The U.S. Senate is the place where the dealr are flowing. The grand stage where big decisions get made, or, in this case, don’t get made.

The GENIUS Act, a bill designed to bring some order to the stablecoin sector, just got flat-out blocked.

The bill failed to get the 60 votes needed to even start debating it. Instead, it stumbled at 49-48.

Comedy

The biggest roadblock? A bunch of Senate Democrats who suddenly pulled the rug out, citing concerns that the bill didn’t do enough to stop money laundering and national security risks.

Some of these people had even backed the bill before! Talk about a flip-flop that caught everyone off guard.

Senator Elizabeth Warren, the crypto skeptic, went full throttle, warning that this bill could open the door to crypto corruption, even dragging President Trump’s alleged crypto ties into the mud.

She claimed this legislation might just line Trump’s pockets through shady stablecoin deals tied to foreign firms. Drama much?

On the other side, Republican Senator Tim Scott wasn’t having any of it. He called out the Democrats for playing politics with bipartisan legislation and putting partisan politics above policy and innovation.

He said this should have been a historic win for Americans, a chance to democratize finance, but instead, it turned into a political circus.

Scott even warned that those Democrats who voted no should expect painful repercussions come election time.

Competition

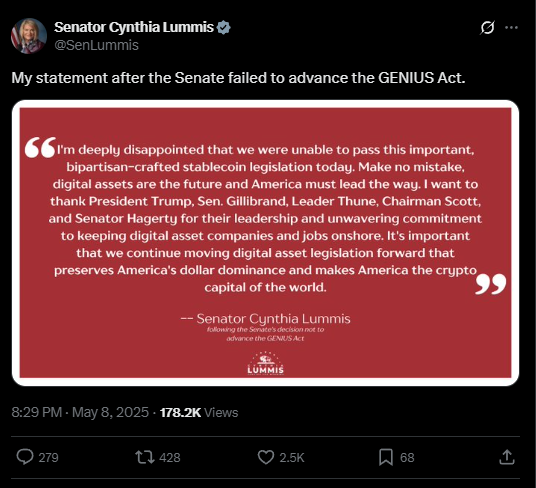

Senator Cynthia Lummis, another co-sponsor, chimed in on social media, reminding everyone that Bitcoin is the future and America must lead the charge.

She said blocking this bill was a step backward for U.S. crypto leadership and dollar dominance.

Treasury Secretary Scott Bessent threw shade at the Senate too, saying the world is watching as American lawmakers twiddle their thumbs.

Without this federal framework, stablecoins face a confusing patchwork of state rules that could stifle innovation and push crypto innovation overseas.

Translation? The U.S. risks losing the race to other countries if it doesn’t get its act together.

Competency

What’s really frustrating here is that the GENIUS Act wasn’t some wild-eyed proposal.

It had bipartisan support, went through amendments to tighten rules on stablecoin issuers, and aimed to protect consumers while encouraging growth. But politics got in the way, again.

So, stablecoins are still hanging in regulatory limbo, with the industry watching and waiting.

The promise of clear rules and U.S. leadership on digital dollars just got delayed, thanks to partisan games and fears about Trump’s crypto connections.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.