ECB is making progress in its quest to launch a digital euro, allegedly wanting to enhance the eurozone’s payment system and lessen reliance on major foreign payment companies like Visa and Mastercard.

The digital euro rulebook

At the heart of this initiative is the creation of a Digital Euro Rulebook.

This document aims to standardize payment processes across the eurozone, ensuring a consistent experience for users, so after gathering feedback from various stakeholders, like consumers, retailers, and payment service providers, the ECB has revised its plans and set up seven new workstreams.

These focus on central areas like user experience standards and risk management protocols, which are vital for the success of the digital euro.

Collaborations with merchants, fintech firms, and academic institutions have allowed for testing features like conditional payments, where transactions happen automatically based on predefined criteria.

A detailed report on these tests is expected by July next year.

The state will decide what you allowed to do

The ECB has also wrapped up a call for applications to find potential providers for the digital euro’s components, and selected bidders are now invited to submit proposals, with results anticipated in 2025.

Building strong partnerships will be essential for creating a smooth infrastructure to support this new digital currency and those who controls it.

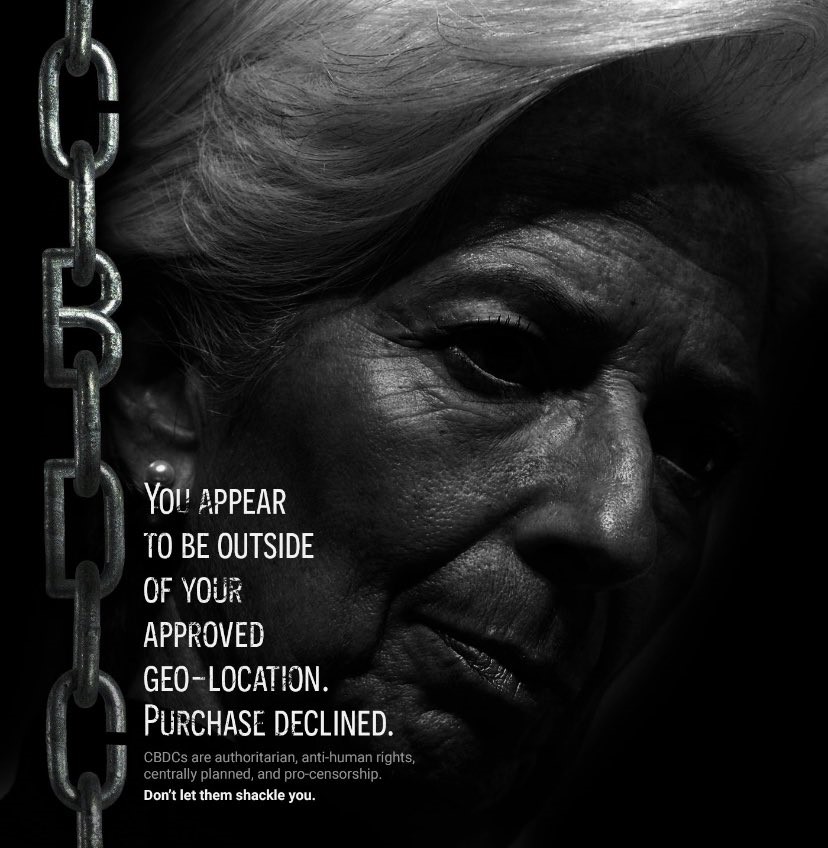

Not everyone is excited about the idea of a central bank digital currency, the CBDC, or slavecoins, as many call them in the social media. Some critics liken it to a new form of serfdom.

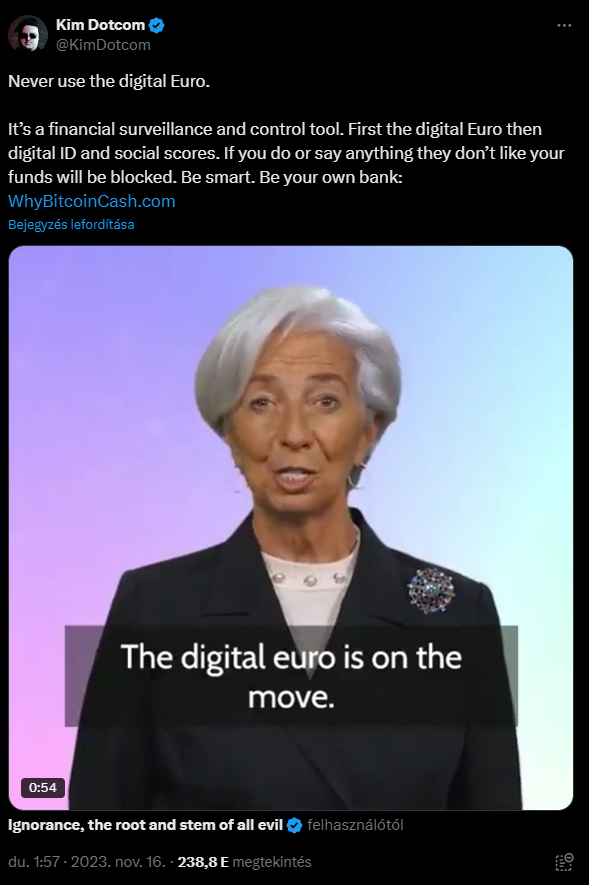

One user on X warned against using the digital euro, claiming it could be a tool for financial surveillance and control.

“First comes the digital euro, then digital IDs and social scores.”

What does this mean for global finance?

If successful, the digital euro could change how the euro functions in the global financial sector.

By reducing dependence on non-European payment processors, it could support the eurozone’s financial independence and challenge the dominance of the U.S. dollar in international trade.

Another exciting aspect is the potential for faster, cheaper, and more transparent cross-border transactions with the digital euro.

This could encourage non-European countries to adopt the euro for trade and investment.

The central bank remains optimistic about refining these aspects in the coming months.

Whether they can meet their ambitious goals of boosting competition and enhancing sovereignty will depend on how well they juggle innovation with regulation and public trust.