Alright, Bitcoin’s liquid supply, that’s the coins actually available to trade on exchanges, has dropped 30% in just 18 months.

Sygnum Bank’s new report shared that this isn’t some minor blip.

Institutional players and new Bitcoin reserve strategies are tightening the market like a noose, setting the stage for some serious price fireworks.

Hoarding Bitcoin?

Since late 2023, about 1 million BTC have been pulled off exchanges. These aren’t just random people hoarding coins, nope.

We’re talking ETFs, corporate buyers, and funds issuing equity or debt just to scoop up Bitcoin.

They’re locking coins away, making fewer available for trading, a classic bullish sign.

It’s like your office suddenly running out of coffee because everyone’s hoarding the last bags. Panic? Maybe. Opportunity? Definitely.

And it’s not just Wall Street getting cozy with Bitcoin. Three U.S. states have jumped on the bandwagon, passing laws to allow Bitcoin reserves.

New Hampshire’s already signed the bill, Texas is likely next. Overseas, Pakistan’s government and the UK’s Reform party are eyeing Bitcoin reserves too.

No official buys yet, but when they do start, expect a huge shift. It’s a signal to the market that Bitcoin’s becoming serious business.

Up only?

Now, the stacking fever isn’t that surprising, because Bitcoin’s reputation as a safe-haven asset is shining brighter amid shaky U.S. fiscal conditions.

The sell-off in U.S. Treasurys has investors scrambling for alternatives, and Bitcoin’s stepping up alongside gold.

It’s like when the office budget gets slashed, and suddenly everyone’s fighting over the last donut. Bitcoin’s that donut now.

