We got ourselves a crypto caper that’s got the whole crypto community whispering in the shadows.

Imagine this, over 80,000 Bitcoin just woke up from a 14-year nap and decided to stretch their legs.

That’s a nice $8.6 billion worth of digital gold moving around like it owns the place.

Source?

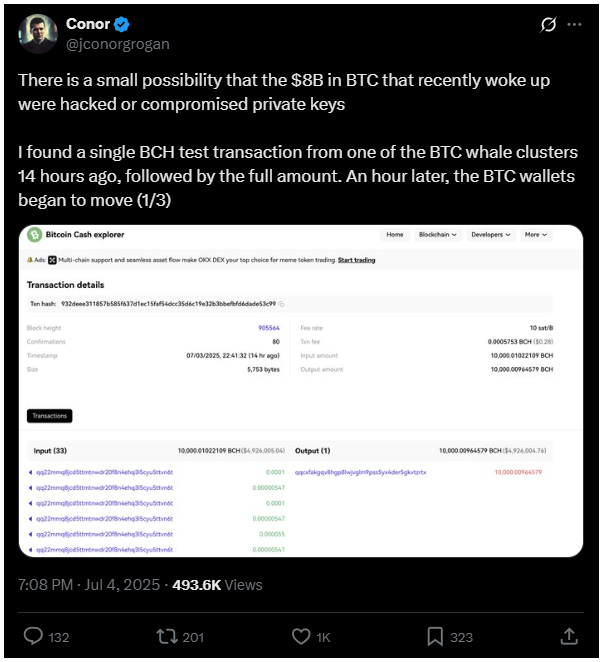

But someone’s ringing the alarm bell, and none other than Conor Grogan, the big boss of product at Coinbase.

He’s waving the flag saying, hey, this might not be just some casual stroll, maybe someone got their hands on the private keys. Now, that’s the kind of news that makes you sit up straight.

Before this massive Bitcoin migration, there was a sneaky little test run with Bitcoin Cash from the same wallets. It’s like testing the waters before diving in.

Then bam! The full Bitcoin stash starts moving. No panic selling, no mad rush to dump it on exchanges, just a cool, calculated shuffle.

Makes you wonder, right? Is this a hacker’s jackpot or some whale playing chess while the rest of us are playing checkers? No one knows.

No drama

Now, don’t get your wallets in a twist just yet, because despite the size of this move, the market’s holding steady.

Bitcoin’s price is cruising around $108,000 in the time of writing, with a market cap north of $2 trillion.

It’s had some minor dips recently but is still up nearly 44% over the last three months. And Bitcoin’s dominance?

Sitting pretty at about 64.6% of the crypto market. So, no immediate chaos, but everyone’s got their eyes glued on those wallets, waiting to see if this is the calm before a storm or just a big, fancy shuffle.

Behind the scenes

Let’s put this into perspective. This is one of the largest Bitcoin moves from wallets that have been silent since the early days, the same league like the infamous Mt. Gox hack, which involved 650,000 BTC.

If these keys were compromised, we’re talking about a breach with a potential to shake the foundations of crypto security.

BILLIONAIRE BITCOIN WHALE WALLETS ARE WAKING UP

So far, 7 addresses have now moved a total of $7.6 Billion in BTC since last night.

The addresses below have all been holding since April-May 2011, over 14 years. pic.twitter.com/AMbc3sUMAM

— Arkham (@arkham) July 4, 2025

But so far, no official word from regulators or any signs of a fire sale. Just a lot of speculation and cautious watching.

Private key security is no joke. Whether this is a long-lost owner cashing in or a hacker’s windfall, the market’s playing it cool, for now.

But like that coworker who suddenly starts acting too friendly after years of silence, you gotta wonder what’s really going on behind the scenes.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.