President Trump’s latest reciprocal tariffs have hit the markets like a wrecking ball, and the crypto market is no exception.

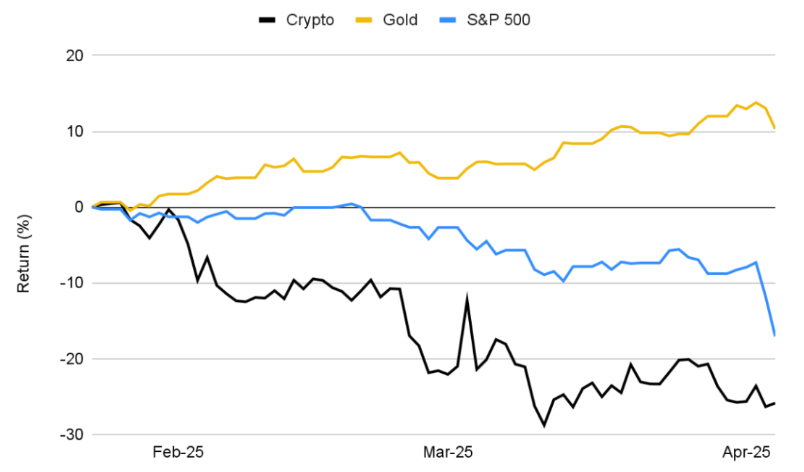

Bitcoin? Down 19%. Memecoins? Oh, they got obliterated, plunging over 50%.

Panic reaction

Let’s talk about these tariffs. Starting this week, Trump slapped a 25% tax on imports from Canada and Mexico and a 10% levy on Chinese goods. The idea? To protect American interests and curb illegal activities.

The reality? Global markets are bleeding, with crypto taking a particularly nasty hit. Bitcoin dropped below $75,000, Ethereum tanked over 40%, and memecoins are now in freefall.

The GMCI Meme Index shows a brutal 30% drop in just one week. Trump’s own branded memecoin? Down 77% from its peak. Have fun.

Correlation

Now, you might be thinking, why is crypto getting dragged into this mess? Good question.

Turns out, cryptocurrencies are behaving more like traditional risk assets these days, especially because they are among the most liquid, salable assets.

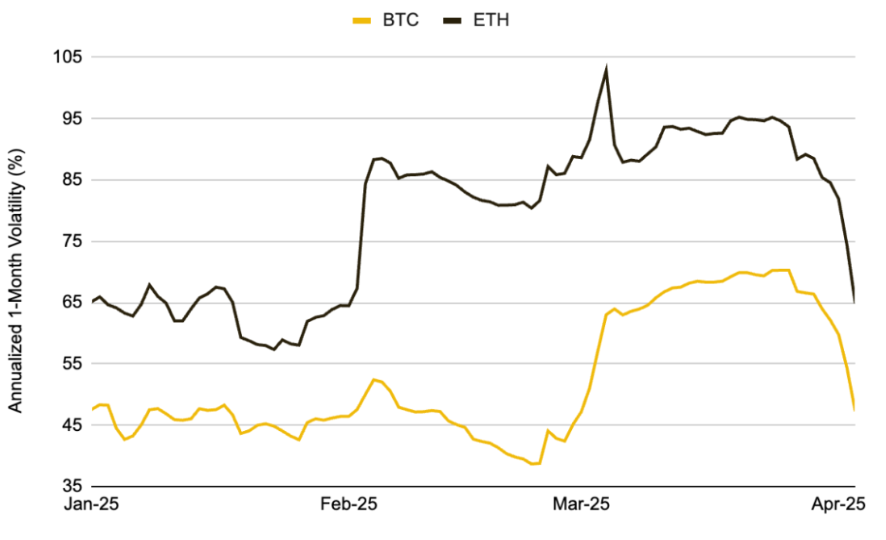

When global markets panic, so does crypto. Binance’s latest report highlights how Bitcoin’s correlation with equities has climbed to 0.47, meaning it’s moving in sync with the stock market more than ever before.

And gold? Forget about it, Bitcoin’s correlation with the shiny stuff has turned negative.

These tariffs aren’t just bad news for foreign economies, they’re allegedly hitting home too.

Economists predict that U.S. real GDP per capita could drop by 1%, while the global economy might lose up to $1.4 trillion in output.

Inflationary pressures are building, and the Federal Reserve might have to cut rates to keep things from spiraling further.

Safe haven?

So where does that leave Bitcoin? Is it still the safe haven everyone hoped it would be? Not quite.

While it has shown resilience in past crises, its behavior now seems tied to macroeconomic factors like trade wars and interest rates.

Sure, Bitcoin might still offer some diversification benefits, but relying on it as a consistent safety net during volatility? That’s a gamble.

And memecoins are taking the brunt of the damage. Their high volatility makes them especially sensitive to market sentiment shifts, and right now, sentiment isn’t looking great.

Have you read it yet? Schiff and Saylor agrees on Bitcoin, is this a legendary moment?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.