Imagine you’re at a party, and just as things are getting wild, the cops show up. But instead of shutting it down, they decide to leave without issuing any fines.

That’s basically what just happened in the world of NFTs. The U.S. Securities and Exchange Commission has closed its investigation into OpenSea, one of the biggest NFT marketplaces out there.

The industry strikes back

OpenSea’s founder, Devin Finzer, is thrilled about this development. He called it a win for everyone in the industry because labeling NFTs as securities would have been like putting handcuffs on innovation.

The SEC is closing its investigation into @opensea. This is a win for everyone who is creating and building in our space. Trying to classify NFTs as securities would have been a step backward—one that misinterprets the law and slows innovation.

Every creator, big or small,…

— dfinzer.eth | opensea (@dfinzer) February 21, 2025

This news comes hot on the heels of another big crypto win, as Coinbase had its lawsuit dismissed by the SEC just hours earlier.

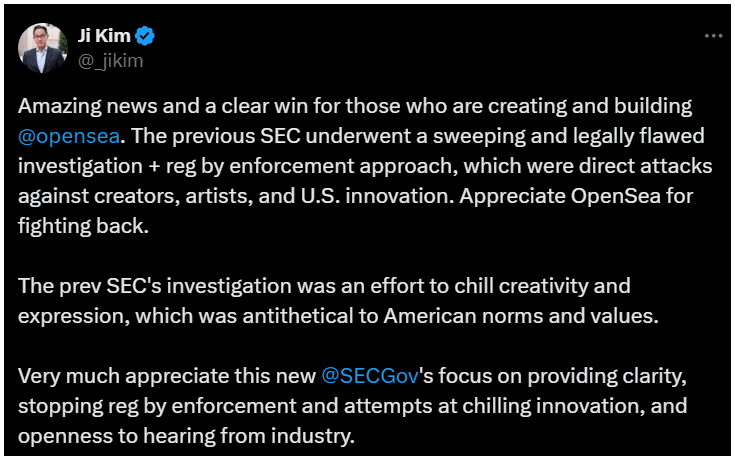

The investigation started back in August 2024 when OpenSea received a Wells notice suggesting they were dealing with unregistered securities. But now that it’s all cleared up, other players in the field are celebrating too.

Magic Eden’s Chris Akhavan said even though they compete with OpenSea, this is still a victory for everyone involved because it shows that NFTs can thrive without being treated like traditional stocks.

NFT season is coming?

Some people even think this could kickstart another NFT boom. Beanie, a popular crypto commentator on X, believes that OpenSea has helped clarify some murky regulatory waters for NFTs.

They praised OpenSea for taking one for the team by pushing through tough times to get some clarity on how these digital assets should be treated legally.

Big changes at the OpenSea

Meanwhile, OpenSea itself is moving forward with new projects. Just days ago, they announced plans to launch their own token called SEA, though we don’t know exactly when yet.

On the other hand, not everything has been smooth sailing, especially as users recently criticized their new reward system before it was paused due to concerns about fairness and trading practices.

Have you read it yet? How a Solana ETF could change the game

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.