Bitcoin’s been strutting around $110,000 like it owns the place. It’s teasing us with a new ATH just around the corner, but the market’s sending mixed signals.

The word on the street? A summer slowdown might be creeping in.

Summer is here

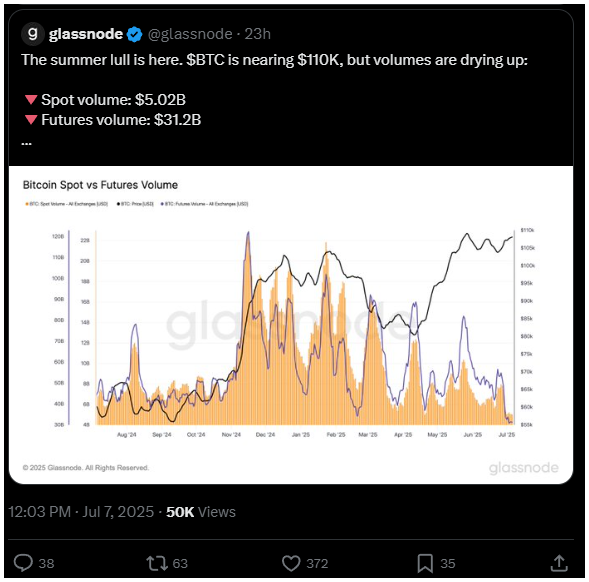

Glassnode just dropped some stats that make you go, hmm. Trading volumes are taking a dip. Spot volume? Down to $5.02 billion.

Futures volume? Slumped to $31.2 billion. Both numbers hitting lows we haven’t seen in over a year. It’s like the trading floor just emptied out for vacation season.

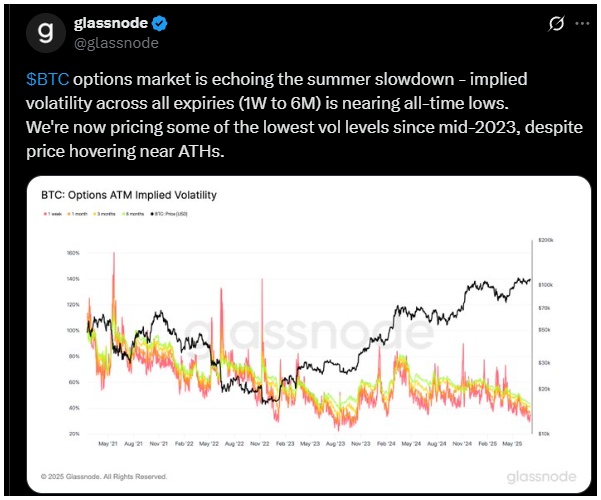

And here’s where it gets interesting, because the Bitcoin options market showing implied volatility at rock-bottom levels across all expiries, from one week to six months.

Glassnode says this chill vibe matches what we saw back in mid-2023. Basically, traders are betting on less drama in Bitcoin’s price for the near future. Summer’s here, people are off sipping cocktails, and the market’s taking a breather.

Consolidation

But Bitcoin’s price keeps inching higher, flirting with $110K, no matter what, while volumes shrink.

That’s a classic case of divergence, price climbing but liquidity drying up. It’s like a party where the music’s loud but half the guests have left.

Thin liquidity means even small trades could cause swings. So, watch out for some sudden moves.

Historically, these quiet spells often come after big rallies, with traders cashing in profits and waiting for the next big play.

The options market’s low volatility hints at a consolidation, Bitcoin digesting recent gains, catching its breath.

Line in the sand

The good news is that despite the slowdown, Bitcoin’s holding its ground above key support levels.

That’s aclear sign of strength, especially with institutional money flowing in. Check this, CoinShares reported over $1 billion in digital asset inflows last week alone.

Bitcoin snagged $790 million of that, with Ethereum pulling in $226 million. That’s twelve weeks straight of fresh capital, like a steady stream feeding the beast.

CryptoQuant analysts are still waving the bull flag, saying the Bitcoin rally’s not done yet. But with low volatility and quiet trading, expect a range-bound market.

Bitcoin could either break out to a new ATH above $112K or pull back toward the $100K psychological floor. And the $100K level? It’s the line in the sand now.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.