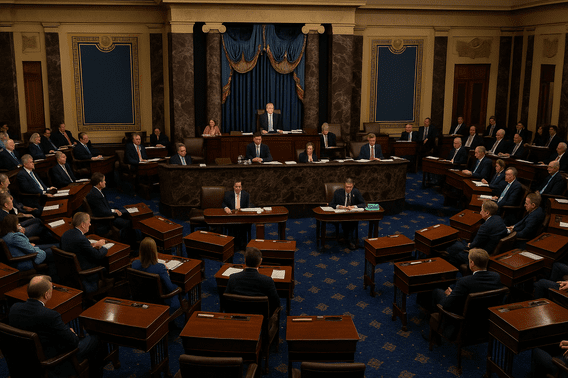

The US Senate vote passed 66–32 on May 19, advancing the GENIUS Act, a new stablecoin bill focused on creating rules for the stablecoin market.

This procedural vote sets the stage for a full Senate debate before May 26, Memorial Day.

Democratic Senators Mark Warner, Adam Schiff, and Ruben Gallego changed their earlier positions and supported the motion. The shift helped clear the legislative block that stopped the bill on May 8.

Senator Cynthia Lummis, a Republican and supporter of the GENIUS Act, said on May 15 that lawmakers aim to pass the bill by Memorial Day.

Democrats Raise Concerns Over Trump Crypto Ventures

Earlier, Democratic lawmakers blocked the bill due to its links with Trump crypto ventures.

The former president and his family recently launched several crypto-related projects, including a stablecoin called USD1, which now ranks as the seventh-largest by market cap, according to CoinGecko.

Senator Elizabeth Warren, who has opposed crypto policies in the past, spoke against the bill before the Senate vote. She said the legislation failed to address Trump’s financial involvement in the USD1 stablecoin.

“Trump and his family have already pocketed hundreds of millions of dollars from his crypto ventures,” Warren said. “They stand to make hundreds of millions more from his stablecoin, USD1, if this bill passes.”

Despite this, Mark Warner decided to support the bill’s progress. He stated that lawmakers need to act as crypto technology continues to grow.

“We cannot allow that corruption to blind us to the broader reality: blockchain technology is here to stay,” Warner said.

GENIUS Act Targets Stablecoin Regulation, Licensing, and Audits

The GENIUS Act—short for Guiding and Establishing National Innovation for US Stablecoins Act—was introduced by Senator Bill Hagerty on February 4.

The bill seeks to set up clear federal rules for the stablecoin market, which is now worth nearly $250 billion.

It includes multiple requirements for stablecoin issuers:

-

They must be licensed stablecoin issuers approved by federal or state regulators.

-

All stablecoins must be fully backed by reserves.

-

Issuers must conduct regular security audits.

-

The bill restricts the use of algorithmic stablecoins.

These measures aim to bring structure to a market largely led by private issuers like Tether (USDT) and Circle’s USDC.

Hagerty Builds on Previous Stablecoin Proposals

Bill Hagerty based the current stablecoin bill on a draft prepared in October for former Representative Patrick McHenry’s Clarity for Payment Stablecoins Act. That earlier version laid out principles that now appear in the GENIUS Act.

Hagerty’s proposal focuses on giving the government power to monitor and approve licensed stablecoin issuers.

It also addresses concerns about stablecoin regulation, especially as more private players enter the market.

Senate Debate Set to Focus on AML Provisions and USD1 Links

As the bill moves to full debate, senators are expected to discuss its Anti-Money Laundering (AML) provisions and the possible impact of Trump crypto ventures, particularly the USD1 stablecoin.

The final version may include additional guardrails based on lawmaker concerns. While the Senate has not confirmed a final vote date, the timeline set by Senator Lummis points to potential action by May 26.

The GENIUS Act continues to draw attention as lawmakers weigh the future of stablecoin regulation in the United States.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.