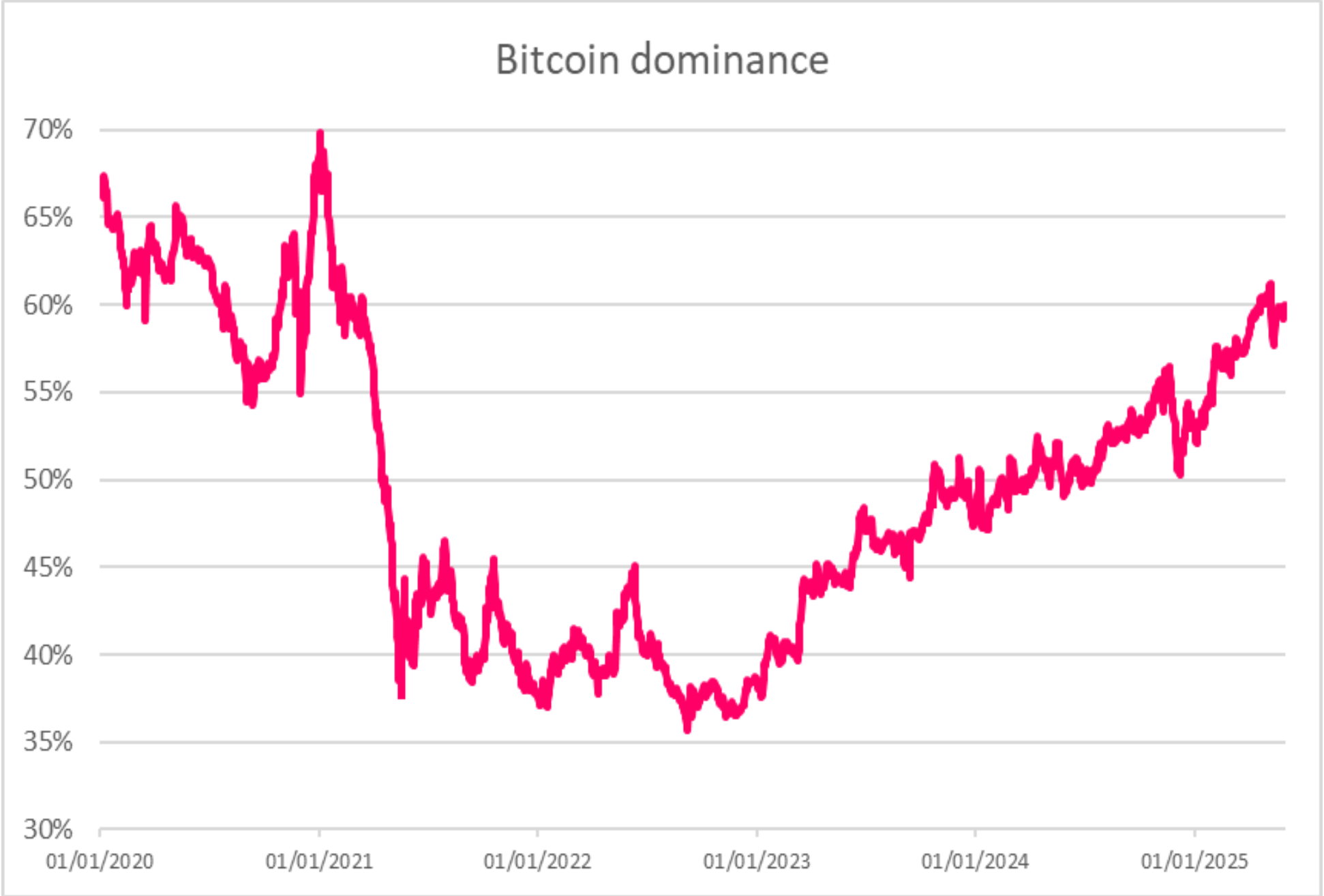

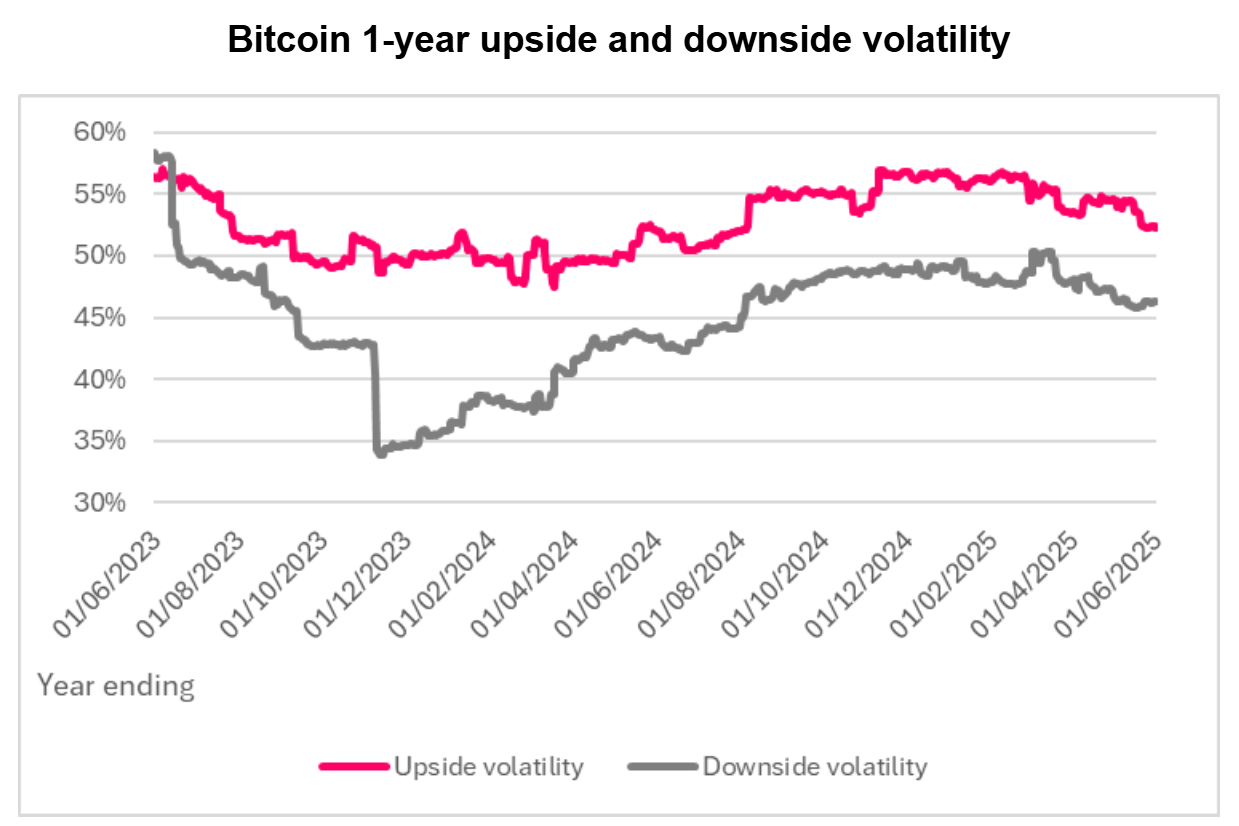

Sygnum also points out something interesting about Bitcoin’s volatility. Over the past three years, the upside swings have outpaced the downside.

That’s a sign the market’s maturing, with institutions playing a bigger role. No more insane crashes dominating the headlines, instead, more controlled, mostly upward momentum.

Comeback

And don’t forget Ether. After years of lagging, it’s making a comeback, likely thanks to the Pectra upgrade.

Big financial institutions are flocking back, building tokenization platforms on Ethereum and its layer-2 networks. It’s like the office newbie who suddenly becomes the star player.

So, Bitcoin’s shrinking supply, growing institutional demand, and new reserve laws are cooking up a perfect storm.

If you’re watching the crypto market like it’s your favorite TV drama, this next chapter could be your new fav!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.