Dubai launched the first licensed tokenized property project in the Middle East and North Africa (MENA) region.

The project received backing from the Dubai Land Department (DLD), the Central Bank of the United Arab Emirates, and the Dubai Future Foundation.

The new Prypco Mint platform will host all digital property tokens. Zand Digital Bank is handling the pilot’s financial operations.

This initiative follows a recent regulatory update. On May 19, 2025, Dubai’s Virtual Assets Regulatory Authority (VARA) officially allowed real-world asset (RWA) tokenization for secondary market trading.

The program only accepts Emirati dirham (AED) and restricts participation to UAE ID holders during the pilot.

No cryptocurrencies are involved in the transactions. Officials stated that a global expansion plan is already in place.

AED 2,000 Minimum to Join Fractional Real Estate Investment in Dubai

The project allows investors to buy fractional shares of licensed tokenized property in Dubai.

The minimum required amount is AED 2,000, or roughly $545. Each token reflects a portion of a real, ready-to-own property in the city.

All transactions go through the Prypco Mint platform. The tokens represent legal ownership shares and are supported by blockchain technology. However, investors use only fiat currency at this stage.

The Dubai tokenized real estate project is part of a controlled rollout. Officials will use the pilot phase to test transaction flows, compliance, and system security.

DLD Real Estate Tokenization Linked to Government Registry

In April 2025, the Dubai Land Department (DLD) and VARA signed an agreement to link the Dubai real estate registry blockchain to property tokenization.

The goal is to create a unified system that records all tokenized property activity.

This system is part of DLD’s wider effort to expand real estate tokenization UAE. The registry will verify and store ownership data of tokenized properties.

This makes Dubai one of the first cities to connect a public property registry with RWA tokenization UAE rules.

The current project builds on earlier regulatory developments. The updated VARA framework supports digital property instruments for legally approved platforms in the UAE.

Real Estate Tokenization Market Forecast at $19.4 Billion by 2033

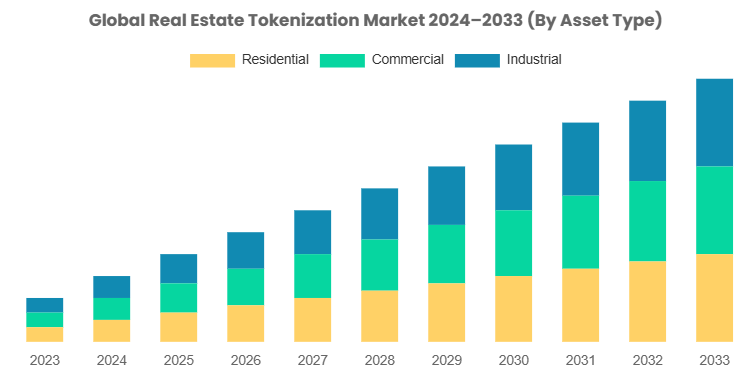

According to Custom Market Insights, the global real estate tokenization market is projected to reach $19.4 billion by 2033.

It is expected to grow at a compound annual rate of 21%. The forecast includes residential, commercial, and industrial property segments.

Several companies, such as RealT and Metlabs, are active in this area. However, many others have failed due to strict compliance requirements.

The MENA real estate tokenization market now sees Dubai as one of the most developed test cases due to government and central bank involvement.

The UAE’s updated rules aim to simplify access for fractional real estate investment in Dubai, especially by working within licensed legal frameworks.

UAE Broadens RWA Tokenization as Crypto Sector Expands

The RWA tokenization UAE landscape is expanding beyond real estate. Dubai recently partnered with Crypto.com to enable crypto payments for public services.

At the same time, the local crypto regulator issued a VASP license to a blockchain project focused on real-world assets.

In 2024, AppsFlyer reported a 41% increase in crypto app downloads across the UAE. These developments suggest rising digital adoption in financial and property sectors.

By integrating tools like the Prypco Mint platform and linking with the Dubai real estate registry blockchain, the country continues to build a framework that supports licensed tokenized property backed by legal infrastructure.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.