Uniswap Labs, the brains behind the largest decentralized trading platform on Ethereum got the green light from the authorities, after the U.S. Securities and Exchange Commission has wrapped up its investigation without taking any enforcement action.

This is huge for Uniswap and the whole crypto industry, signaling a possible shift in how the SEC handles cryptocurrency regulation.

The Uniswap job

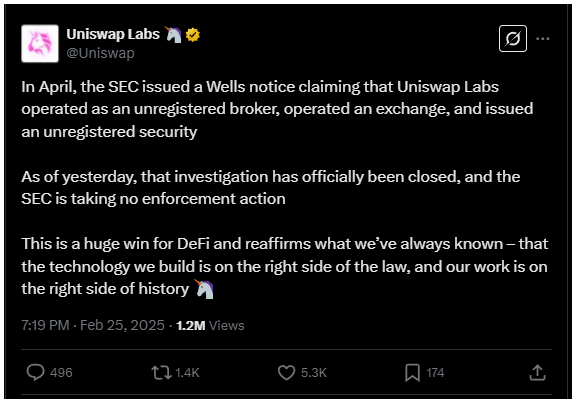

The SEC started looking into Uniswap back in 2020, questioning whether it was operating as an unregistered broker, exchange, or clearing agency.

They also wondered if Uniswap’s native token, UNI, was an unregistered security.

In April 2024, things got serious with a Wells Notice, which hinted at potential legal action. But, in the end, no charges were filed.

Uniswap always maintained it was playing by the rules, arguing that its protocol isn’t an exchange or clearing agency under U.S. law and that UNI isn’t a security.

Hayden Adams, Uniswap’s founder, wasn’t shy about criticizing the SEC’s approach, saying it was trying to fit decentralized networks into a regulatory framework meant for centralized finance.

Market reaction and SEC shift

The news sent Uniswap’s UNI token up by over 4.5% in just 24 hours, and it’s now trading at $8.44, which is a nice little bump.

But what’s more interesting is that Uniswap isn’t alone in dodging SEC bullets. Coinbase, OpenSea, and Robinhood have all recently emerged unscathed from similar investigations.

This trend might be part of a larger shift under new SEC leadership, as Chairman Mark Uyeda has been shaking things up with reforms like a crypto task force and oversight board.

It seems the SEC is trying to find a better balance in regulating cryptocurrencies, especially with President Trump’s administration wanting to ease up on the industry.

What does it mean for crypto?

For crypto industry participants, this is a win. It suggests that regulators are starting to understand the differences between decentralized and centralized systems, and maybe we’re moving towards a more nuanced approach to crypto regulation, one that acknowledges its unique nature.

Either way, it’s an exciting time for DeFi, and Uniswap’s victory is definitely something to celebrate.

Have you read it yet? SEC drops OpenSea investigation

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.