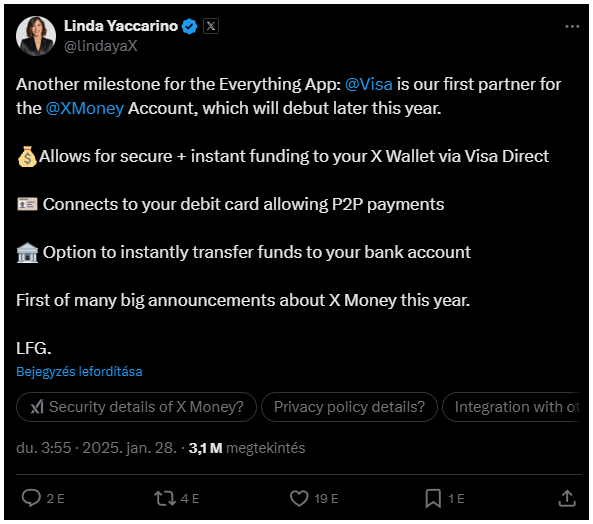

X is teaming up with Visa to launch a brand-new digital wallet, and it’s shaping up to be quite the game-changer in the payment sector Elon Musk’s social media platform announced this partnership on January 28, with CEO Linda Yaccarino calling it another milestone for the Everything App.

The new player on the field

X will utilize Visa Direct, which is Visa’s magic wand for real-time money transfers, to help users load funds into their upcoming X Money wallet.

This wallet isn’t just for show, it’ll allow users to pay each other and even transfer cash back to their bank accounts.

Mark your calendars because X Money is set to launch later in 2025, and it’ll be going head-to-head with big names like Venmo, Cash App, and Zelle.

X Money wants to make payments as easy as sending a tweet, and honestly, that sounds quite cool.

Platform-native ecosystem

Visa confirmed that this partnership means U.S. users of X Money will be able to fund their accounts and transfer money instantly using their debit cards.

Plus, creators on the platform will finally have a way to get paid for their content directly on X instead of relying on traditional banking methods.

Rumor has it that more financial partnerships are in the works, which could mean even more features for users.

Podcaster Lex Fridman is already buzzing about it, saying he can’t wait for the innovations in payments and banking. He even tossed in a wish for crypto integration, because why not?

When Dogecoin integration?

So, let’s not forget about the elephant in the room, the crypto payments. There have been whispers that Musk might enable Dogecoin payments on X, but so far, no official word has been given about crypto in this announcement.

Musk has had his sights set on transforming X into a financial powerhouse since he purchased it. He’s been dreaming of tipping creators and offering high-yield options for funds held within the app, and in a March 2023 interview, he boldly claimed that X could become “the biggest financial institution in the world.”

Of course, there’s a bit of red tape to navigate before all this can happen, especially because getting money transmitter licenses in the U.S. isn’t exactly a walk in the park.

X has been busy applying for these licenses and currently holds them in 41 states while also being registered with the Financial Crimes Enforcement Network.

But don’t be surprised if X Money isn’t available everywhere when it launches.