Canada, bless its heart, decided to play hardball with stablecoins, and maybe, just maybe, messed it up big time. Are we surprised?

Wrong decision

Back in December 2022, right after the crypto world got rocked by the FTX collapse, Canada’s regulators threw stablecoins into the securities and derivatives basket.

You know, like they’re some risky stocks or complex financial instruments.

Tanim Rasul, the COO over at Canadian crypto exchange NDAX, isn’t shy about calling it out.

At the Blockchain Futurist Conference in Toronto, he laid it out plain and simple: Canada got it wrong treating stablecoins like securities.

Now, while Canada’s busy putting stablecoins in a regulatory straitjacket, other big players are thinking differently.

Europe, for example, is eyeing stablecoins as payment tools, not securities. Rasul points to Europe’s MiCA framework, saying, that could be the viable path.

Because treating a digital dollar-pegged coin like a stock? That’s like calling a taxi a spaceship.

“Look at how they’re handling it. Stablecoins are payment instruments in Europe. They should be regulated that way.”

Doing business?

The Canadian Securities Administrators, the CSA made this call after FTX’s dramatic fall in November 2022, and they doubled down with more rules in 2023, labeling stablecoins under value-referenced crypto assets.

The fallout? Big crypto names like Binance, Bybit, OKX, Paxos, and Gemini started packing their bags and scaling back in Canada. Gemini even announced it’s exiting the market.

But don’t count Canada out just yet. Despite the regulatory mess, the local crypto industry is still buzzing.

According to Grand View Research, Canada’s crypto industry pulled in $224 million in revenue in 2024, up from previous years, and it’s set to grow at a solid 18.6% annually until 2030.

By then, we’re talking $617.5 million in yearly revenue. So yeah, the market’s tough, but it’s not dead.

Really?

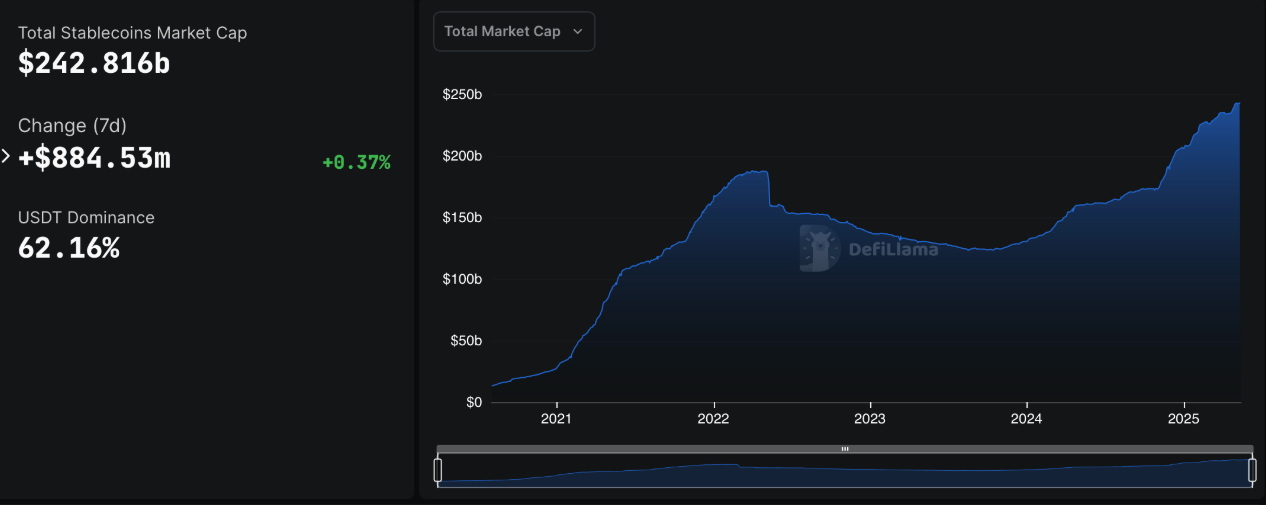

Let’s talk stablecoins themselves, as their market cap hit $242.8 billion, up nearly 52% in a year.

Governments and economic blocs worldwide are scrambling to figure out how to regulate these coins because their use is exploding.

While the US dollar dominates stablecoins, there’s growing interest in coins pegged to other currencies too.

Canada’s playing catch-up and maybe shooting itself in the foot by treating stablecoins like securities.

Meanwhile, the rest of the world’s moving on, treating them like what they really are, digital cash.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.