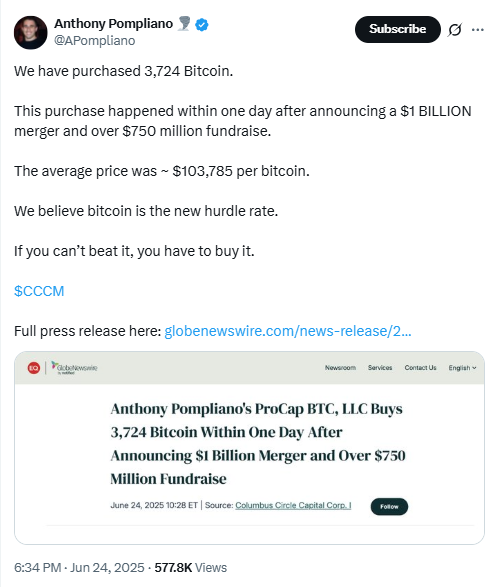

ProCap, the crypto firm led by Anthony Pompliano, confirmed a major Bitcoin acquisition on June 25. The firm bought 3,724 BTC for $386 million.

This was ProCap’s first disclosed Bitcoin transaction.

ProCap said it bought the Bitcoin at a time-weighted average price of $103,785 per BTC. Since then, the value of the purchase has risen slightly. At current prices, the holding is now worth nearly $400 million.

The firm, which operates as ProCap BTC, announced the Bitcoin acquisition one day after revealing its plan to go public.

The transaction places ProCap among the companies adding digital assets to their corporate Bitcoin treasury.

ProCap IPO Plan Includes $1 Billion Bitcoin Strategy

ProCap also outlined a plan to acquire up to $1 billion in Bitcoin. This move is part of a broader strategy tied to its upcoming public listing.

The firm plans to go public through a merger with Columbus Circle Capital, a special purpose acquisition company (SPAC).

The merger will turn ProCap BTC into a new entity named ProCap Financial. The SPAC structure allows the firm to list faster than through a traditional IPO.

As part of the deal, investors have already committed over $750 million. This includes $516 million in equity and $235 million in convertible notes. These funds will support the ProCap Bitcoin strategy.

Pompliano commented on X, “We believe Bitcoin is the new hurdle rate. If you can’t beat it, you have to buy it.” He did not provide additional financial guidance.

ProCap Bitcoin Holdings Rank Among Public Companies

ProCap’s current Bitcoin holding of 3,724 BTC would rank 14th among public companies.

That estimate comes from BiTBO, a platform tracking corporate Bitcoin holdings. It places ProCap just below Semler Scientific, a medical technology firm.

ProCap joins a growing list of firms using Bitcoin as part of their treasury allocation. These include companies from sectors such as real estate, finance, energy, and mining.

Other corporate entities buying Bitcoin often tie the decision to broader financial strategies or capital restructuring plans. These holdings are usually disclosed through public filings or press statements.

Bitcoin Acquisitions by Other Firms This Week

Several other companies also announced Bitcoin acquisitions this week. MicroStrategy confirmed that its Bitcoin balance has grown to 592,345 BTC. Japan’s Metaplanet increased its total to 11,111 BTC.

Real estate investor Grant Cardone said his company acquired 1,000 BTC for its corporate treasury. No additional terms were disclosed.

Panther Metals, a mineral exploration company, also introduced a mixed treasury model. It includes $5.4 million allocated for Bitcoin.

Norwegian firm Green Minerals said it plans to buy $1.2 billion in Bitcoin. The firm is known for its deep-sea mining operations.

If completed, the investment would be one of the largest corporate Bitcoin purchases to date.

Each of these companies used Bitcoin as part of a corporate finance strategy. Most of them publicly disclosed the amount, timing, and funding sources.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.