Bitcoin, recently flirted with the $100,000 level again. You’d think retail traders would be flooding the gates, right? Wrong.

The retail frenzy, the FOMO just isn’t there. Bitcoin’s price hit a ceiling around $105,800, but the usual retail rush to buy?

Silence

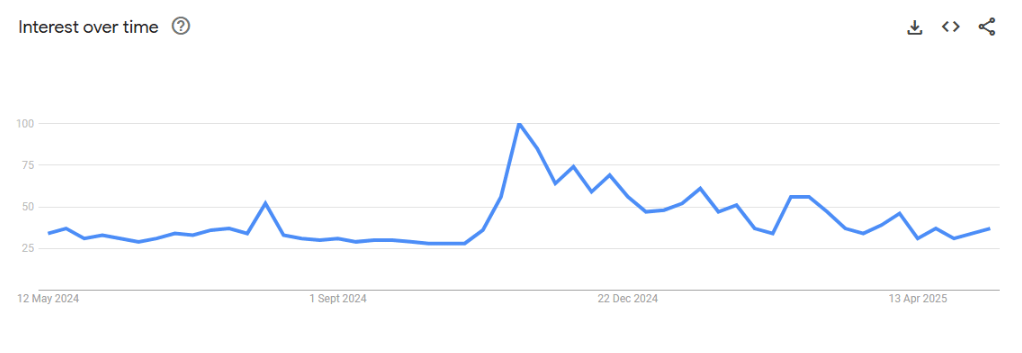

Google Trends tells the tale. Interest in Bitcoin-related searches has dropped to 37, one of the lowest points this year.

That’s pretty weird, considering the hype around Bitcoin’s price. Remember back when Donald Trump won the 2024 election?

Bitcoin searches shot up from 56 to a perfect 100. Everyone was curious, maybe even ready to buy. The market responded with a juicy rally and a flood of liquidity.

But now? All quiet. The decline in Bitcoin searches means retail money’s sneaking off to other playgrounds.

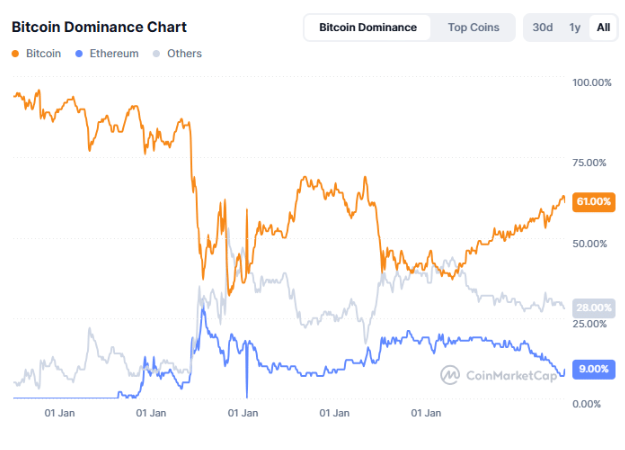

The proof’s in the pudding, Bitcoin Dominance, which measures Bitcoin’s market cap share against the whole crypto market, slid from 64% on May 8 to 61% today. That’s capital moving to altcoins and memecoins.

New toys

Even Bitcoin Exchange Reserves, the stash of BTC held on centralized exchanges, are creeping up, stuck around 2.44 million BTC.

That’s a sign retail holders are moving their Bitcoin back onto exchanges, probably gearing up to sell or swap for stablecoins and other tokens.

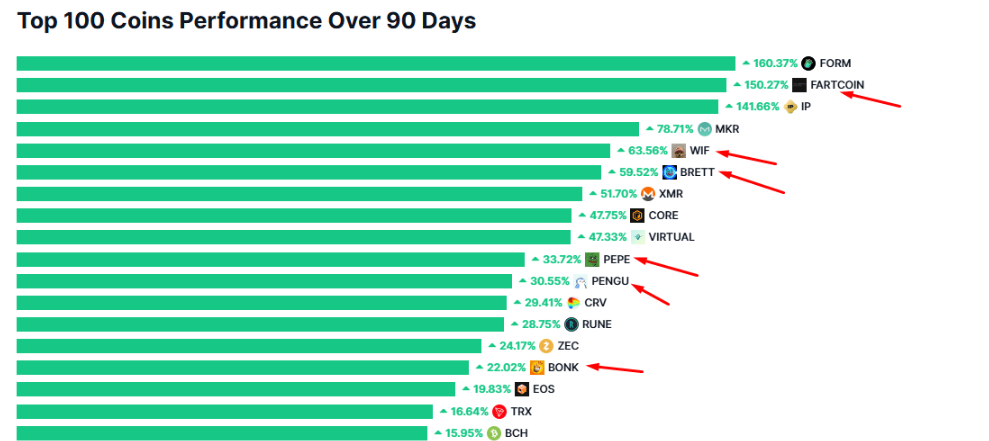

So, where’s the action? Memecoins, baby. The real party’s happening there. CoinMarketCap’s data shows four of the top 10 best-performing coins over the last 90 days are memecoins, $FARTCOIN, $WIF, $BRETT, and $PEPE.

These jokers are killing it, with memecoins rallying 11% in the past week while Bitcoin and its ecosystem took a slight hit, down about 0.9% and 0.5%, respectively.

Hopium

Look, Bitcoin’s the old guard, the reliable don of crypto. But retail traders? They’re chasing the new wild kids on the block, hoping for quick gains and viral hype. Getting rich quickly, probably.

It’s like choosing the flashy sports car over the classic sedan. The memecoin sector is heating up, and the retail crowd is all in.

Now it looks like if you want the retail crowd’s attention, you gotta bring the noise, the memes, and the hype. Bitcoin’s steady grind? Not sexy enough anymore.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.