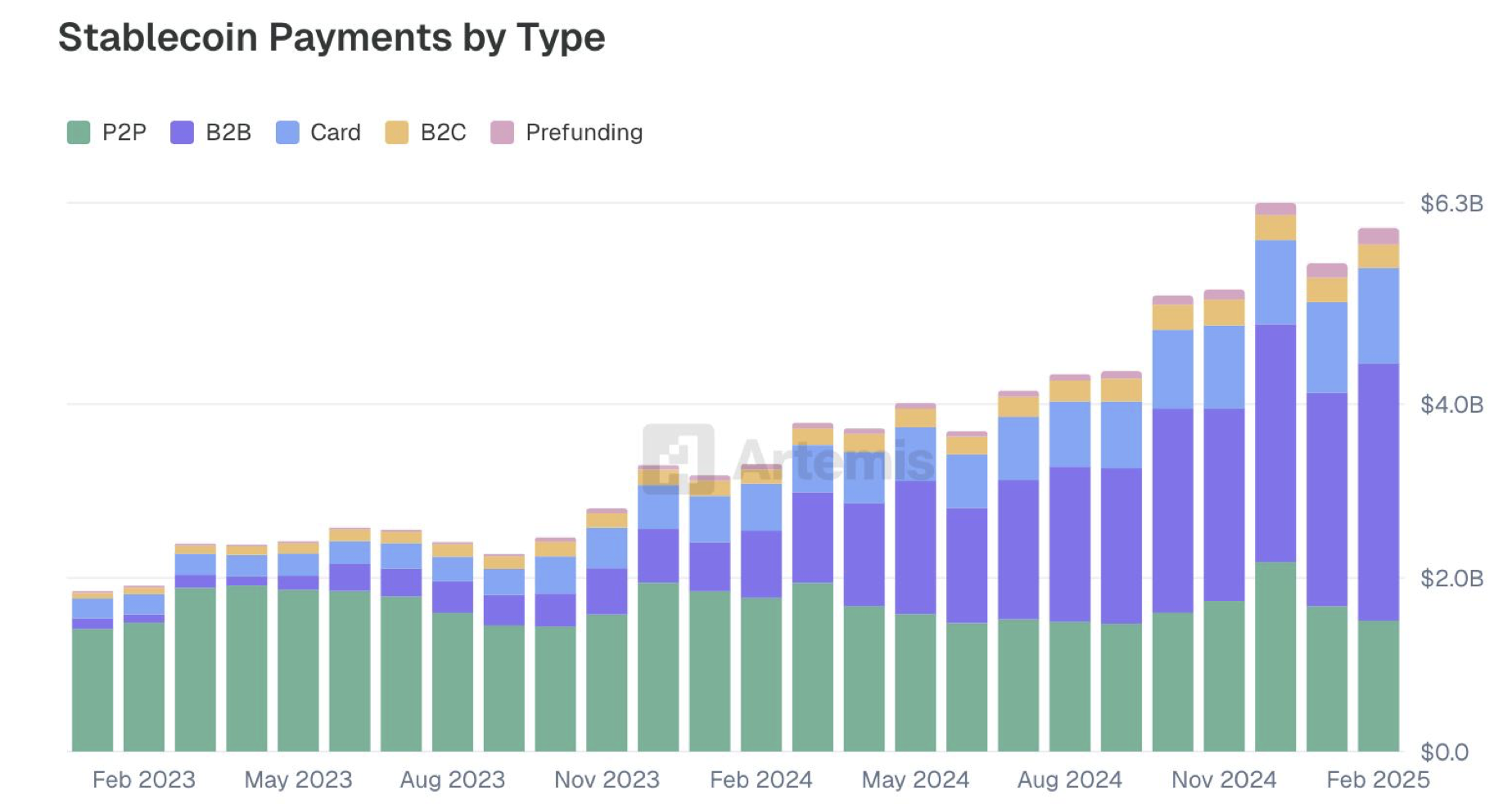

From January 2023 to February 2025, stablecoin payment volume reached $94.2 billion, according to Artemis.

Business-to-business (B2B) transfers made up the largest portion, with an annual run rate of $36 billion.

Most high-value B2B payments occurred on Tron and Ethereum, where the average transfer size exceeded $219,000.

Binance Smart Chain followed in overall volume but showed smaller transaction sizes.

These figures indicate the use of stablecoins for large-scale transactions among institutions and companies across these three blockchain networks.

Card-Linked Stablecoin Payments Exceed $13.2 Billion

Artemis reported that card-linked stablecoin payments reached over $13.2 billion annually. These transactions involve spending stablecoins via cards connected to mobile wallets and financial apps.

Platforms that support debit or credit cards linked to stablecoin balances have contributed to this growth, allowing users to make purchases using digital assets in everyday situations.

This type of spending reflects the increasing use of stablecoins in retail-level payments across supported blockchain ecosystems.

Tether’s USDt Leads in Stablecoin Usage

Tether’s USDt was the most used stablecoin across all payment types. Circle’s USDC came second, with both tokens handling the majority of payment flows.

Most USDt transactions took place on Tron, while Ethereum processed more USDC activity. These networks also recorded the highest average B2B transaction values.

Artemis noted that these preferences reflect current user behavior across both institutional and retail payment environments.

Stablecoin Market Cap Climbs to $247.3 Billion

According to DefiLlama, the stablecoin market cap stood at $247.3 billion on May 29, up 54.5% year-over-year. The rise coincides with broader adoption in cross-border payments and commercial transactions.

In response, governments and banks are reviewing their approach to stablecoins. In the United States, lawmakers are drafting legislation to regulate these assets.

The European Union and United Arab Emirates already permit approved stablecoin issuers to operate under regulatory frameworks.

This regulatory activity has played a role in expanding the global stablecoin ecosystem across both public and private sectors.

Stripe Rolls Out Stablecoin Accounts Globally

On May 7, Stripe launched stablecoin accounts in over 100 countries, offering users the ability to manage digital dollar balances directly on its platform.

The feature supports USDC on Solana, targeting users who want faster settlement options for global transactions.

The expansion gives more participants access to stablecoin tools through Stripe’s existing network.

This launch followed growing interest in business-friendly payment options using dollar-pegged digital assets.

U.S. Banks and Global Players Eye New Stablecoin Models

A Wall Street Journal report in May revealed that several U.S. banks are in early discussions to develop a joint stablecoin.

No final plans or participants were disclosed, but the idea centers on shared infrastructure for payments.

At Token2049, Dea Markova, Head of Policy at Fireblocks, said governments outside the U.S. are showing more interest in non-dollar stablecoins.

These alternatives may appeal to countries seeking digital currency options tied to local or regional units.

Both developments reflect an expanding field where stablecoin models are being tailored to new regulatory and operational needs.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.