The crypto market is waiting for the U.S. Securities and Exchange Commission to make a move. But instead of delivering answers, they’ve hit the snooze button, again. Come on!

Delay

The SEC has delayed its verdict on Ethereum ETF options, pushing the timeline. And let me tell you, this isn’t the first time they’ve kicked the can down the road.

This time, it’s about Ethereum ETFs and their fancy features like staking and in-kind redemptions.

These aren’t just buzzwords, but game-changers. Staking could boost returns, while in-kind redemptions let investors trade actual Ethereum instead of cash, avoiding taxable events and improving liquidity.

Sounds great, right? Well, not so fast. The SEC says it needs more time to think things over. Deadlines have now been extended to early June for some decisions and April for others.

A waiting game that’s testing patience

Ethereum ETFs aren’t new. They’ve already attracted nearly $10 billion in net assets since their debut last year, about 3% of Ethereum’s market cap.

That’s no small potatoes. Investors were hoping that adding options trading to these ETFs would open up even more opportunities, like better risk management and liquidity.

But instead of greenlighting progress, the SEC is dragging its feet. Why? They claim they need to evaluate the market impact more thoroughly.

Critics might say it’s just another example of regulators being overly cautious, or maybe even stalling for reasons they’re not sharing.

Gary Gensler, the SEC chair who many saw as a crypto skeptic, stepped down not so long ago. His temporary replacement, Mark Uyeda, is holding down the fort until Paul Atkins, a supposedly crypto-friendly figure takes over.

Analysts are speculating that once Atkins is confirmed, we might finally see some movement on these ETF approvals.

The market reacts… or doesn’t

You’d think this kind of news would shake things up for Ethereum prices or investor sentiment, but nope, crickets.

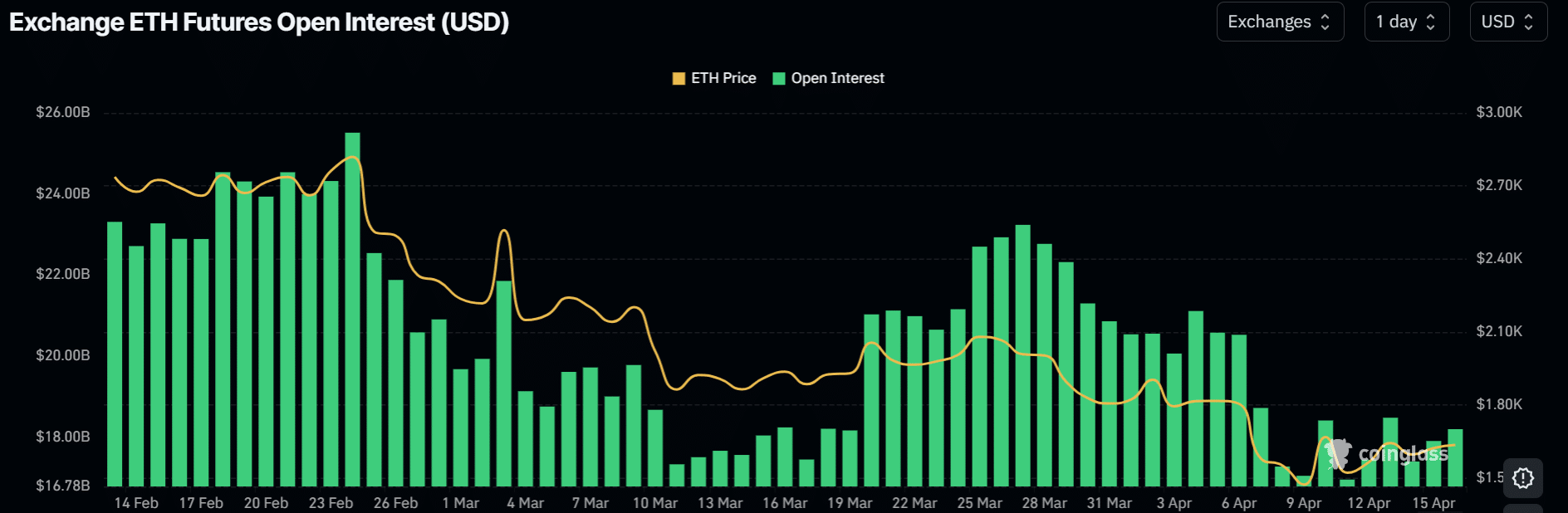

Open Interest in Ethereum has been sliding since February, dropping from $26 billion to under $20 billion.

On top of that, Ethereum’s price chart isn’t exactly inspiring confidence. Analysts warn it could dip below $1,500 again if bearish patterns hold.

So the situation is far from bright, investors frustrated, regulators stalling, and Ethereum stuck in limbo.

Will April 2025 finally bring clarity? Maybe. Or maybe we’ll just get another delay wrapped in bureaucratic red tape.

Have you read it yet? Google’s crypto ad rules are a big win for safety but a blow to small players?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.