Listen up, guys, picture a high-stakes poker game where the dealer just flipped the table. But not once, but twice.

That’s pretty much what went down with Pump.fun and its flashy $PUMP token.

Mega-deal?

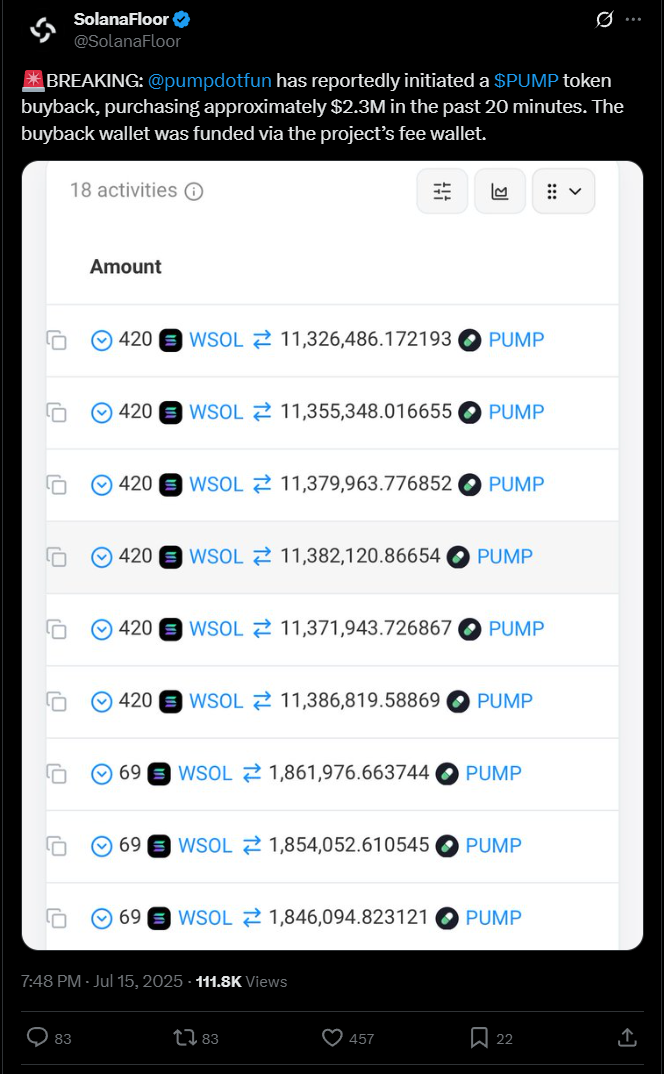

What started as an impressive presale, raising a cool $1.32 billion by selling 33% of its $PUMP stash, now looks like a drama-filled TV-show as they dropped $2.3 million to buy back their own tokens.

And they did it quick, in just 20 minutes. You gotta ask, is this savvy strategy or a panic move?

Pump.fun sold about 330 billion $PUMP tokens at a bargain $0.004 each, slapping a near $6 billion valuation on the whole shebang.

If you work in an office, it’s like your startup just landed a mega-deal, champagne ready, and everyone’s expecting fireworks.

But the party wasn’t quite as lively as the numbers suggested. Investors started twitching. The token’s price was wobbling like a rookie on roller skates.

What to do?

Enter the $2.3 million buyback, allegedly from the project’s fee wallet. On the surface, it’s a classic “calm the waters” tactic, try to steady the ship, reassure the crew.

But the crypto community’s talking, and not everyone’s buying the act.

Critics, including the sharp-eyed guys at BitMart Research, point out $PUMP’s glaring weaknesses, no governance rights, no revenue-sharing, nothing to suggest the token actually does anything beyond slapping a shiny brand on the coins.

It’s a bit like a sitcom where the lead character shows up with all the confidence, but no real skills to back it up.

IncomeSharks and other trading groups wasted no time dubbing this buyback move desperation dressed as strength.

And with platform activity cooling off and eyes shifting elsewhere, Pump.fun’s runway looks shorter by the day.

What’s the real value?

So what’s the real story? Is Pump.fun cleverly managing volatility for the long haul or just struggling to keep a spotlight on a token built mostly on hype?

In a crypto market packed with projects fighting for relevance, this buyback might be the make-or-break moment.

Investors and traders will be watching closely, looking for signals that $PUMP can go from flashy newcomer to solid player, or else fade into the background.

Big promises, big money moves are here, but the ever-hovering question, what’s the real value underneath?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.