Alright, listen up, Bitcoin’s been sneaking around the $97,000 level, the highest it’s hit since February, and it’s just a stone’s throw away from that sexy $100K milestone. Just 3.5% shy, guys.

But don’t let that small gap fool you, the signs flashing on the blockchain say this thing could break out big time soon.

Boy astrology

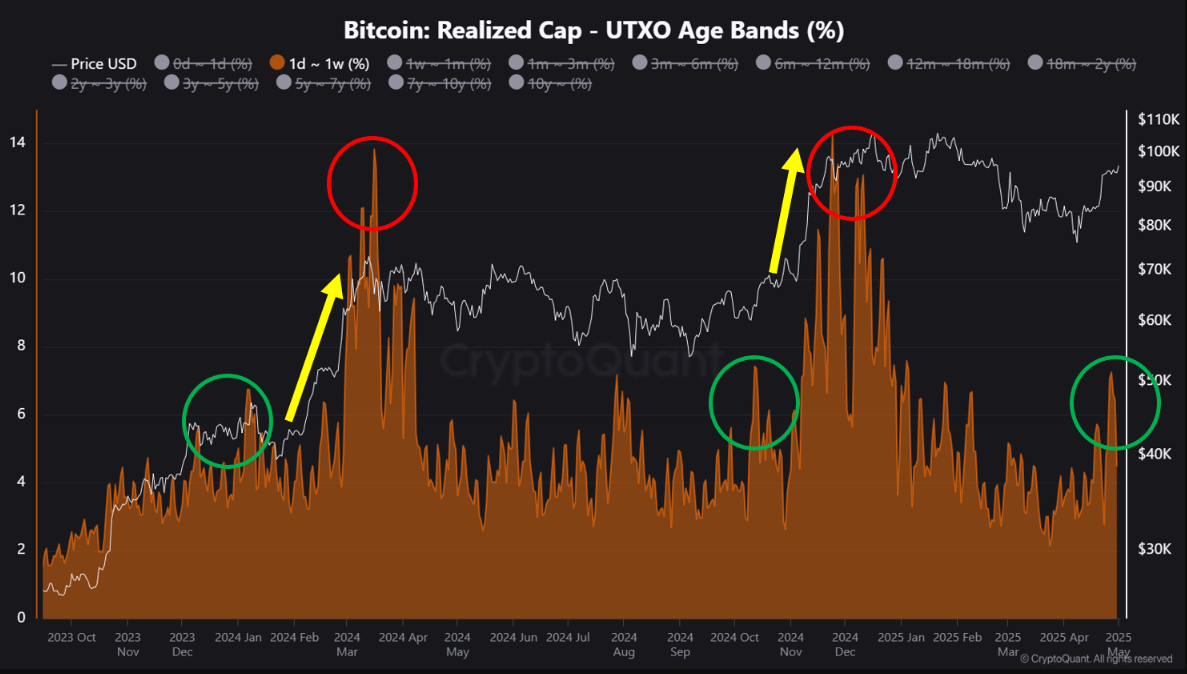

CryptoQuant, those on-chain number crunchers, noticed something spicy, short-term holders, those who’ve held Bitcoin between one day and one week, are piling in like it’s the last cannoli at the family dinner.

This pattern? It ain’t new. It’s the same kind of accumulation dance that kicked off Bitcoin’s price rockets in early and late 2024. When these short-term holders push their stacks higher, Bitcoin tends to follow with a jump.

CryptoQuant’s take? If this keeps up, we’re looking at a $100K breakout and a strong bull run right after.

Blockware, the guys who know their way around Bitcoin mining, are waving their flags too. They’re seeing long-term holders, wise guys holding for over six months, stocking up more Bitcoin.

Robert Breedlove, a sharp but controversial analyst, said these long timers grabbed about 150,000 BTC in the past month alone.

Next is the long-term holder supply. This measures the amount of Bitcoin that have not moved on-chain in at least 155 days (and the 30-day change)

At its core, the Bitcoin price is simply a function of supply and demand. After an increase in the Bitcoin price, you start to see… pic.twitter.com/U5pSVXpuB5

— Robert ₿reedlove (@Breedlove22) May 1, 2025

Translation? The usual sellers who’d dump their coins between $80K and $100K are running out of ammo. Fewer sellers, more pressure on the price to climb.

Liquidity cycles?

But there’s a catch, the U.S. dollar liquidity. Think of liquidity as the cash flow in the system. When it’s flowing, Bitcoin tends to dance.

Remember the 2020-2021 party? Liquidity spiked, and Bitcoin shot from $3,500 to nearly $69,000.

After a dry spell in late 2024 and early 2025, liquidity’s making a comeback in Q2 2025.

If this rebound sticks, it could pour fuel on Bitcoin’s fire, pushing bids higher and sending prices north. Some even say the liquidity is stronger than the 4-year cycle’s power.

On the charts, things look pretty slick too. The 4-hour Super Trend indicator is flashing ‘buy,’ and Bitcoin’s price is cruising above key moving averages. Basically, the bulls have the upper hand right now.

Resistance?

Sure, there’s always chatter about resistance zones and profit-taking, some holders eyeing exits near $95K to $98K, but the overall vibe?

Bullish. The on-chain signals and technicals are lining up like a well-oiled crew ready to make a move.

So, Bitcoin’s gearing up for a potential sprint to $100K. The big breakout might just be knocking on the door.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.