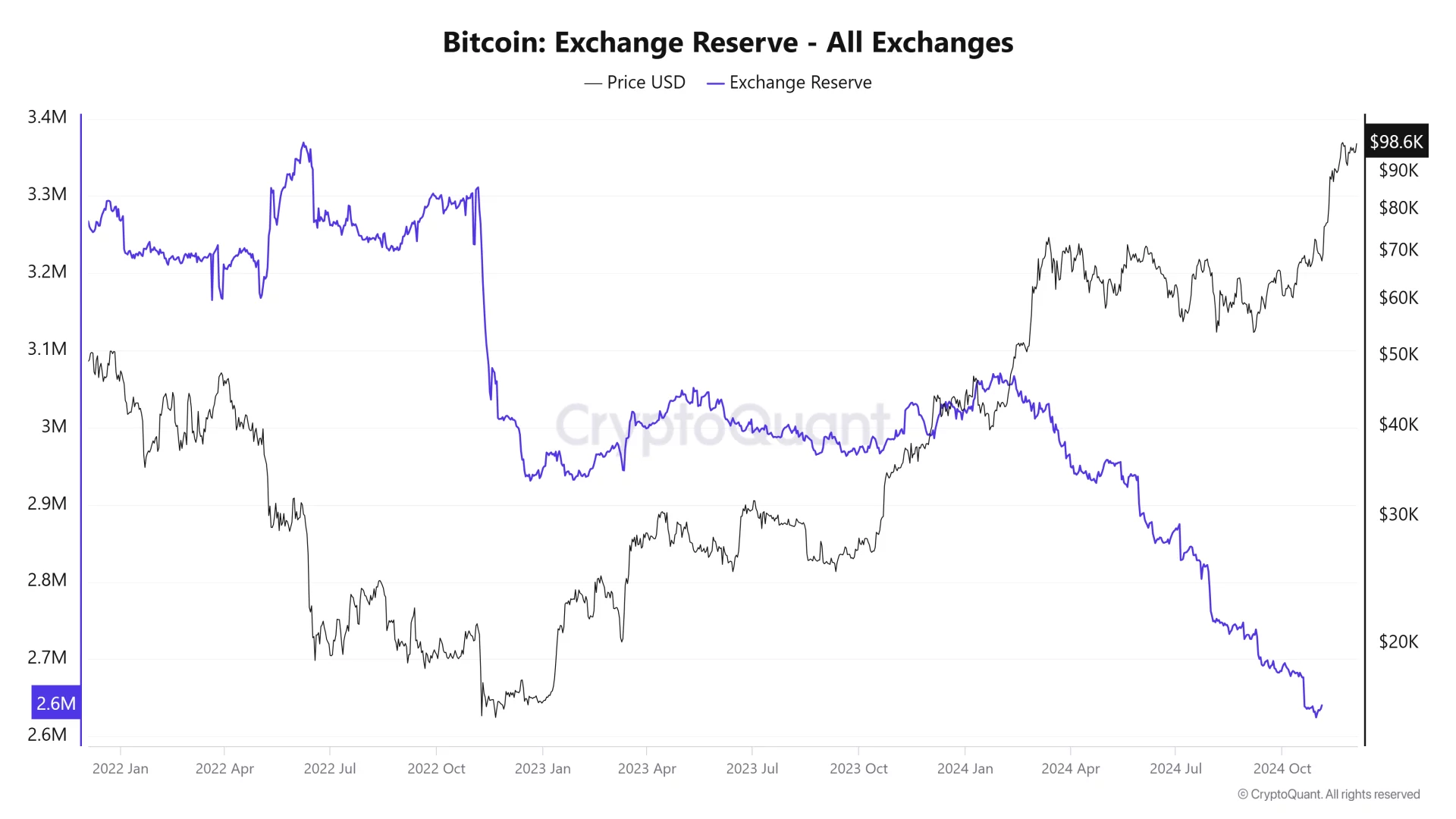

Bitcoin reserves on exchanges have fallen to 2.46 million BTC, down from 3.33 million BTC just a year ago.

This decline is happening during a bull market, which usually sees investors moving their BTC onto exchanges to cash in on profits.

But this time, it’s a different story, more and more Bitcoin is being pulled off exchanges and into cold wallets.

Since Donald Trump won the November presidential election, over 171,000 BTC have been withdrawn from exchanges, and this suggests that many holders are shifting their assets for long-term storage, showing a growing confidence in Bitcoin’s future.

Vires in numeris

The trend of decreasing exchange reserves began back in November 2022 and continued into 2024.

Between February and October of this year alone, reserves dropped from 3.05 million BTC to 2.63 million BTC, a decline of about 13.77% over eight months. With current reserves sitting at just 2.46 million BTC, we’re looking at the lowest levels in years.

This ongoing decline hints at a potential supply shock for Bitcoin, which could drive prices up as demand continues to rise, but there are no sellers.

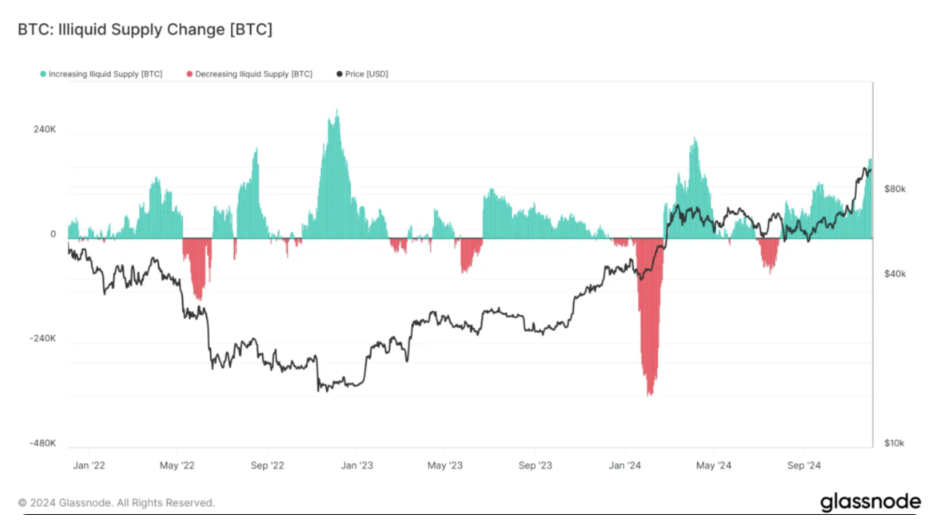

Another sign that investors are getting serious about holding onto their Bitcoin is reflected in Glassnode’s illiquid supply metric.

In the past 30 days, the illiquid supply has increased by 185,000 BTC, bringing the total to approximately 14.8 million BTC, that’s nearly three-fourths of the total circulating supply! If this trend continues, we could see prices surge simply due to scarcity.

Number go up?

With Bitcoin’s price reaching an ATH of $99,600, many are wondering what’s next.

The combination of declining exchange reserves and increasing long-term holdings suggests that Bitcoin might be gearing up for another price jump.

#Bitcoin $BTC could be forming a head-and-shoulders pattern, which could trigger a price correction to $90,000! pic.twitter.com/mWLDabsYRV

— Ali (@ali_charts) December 3, 2024

If Bitcoin can hold above key support levels and maintain its bullish momentum, we might just see it push toward new highs.

There is a tightening supply and there is the growing demand, so this likely setting the stage for some nice gains ahead.