A group of Amazon shareholders is urging the tech giant to invest at least 5% of its assets in Bitcoin as a hedge against inflation and a way to grow shareholder value.

This proposal comes from the National Center for Public Policy Research, a conservative think tank that’s looking to shake things up.

The case for Bitcoin

Imagine if Amazon started buying Bitcoin, sounds wild, right? But that’s exactly what these shareholders are suggesting, because Tim Kotzman shared the proposal, which recommends that Amazon add Bitcoin to its treasury as part of a strategy to diversify its assets and protect against inflation.

With Amazon’s $585 billion in total assets, a 5% allocation would mean investing about $29 billion in Bitcoin.

The proposal argues that while Bitcoin can be volatile, just like Amazon stock has been at times, companies have a responsibility to maximize shareholder value over both the short and long term.

By diversifying with some Bitcoin, they believe it could help mitigate risks without diving too deep into volatility.

Performance matters

Bitcoin has been on fire this year, jumping over 130% and breaking through the long-awaited $100,000 barrier. This performance has outshone other major assets like gold and corporate bonds, making it an attractive option for investment.

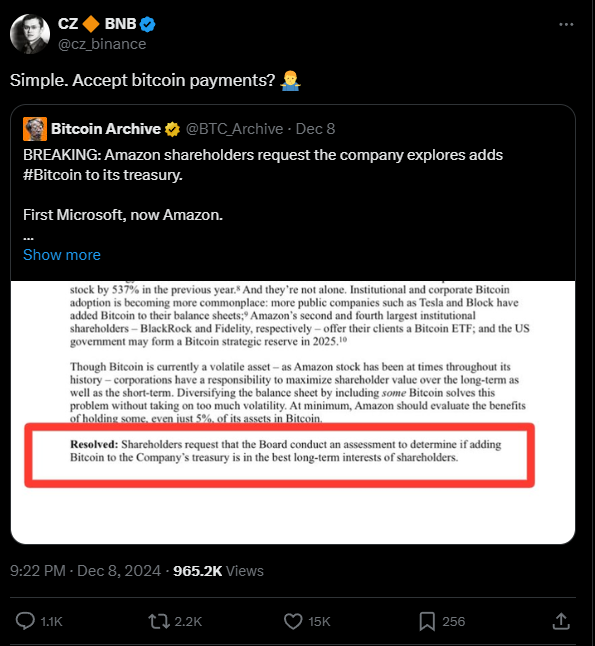

The NCPPR is calling on Amazon’s board to consider whether allocating funds toward Bitcoin aligns with shareholders’ long-term interests.

his proposal is part of a broader trend of institutional interest in Bitcoin. Just last October, the NCPPR sent a similar suggestion to Microsoft, but Microsoft’s board advised against it, stating they had already considered a range of investable assets, including BTC.

Now, Amazon’s board will have to decide whether to include this proposal in the company’s proxy statement for the annual shareholders meeting scheduled for April 2025.

Could Amazon accept Bitcoin payments?

Alongside this investment push, there are suggestions that Amazon could also start accepting Bitcoin as a payment method.

Changpeng Zhao, the founder of Binance pointed out that despite concerns about transaction times, Bitcoin is still reliable because it operates without intermediaries, and this is a huge improvement over traditional finance systems.

Critics argue that Bitcoin isn’t practical for everyday transactions due to its slower confirmation times, but Zhao believes that its reliability makes it a viable option for payments.