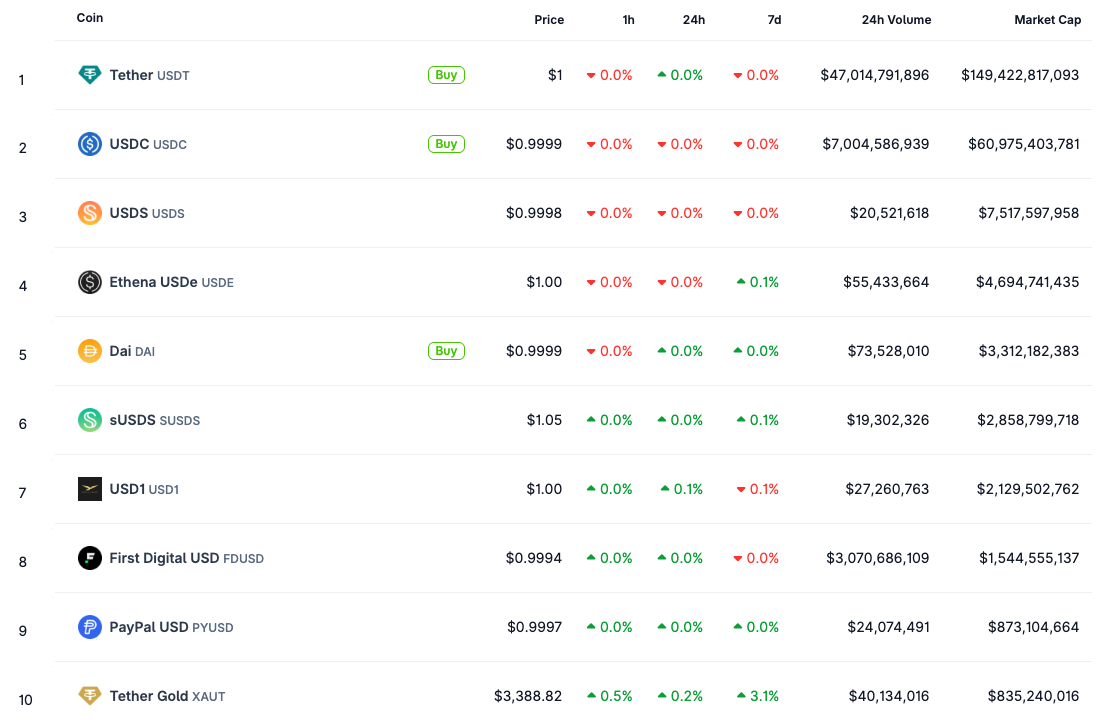

The USD1 stablecoin, launched by World Liberty Financial (WLFI) and backed by Donald Trump’s affiliated network, now ranks as the seventh-largest stablecoin globally.

The USD1 market cap jumped from $128 million to $2.2 billion in less than two months, according to CoinGecko.

This increase followed a $2 billion WLFI investment plan announced by Eric Trump, involving Abu Dhabi-based MGX.

USD1 initially launched in early March with a $3.5 million supply. Since then, the Trump-backed USD1 has seen rapid growth and overtaken other stablecoins like First Digital USD (FDUSD), PayPal USD (PYUSD), and Tether Gold (XAUT).

Data from CoinGecko confirms that the USD1 market cap surged 1,540% in late April.

The sudden spike occurred just before Eric Trump revealed MGX’s plan to use the USD1 stablecoin for crypto investments.

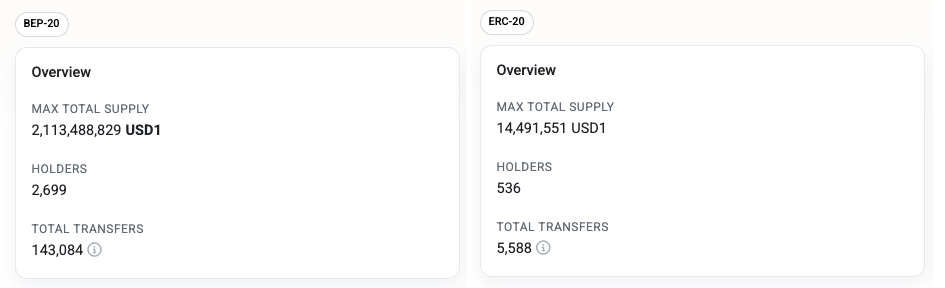

BNB Chain Hosts 99% of USD1 Stablecoin Supply

Most of the Trump-backed USD1 supply exists on the BNB Chain. According to BscScan, the BNB Chain holds about $2.1 billion of the total USD1 supply, issued as BEP-20 tokens.

That accounts for more than 99% of the total. In contrast, only $14.5 million of USD1 is issued on Ethereum as ERC-20, based on Etherscan.

Although Trump-backed USD1 is tied closely to the BNB Chain, both Binance and Trump have denied claims of any direct partnership.

Still, the data confirms that nearly all USD1 issuance is currently limited to Binance’s blockchain.

The WLFI investment activity aligns with this chain preference. CoinGecko charts show a rapid climb in the USD1 market cap before MGX’s $2 billion announcement.

HTX USD1 Listing Marks Entry Into Centralized Markets

HTX became the first major centralized exchange to list the Trump-backed USD1 stablecoin.

Formerly known as Huobi, HTX announced the BEP-20 USD1 listing on May 6, along with permanent zero-fee withdrawals.

The listing is limited to the BNB Chain version of USD1. Data from CoinMarketCap and CoinGecko shows that the USD1 stablecoin is still mostly traded on decentralized exchanges like PancakeSwap and Uniswap.

HTX, which is backed by TRON founder Justin Sun, listed the token during the same week the USD1 market cap crossed $2 billion. At the time, there was no confirmed listing for the ERC-20 version.

WLFI Investment Mostly Comes From Outside the United States

Most of the WLFI investment reportedly comes from outside U.S. borders. According to a community poll by Notaz.Sol, founder of V1PS, up to 90% of investors are from regions including Europe, Asia, and Latin America.

A Bloomberg report on May 7 also stated that more than half of the top holders of Trump-themed memecoins live abroad. These numbers suggest that WLFI’s growth is largely driven by non-U.S. users.

The WLFI team has not commented on these figures. However, the data supports a pattern of international involvement with the USD1 stablecoin and the broader WLFI investment pool.

USD1 Growth Aligns With Trump’s Digital Currency Order

The USD1 stablecoin growth follows Trump’s executive order issued in January 2025. The order, titled “Strengthening American Leadership in Digital Financial Technology,” outlined support for stablecoins and digital finance.

While the USD1 stablecoin is marketed as U.S. dollar-backed, it is not available on most major exchanges.

WLFI launched a snapshot vote for airdrop distribution, and token governance proposals are ongoing.

There are no confirmed integrations beyond the BNB Chain. WLFI has not responded to reports of future cross-chain plans or expansion.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.