Imagine if the United States could trim its national debt by 35%. Well, according to a new report from investment firm VanEck, it might just be possible with the creation of a Bitcoin reserve.

This is not how government funding works btw

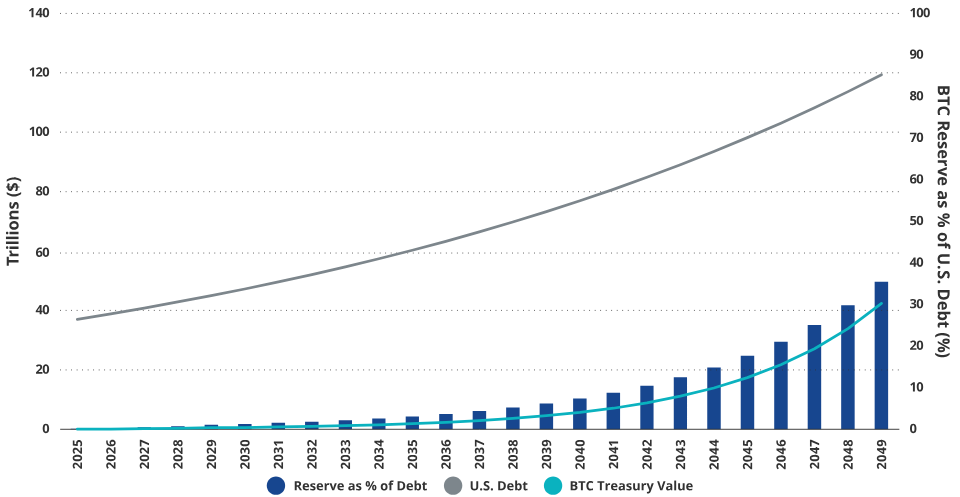

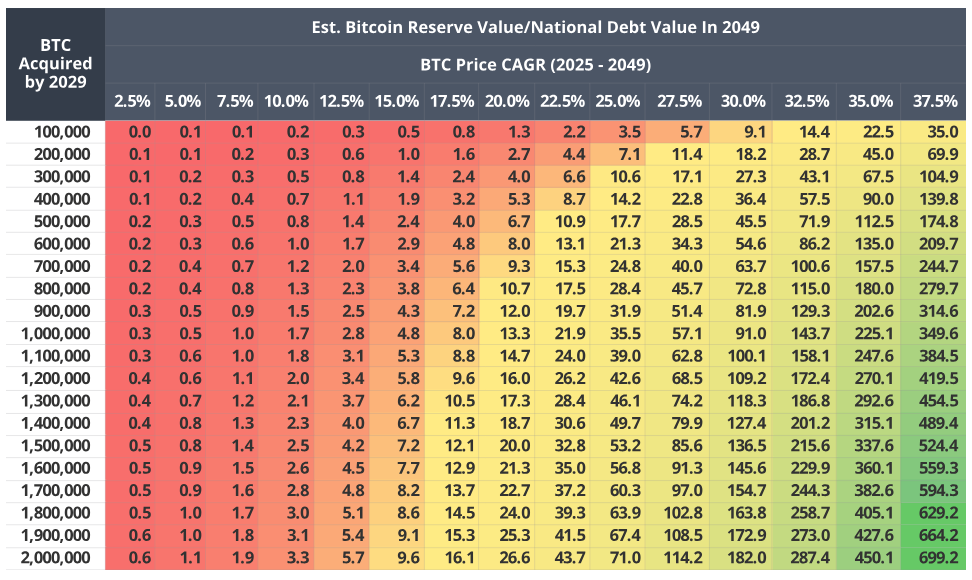

VanEck suggests that if the U.S. were to establish a reserve of 1 million Bitcoin, it could offset around $42 trillion of the national debt by 2049.

This proposal aligns with a bill introduced by Senator Cynthia Lummis, which wants to leverage Bitcoin’s potential growth to tackle the country’s financial liabilities.

The firm estimates that Bitcoin could grow to $42.3 million per coin over the next 24 years, assuming it grows at a compounded annual growth rate, or CAGR of 25%.

On the other hand, they predict that the national debt will balloon from $37 trillion at the start of 2025 to $119.3 trillion by the same year.

Numers doesn’t lie

So how does this work? VanEck’s head of digital asset research, Matthew Sigel, and analyst Nathan Frankovitz explained that if Bitcoin hits that $42.3 million price, it would represent about 18% of all global financial assets, up from a mere 0.22% today!

To put this in perspective, Bitcoin would need to more than double its current price of around $95,360 to start from a projected value of $200,000 in 2025, but if everything goes according to plan, this Bitcoin reserve could account for roughly 35% of the national debt by 2049.

Stacking sats

Now, how would the U.S. fund this ambitious Bitcoin stash? The plan involves using the 198,100 Bitcoin already held by the government from asset seizures and acquiring an additional 801,900 through various means.

This could include selling off part of the country’s gold reserves, valued at about $455 billion, or utilizing Emergency Support Functions.

The beauty of this strategy is that they say it wouldn’t require printing more money or tapping into taxpayer funds, instead, it would create a new avenue for managing national debt without burdening citizens.

Yes, of course. No one believes this, but sounds good for sure.

VanEck believes that increasing adoption of Bitcoin at state and institutional levels would further boost these growth estimates.

Plus, countries in the BRICS alliance are also showing interest in using Bitcoin as a currency to bypass U.S. dollar sanctions.