Strategy confirmed buying 15,355 Bitcoin between April 21 and April 27, according to an April 28 filing. The purchase cost $1.42 billion, with an average price of $92,737 per Bitcoin.

The acquisition raised Strategy’s total Bitcoin holdings to 553,555 BTC, now valued at more than $50 billion. The purchase increased its Bitcoin reserves by approximately 3%, based on the company’s public filing with the United States Securities and Exchange Commission (SEC).

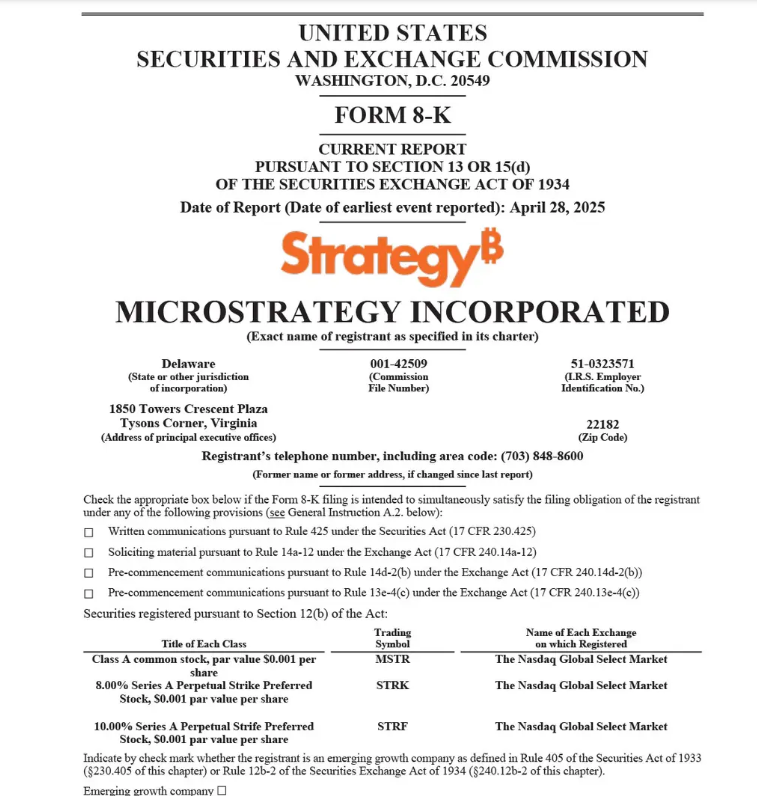

Data from Strategy’s Form 8-K filing confirmed the size and timing of the acquisition. Bitcoin’s price moved above $90,000 during the period.

Strategy’s Largest Bitcoin Acquisition Since March

This latest Bitcoin buy is Strategy’s biggest since March 2025, when it bought 22,048 BTC for $1.92 billion. The March purchase was made at an average price of $86,969 per Bitcoin.

During the recent buying period, Bitcoin’s price climbed about 8%, rising from $87,000 to nearly $94,000, according to CoinGecko. As of April 28, Bitcoin traded around $95,442, remaining below its all-time high of over $109,000 recorded on January 21.

Strategy continued adding Bitcoin even as the price moved higher. The company did not announce changes to its Bitcoin acquisition approach.

Bitcoin Yield Reaches 13.7% Year-to-Date

Strategy’s co-founder Michael Saylor shared that the firm achieved a 13.7% Bitcoin yield for 2024. He wrote on X,

“As of April 27, we hodl 553,555 BTC acquired for approximately $37.90 billion at $68,459 per Bitcoin.”

Strategy defines Bitcoin yield as the percentage change in the ratio between Bitcoin holdings and diluted shares. In 2024, the yield increased by 74%, according to the company’s reported figures.

The company expects its Bitcoin yield target to reach 15% in 2025, according to the latest internal projections.

Bitcoin Price Movement and Market Context

During the purchase window, Bitcoin showed strong upward movement. The price rose steadily from $87,000 to $94,000 without major pullbacks. Strategy’s Bitcoin buy occurred during this climb.

At the time of writing, Bitcoin trades near $94,560, according to CoinGecko. The price remains higher than at the start of 2025 but still under its January peak.

Strategy’s actions came during a period of growing market interest, with Bitcoin prices recovering after previous corrections earlier this year.

Michael Saylor Comments on Bitcoin Accumulation

Michael Saylor made several public comments regarding Bitcoin accumulation. On April 25, he posted,

“You can still buy BTC for less than $0.1 million.”

Earlier that week, he shared another message,

“Stay humble. Stack sats [satoshis].”

He attached a portfolio screenshot showing Strategy’s Bitcoin holdings during the recent purchase phase.

Strategy’s MSTR Stock and Institutional Exposure

Strategy’s market capitalization is moving closer to $100 billion, supported by Bitcoin acquisitions and stock performance. According to TradingView, MSTR shares gained around 23% year-to-date, trading at $368.7 at the time of publication.

More than 13,000 institutions reportedly hold exposure to Strategy through various investment vehicles, according to public market data. The company has not disclosed any new Bitcoin purchasing plans beyond its Form 8-K announcement.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.